/Rollins%2C%20Inc_%20workspace%20by-%20MacroEcon%20via%20Shutterstock.jpg)

Rollins, Inc. (ROL), valued at a market cap of $27.3 billion, is a global leader in pest and termite control services, anchored by its flagship brand Orkin. Headquartered in Atlanta, Georgia, the company has a presence in more than 70 countries, providing comprehensive solutions to both residential and commercial customers.

Companies valued at $10 billion or more are generally described as “large-cap stocks,” and Rollins definitely fits that description. Its global footprint, spanning more than 70 countries, coupled with a broad customer base that includes both residential and commercial segments, provides strong revenue diversification and stability. The company benefits from recurring service contracts, high customer retention, and steady demand for pest control as an essential service.

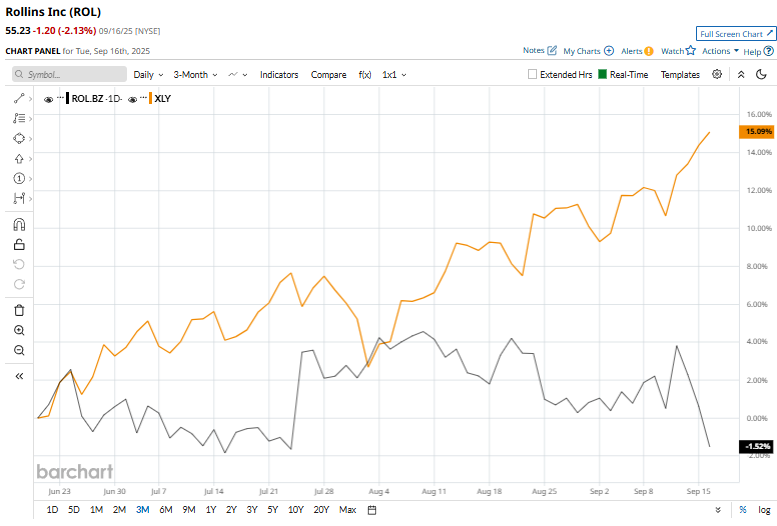

ROL recently touched its 52-week high of 59.10 on Aug. 8 and is currently trading 6.6% below the peak. Shares of Rollins have fallen 2.6% over the past three months, lagging the Consumer Discretionary Select Sector SPDR Fund (XLY), which has gained 13.2% over the same time frame.

Rollins has gained an impressive 19.2% year-to-date, significantly outperforming the XLY’s 8% rise. However, over the past 52 weeks, ROL shares have climbed 8.5%, trailing the XLY’s 26% rally.

The stock has been trading above the 200-day moving average since the end of January, but it has recently dipped below its 50-day moving average.

On Jul. 23, ROL reported its Q2 results, and shares rose 5% in the following trading session. Its adjusted EPS of $0.30 surpassed Wall Street expectations of $0.29, reflecting efficient cost management and steady operational performance. The company’s revenue was $999.5 million, surpassing Wall Street forecasts of $979.4 million, driven by strong demand across both residential and commercial pest control services, as well as contributions from recurring service contracts and higher customer retention rates.

In the competitive pest control and services space, contender H&R Block, Inc. (HRB) has trailed behind Rollins in terms of performance. HRB shares have declined 22.1% over the past 52 weeks and are down 5% year-to-date.

Among the 13 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $60.91 reflects a premium of 10.3% from the current market prices.