Veteran investor Ross Gerber slammed companies like Strategy Inc. (NASDAQ:MSTR) for selling stock to the public to purchase Bitcoin (CRYPTO: BTC), warning that such an approach could “nuke” the cryptocurrency.

MSTR shares are showing limited movement. Check out the latest moves here.

Selling ‘Inflated’ Stock To Buy Bitcoin Is ‘Crazy’

In a note to Benzinga shared Friday, Gerber expressed his skepticism about companies issuing stock without a “real underlying business” to buy Bitcoin.

“The fact they can sell stock at some inflated valuation to then buy Bitcoin is crazy bad math for the investor,” the CEO of Gerber Kawasaki Wealth and Investment Management said. “Why would you buy $100 of Bitcoin for $200?”

See Also: Bitcoin Down To $116,000: ‘Shakeout’ Before Going Higher Or Final Stop Before $112,000?

Notably, Strategy's stock trades at a premium to its Bitcoin holdings, currently at 1.61x, suggesting that investors are paying a multiple for exposure to Bitcoin.

That said, Strategy’s Bitcoin yield — a metric that measures the percentage change in the BTC per share — has increased by 25% year-to-date, meaning that each share of MSTR is equivalent to 1.25 BTC.

However, the math only works if Bitcoin continues to rise.

Overleveraged Bet Could Nuke Bitcoin, Says Gerber

“What happens when Bitcoin goes down again, as it eventually does and corrects hard every couple of years. If they are forced to sell, then the cycle reverses and it blows up,” Gerber said.

He also questioned the use of debt to fund purchases, warning that such an approach could “nuke” Bitcoin. Gerber argued that owning Bitcoin directly or through an exchange-traded fund is a better option

In its defence, Strategy said the company’s structure is “smooth” and can weather an 80% BTC crash during a bear market. CEO Michael Saylor cited the company's pivot to a perpetual preferred stock strategy, which has no maturity date and retains the initial capital invested, and is reducing reliance on convetible debt offerings.

MSTR Lags Bitcoin

The criticism comes in the wake of Strategy adding 430 BTC to its corporate treasury for approximately $51.4 million. The company now holds 629,376 BTC, worth over $72 billion.

However, despite Bitcoin hitting all-time highs, Strategy’s stock has been underperforming Bitcoin, causing concerns among traders about the viability of investing in Bitcoin treasury companies. Over the past six months, Bitcoin is up 20.5%, while MSTR has gained only 14%.

Price Action: At the time of writing, BTC was exchanging hands at $115,025.80 down 0.47% in the last 24 hours, according to data from Benzinga Pro.

Shares of Strategy rose 0.11% in after-hours trading after closing 0.74% lower at $363.60 during Monday’s regular trading session.

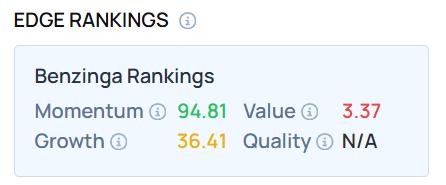

MSTR demonstrated a very high momentum score—a measure of the stock’s relative strength based on its price movement patterns and volatility over multiple timeframes—as of this writing. Find out the top 20 stocks with the highest momentum on Benzinga Edge Stock Rankings.

Read Next:

Photo Courtesy: PJ McDonnell on Shutterstock.com