Robinhood Markets Inc (NASDAQ: HOOD) shares hit a new all-time high on Monday, propelled by recent positive operational results and strategic growth announcements. CEO Vlad Tenev revealed on social media that more than four billion event contracts have been traded on the platform since launch. Here’s what investors need to know.

What To Know: Tenev said in an X post on Monday that event contract participation is accelerating as trading volumes crossed two billion contracts in the third quarter alone, representing about half of the event contracts traded on the platform since inception.

The rally to new highs to start the week follows a strong August report that revealed significant year-over-year growth. The company’s total platform assets swelled by 112% to $304 billion last month, and it attracted $4.8 billion in net deposits for August.

Fueling the optimism are several new initiatives aimed at expanding its user base and revenue streams. The company's recently launched prediction-market business is accelerating, now pacing at an annualized revenue rate of over $200 million.

Furthermore, Robinhood is expanding its customer base by introducing features for more sophisticated investors, including short selling and a social trading platform. The company also announced the Robinhood Ventures Fund I, designed to give retail investors access to pre-IPO companies.

Analyst sentiment has turned increasingly bullish, with both Piper Sandler and Goldman Sachs recently reiterating positive ratings and raising price targets.

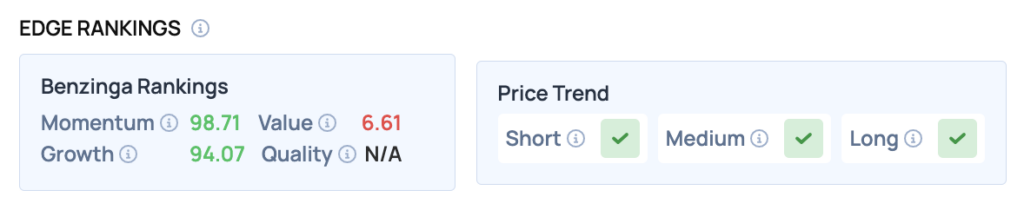

Benzinga Edge Rankings: The stock’s powerful surge is quantified by its Benzinga Edge rankings, which award Robinhood an exceptional Momentum score of 98.71.

HOOD Price Action: Robinhood Markets shares were up 11.56% at $135.86 at the time of publication Monday, according to Benzinga Pro. Over the past month, Robinhood has gained about 34% versus a 4.1% rise in the S&P 500. The stock is up roughly 249% year-to-date compared to the index’s 12.6% gain.

Robinhood stock is significantly above its 50-day moving average of $110.60, indicating bullish sentiment and potential support at this level. Shares have rallied through resistance levels and are now trading at all-time highs.

Read Also: Robinhood Soars, Oil Dips And Gold Defies Gravity: What’s Moving Markets Monday?

How To Buy HOOD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Robinhood Markets’ case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock