Shares of Roblox Corp (NYSE: RBLX) are trading higher Monday morning following news that video game giant Electronic Arts is set to go private in a landmark leveraged buyout. Here’s what investors need to know.

What To Know: The surge in Roblox’s stock is part of a broader rally across the gaming industry, sparked by the massive vote of confidence in the sector. Electronic Arts, the maker of franchises like Battlefield and Madden NFL, is being acquired for approximately $50 to $55 billion by a consortium including private equity firm Silver Lake and Saudi Arabia’s Public Investment Fund, Reuters reports.

The massive investment is creating a halo effect for other industry leaders. The positive sentiment is lifting stocks like Roblox as investors speculate on the overall health of the gaming market and the potential for future consolidations.

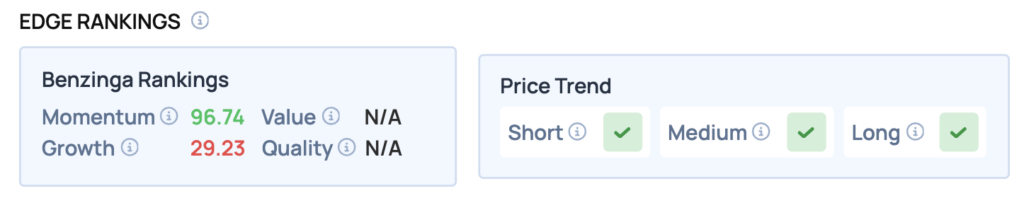

Benzinga Edge Rankings: Reflecting this market activity, Benzinga Edge rankings show Roblox with an exceptionally strong Momentum score of 96.74.

RBLX Price Action: Roblox shares were up 4.47% at $141.10 at the time of publication Monday, according to Benzinga Pro. Over the past month, Roblox has gained about 16.4% versus a 3.8% rise in the S&P 500 and is up roughly 141% year-to-date compared to the index’s 12.3% gain. With Monday’s gains, the stock is approaching its 52-week high of $150.59.

The stock is significantly above its 50-day moving average of $127.43, indicating strong upward momentum. Key resistance is observed near the 52-week high of $150.59, while support can be identified around the 50-day moving average.

Read Also: What Is Going On With Datavault Stock On Monday?

How To Buy RBLX Stock

By now you're likely curious about how to participate in the market for Roblox – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.