Ahead of its third-quarter earnings results on Wednesday, prominent analysts remain divided on Robinhood Markets Inc. (NASDAQ:HOOD) and its near and long-term prospects.

The Company’s Fundamentals Are Amazing’

Robinhood “really has come a long way since the meme stock craze,” said Ed Carson, a news editor at Investor's Business Daily, while appearing on the Earnings Cheat Sheet show by IBD last week.

He noted that the stock was up 280% year-to-date, while adding that its entry into new services, such as prediction markets, can help garner “a lot more revenue.” Carson referred to the discount stockbroker as “one of the hottest stocks of 2025,” with plenty of growth drivers to keep it going.

See Also: Insights into Robinhood Markets’s Upcoming Earnings

Carson said that the company’s “fundamentals are amazing,” but cautioned that investors will be looking to see if this growth can continue unabated, or if it is going to start slowing down at some point.

Stock Is Now ‘Meaningfully Overvalued’

Analyst Parkev Tatevosian, CFA, acknowledged the stock’s remarkable performance in 2025 but warned that it is now “meaningfully overvalued,” trading at $136.80 per share as of Tuesday, relative to its intrinsic value, which he said was at $48 per share.

“I would have put Robinhood in the category of Tesla or Palantir,” he said, that is strong businesses with lofty valuations. But heading into next week's update, Tatevosian warned, “I see a bigger downside than I do any upside.”

Robinhood’s Crypto Revenue Being Underestimated

Analyst Ed Engel of Compass Point raised their price target for the stock from $105 to $161 per share last week, representing an upside of 17.6% from current levels, according to a report by Yahoo Finance.

Engel noted that leading analysts have significantly undervalued Robinhood’s growing cryptocurrency business for the second half of 2025 and 2026. He cited “higher fee rates and staking revenue” to justify his target for the stock, which he said can be a significant growth driver going forward.

He also sees strong tailwinds for the company’s prediction markets business from the NFL season during the fourth quarter. “We model HOOD’s 4Q prediction reaching ~$50m alongside a full quarter of NFL season,” he said.

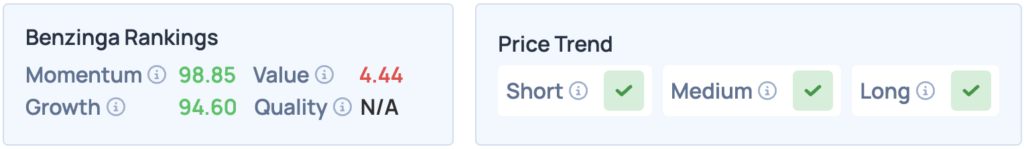

The stock was down 6.99% on Tuesday, closing at $136.80, and is up 0.71% overnight. The stock scores high on Momentum and Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo: dennizn on Shutterstock.com