Shares of Rocket Companies Inc (NYSE:RKT) are trading higher Thursday morning as new economic data fueled investor bets on an imminent Federal Reserve interest rate cut. Additionally, Rocket earlier announced the company and the Bank of Montreal extended and expanded the existing Master Repurchase Agreement.

What To Know: The move came after fresh reports showed a surprising jump in both inflation and jobless claims. The Consumer Price Index for August rose 2.9% year-over-year, the highest since January, while initial jobless claims surged to 263,000, a peak not seen since late 2021. This combination of rising prices and a weakening labor market is increasing pressure on the Fed to stimulate the economy.

Market sentiment could now anticipate a potential 25-basis-point rate reduction at the central bank’s next meeting. For a mortgage giant like Rocket, lower interest rates are a significant boon.

The prospect of cheaper borrowing costs could reignite both the home purchase and refinancing markets, directly benefiting the company's loan origination volume. Investors are bidding up the stock Wednesday in anticipation of this more favorable lending environment.

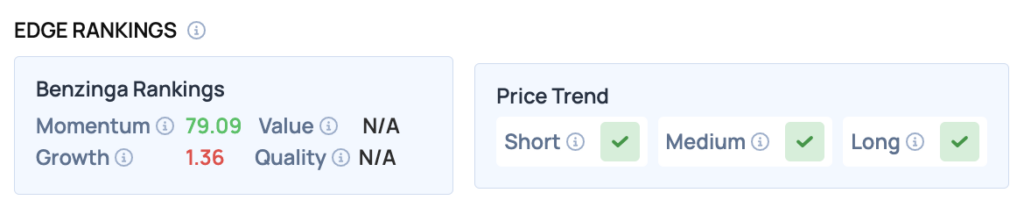

Benzinga Edge Rankings: The stock’s rally is further supported by strong technicals, as reflected in its Benzinga Edge Momentum score of 79.09.

Price Action: According to data from Benzinga Pro, RKT shares are trading higher by 5.15% to $21.98 Thursday morning. The stock has a 52-week high of $22.08 and a 52-week low of $10.06.

Read Also: Rocket Companies Could See Major Upside With Rate Cuts Approaching: Analyst

How To Buy RKT Stock

By now you're likely curious about how to participate in the market for Rocket Companies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Rocket Companies, which is trading at $21.98 as of publishing time, $100 would buy you 4.55 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock