Advertising veteran Rory Sutherland earlier this year shed light on Jeff Bezos' unconventional decision-making style, revealing how Amazon.com, Inc.'s (NASDAQ:AMZN) founder defied internal pushback to build billion-dollar ventures like Prime, Amazon Web Service and Prime Video.

Bezos' ‘Two-Way Door' Philosophy: Try, Fail, Repeat

Speaking with YouTuber Chris Williamson in February 2025, Sutherland — vice chairman of Ogilvy and one of the world's leading consumer behavior experts — said Bezos' unique mindset separates him from typical corporate leaders.

Sutherland recalled that in Amazon's early days, "everybody except Bezos hated the idea" of Amazon Prime, Prime Video and even AWS.

Yet Bezos pushed ahead. “Jeff has an interesting notion, which is what he calls a two-way door,” Sutherland said.

He explained that Bezos viewed a two-way door decision as one that allowed experimentation without major risk — you could step through, test an idea and easily reverse course if it didn't work.

He believed that taking action and learning from the outcome often cost far less than spending endless time debating whether to proceed.

Why Bezos Thinks Differently From Most CEOs

Sutherland noted that Bezos — much like Elon Musk — possesses an unconventional and at times seemingly irrational way of thinking, one that sets him apart from traditional business leaders.

He described Bezos as a "probabilistic thinker" — someone who accepts that most business outcomes are uncertain. Most corporate leaders, by contrast, operate under the illusion of certainty, relying on data, forecasts and spreadsheets.

"Every spreadsheet is, in some ways, an act of pretense," Sutherland said. "It's past information which you pretend has wonderful predictive value," but weird things happen all the time.

The Risk-Reward Dilemma Inside Companies

According to Sutherland, traditional corporate culture rewards predictability, not boldness. "You capture 100% of the blame" if something fails and only "a pat on the back" if it succeeds, he said.

That's why many visionary thinkers, he added, end up leaving to become entrepreneurs.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Amazon's $2.67 Trillion Empire Posts Strong Q3 Results

Amazon, which currently boasts a market capitalization of $2.67 trillion, reported third-quarter net sales of $180.2 billion — a 13% year-over-year increase that topped the Street's estimate of $177.8 billion, according to Benzinga Pro.

AWS generated $33 billion in revenue, marking 20% annual growth.

In its Prime Video segment, the company reported more than 70 million global viewers for the third season of "The Summer I Turned Pretty" and noted a 16% year-over-year increase in average viewership for the fourth season of "Thursday Night Football," reaching 15.3 million viewers.

Prime Video also launched its first-ever NBA coverage across more than 200 countries for the 2025–2026 season, drawing an average of 1.25 million U.S. viewers for the season-opening doubleheader.

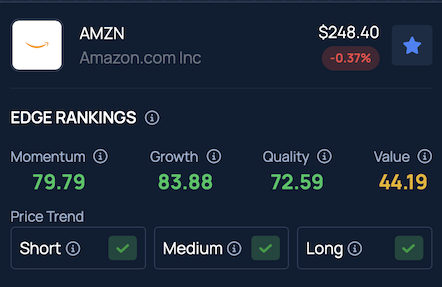

Benzinga's Edge Stock Rankings indicate that the stock maintains a strong upward trajectory across short, medium and long-term periods. Click here to view a detailed comparison with its peers and competitors.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo Courtesy: Shutterstock/Photo Agency