Robinhood Markets Inc (NASDAQ:HOOD) shares are trading higher on Tuesday afternoon, amid the recent release of encouraging operating data for August 2025 and the announcement of a new fund aimed at democratizing access to private markets.

HOOD is demonstrating bullish strength. Check the analyst take here.

What To Know: The company reported a year-over-year increase in funded customers, which grew by 11% to 26.7 million. Total platform assets also saw a significant jump, rising 112% from the previous year to $304 billion.

Net deposits for August reached $4.8 billion, contributing to a total of $53.3 billion over the past 12 months, marking a 199% increase from the prior year’s period. While equity and options trading volumes saw a slight dip from July 2025, they remained up on a year-over-year basis.

Robinhood has also unveiled its Robinhood Ventures Fund I (RVI), a closed-end fund designed to provide everyday investors with access to private, pre-IPO companies.

The fund, which is pending SEC approval, plans to trade on the NYSE under the ticker symbol RVI.

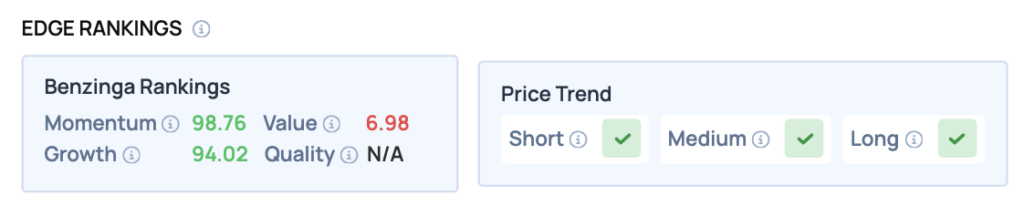

Benzinga Edge Rankings: Underscoring this positive sentiment, Benzinga Edge rankings give the stock an exceptional Momentum score of 98.76 and confirm a positive price trend across short, medium and long-term outlooks.

HOOD Price Action: According to data from Benzinga Pro, Robinhood shares closed higher by 2.22% to $117.38 on Tuesday afternoon. The stock has a 52-week high of $123.44 and a 52-week low of $22.05.

Read Also: What’s Going On With Dave & Buster’s Stock Tuesday?

How To Buy HOOD Stock

By now you're likely curious about how to participate in the market for Robinhood Markets — be it to purchase shares or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Robinhood Markets, which traded at $117.43 on Tuesday, $100 would buy you 0.85 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Image: Shutterstock