/Roper%20Technologies%20Inc%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Based in Sarasota, Florida, Roper Technologies, Inc. (ROP) designs, manufactures, and distributes engineered products and software solutions. With a market capitalization of roughly $58.2 billion, the company serves segments spanning legal, healthcare, government, food, transportation, oil and gas, medical, and other niche industries.

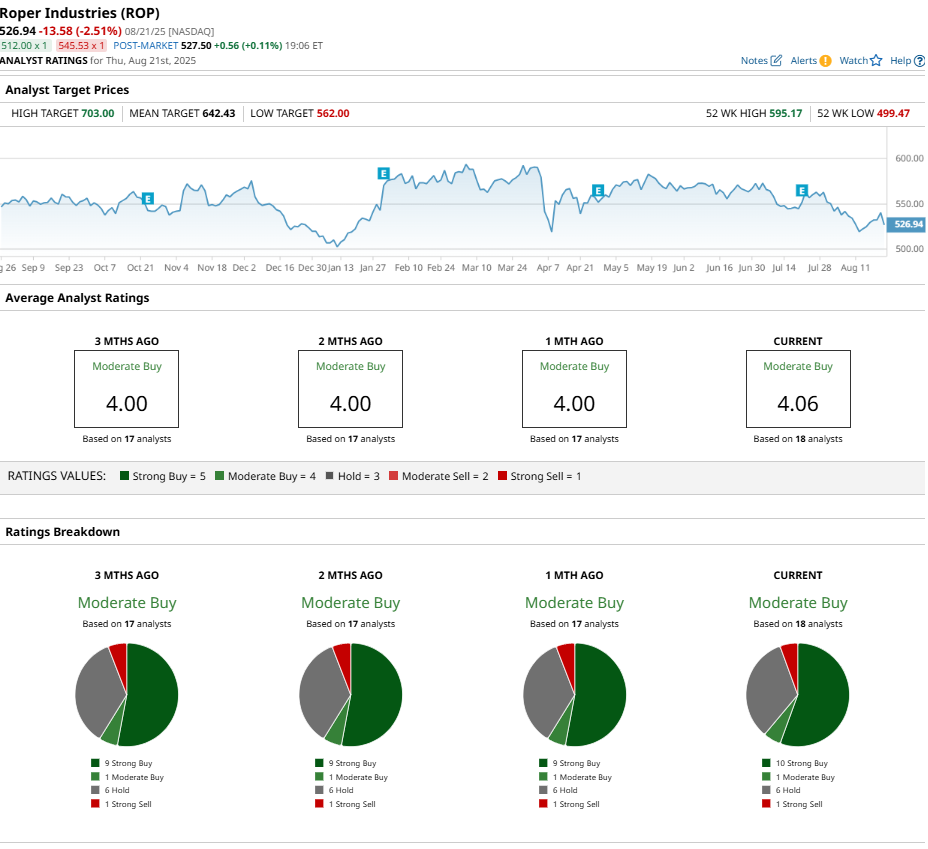

Over the past 52 weeks, shares of ROP have fallen 4.5%, underperforming the S&P 500 Index ($SPX), which climbed 13.3% during the same period. Year-to-date, the stock continues to lag the broader market, posting a modest 1.4% gain compared with the S&P 500’s 8.3% advance.

Within the broader sector, ROP has also trailed the US Technology iShares ETF (IYW), which has risen almost 21% over the past year and 11.8% year-to-date.

However, investor attention sharpened on July 21, when Roper reported Q2 2025 results that surpassed Wall Street expectations. Revenue rose 13.2% year-over-year to $1.94 billion, edging past analyst estimates of $1.93 billion. Organic growth of 7% was driven by strong momentum in the Application Software segment, while acquisitions added another 6% to total sales. Software bookings grew in the high teens, and adjusted EPS grew 8.7% to $4.87, exceeding the Street consensus of $4.82.

The company also announced the acquisition of cloud-native software provider Subsplash, strengthening its vertical market offerings, and raised full-year revenue guidance while revising its debt outlook. On the back of these advances, the stock jumped roughly 1.3% that day and added another 2.2% the following session.

For the fiscal year 2025, ending in December, analysts forecast a 10.8% growth in EPS, estimating $20.28 on a diluted basis. Moreover, the company has a strong track record of consistently outperforming analyst estimates over the last four quarters.

Among 18 analysts covering ROP, the consensus rating stands at "Moderate Buy," comprising 10 “Strong Buy” ratings, one “Moderate Buy,” six “Hold” recommendations, and one “Strong Sell.”

The current analyst sentiment has grown more bullish than a month ago, reflecting increasing investor confidence, with nine analysts holding “Strong Buy” ratings previously.

On July 22, Baird’s Joe Vruwink responded to encouraging trends in the company’s second-quarter bookings by raising ROP’s price target from $668 to $687, while maintaining an “Outperform” rating.

The mean price target of $642.43 represents a 21.9% premium to ROP’s current price levels. Meanwhile, RBC Capital’s Deane Dray has given the stock a Street-high target of $703, suggesting a potential upside of 33.4%.