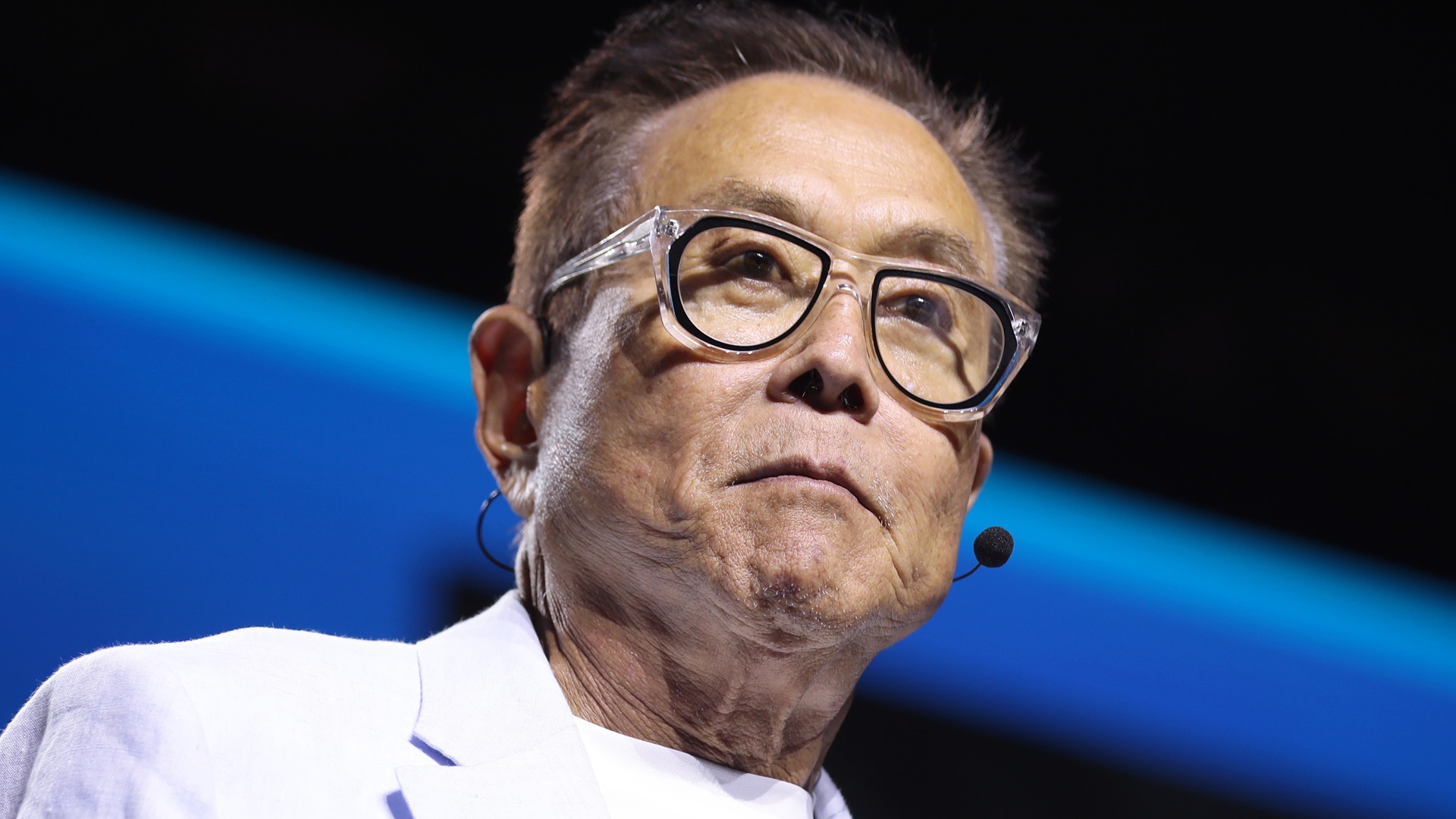

Personal finance author and money expert Robert Kiyosaki made a bold prediction on X earlier this year about the state of the economy. In short, he said hyperinflation could financially wipe out millions of Americans. While inflation has been a hot topic for years, hyperinflation — defined as a monthly inflation rate of 50% or more — is far more severe and historically rare in the United States.

Find Out: How Middle-Class Income in 1980 Compares to 2025

For You: 6 Things You Must Do When Your Savings Reach $50,000

So, how realistic is Kiyosaki’s prediction of hyperinflation coming to the U.S., and what would that mean for your purchasing power, savings and financial security? Here, we break down his claims and examine expert insights to help you understand the risks and how to protect your money.

Inflation vs. Hyperinflation Explained

Just what is the difference in U.S. inflation risk analysis? Here is a quick breakdown:

- Inflation is the general increase in prices and decrease in the purchasing value of money over time.

- Hyperinflation is an extreme and uncontrolled form of inflation characterized by a very rapid increase in prices, often defined as over 50% per month.

- The key difference is the rate and the cause; while inflation can be caused by demand or production costs, hyperinflation is typically driven by a rapid increase in the money supply and a loss of confidence in the currency, thanks to factors such as government shutdowns, tariffs or a rising cost of living.

Up Next: Trump’s $2K Dividend: What Middle-Income Americans Could Expect

What Does Kiyosaki Mean That Hyperinflation Will ‘Wipe Out’ Millions Financially?

“Hyperinflation is a state of extremely high inflation, typically reaching high double digits or triple digits,” said Marko Bjegovic, macroeconomist and founder of Arkomina Research.

Kiyosaki believes everything in the economy will become more expensive, from interest rates for borrowing money to basic necessities. His reasoning is likely that, with the Fed printing money, this could devalue the American currency and lead to higher inflation. It’s safe to say Kiyosaki believes that inflation will become so exorbitant that the average American consumer will be unable to carry their debt moving forward and will have to declare bankruptcy.

Is Kiyosaki’s Hyperinflation Warning Accurate?

Kiyosaki isn’t a stranger to making bold claims about a possible economic collapse — he’s done it many times before. Here’s a review of some of the claims in his X post to try to verify their accuracy and how hyperinflation affects your money.

There’s No Evidence Pointing Towards Hyperinflation

Bjegovic said there’s nothing to suggest that the U.S. is currently on a path to hyperinflation.

“In that sense, the U.S. has never had hyperinflation since the Fed’s inception in 1913,” he said. “Hyperinflation has been commonly associated with countries experiencing extreme political or economic collapse, such as Weimar Germany (1920s), Zimbabwe (2000s), Venezuela (2010s), and Argentina (2020s).”

Since the situation has never occurred in history, it’s unrealistic to expect it to happen this time around, despite Kiyosaki’s claim.

It’s Impossible To Predict Future Prices of Assets

Some of Kiyosaki’s predictions for future asset prices are extremely bold. For context, the highest price of gold ever peaked at over $4,300 per ounce in October 2025. Blake Mclaughlin, gold expert and vice president of exploration at Axcap Ventures, said gold’s recent surge indicates underlying instability in the economy and that based on current conditions, its upward trend may continue.

“Having exposure to commodities like precious metals is a reasonable hedge for inflation. Generally, physical assets, where supplies cannot be readily or easily manipulated, provide a safe and honest place to invest,” he added.

However, no evidence would suggest that gold can reach the value of $25,000 mentioned by Kiyosaki.

Similarly, bitcoin’s highest price ever was just over $126,000 in October but is down around $91,000 now. These numbers are far from the substantial numbers shared by Kiyosaki. For bitcoin to go from $100,000 to one million is an extreme stretch and there’s no evidence pointing towards this possibility. Upon further investigation, there aren’t any other credible experts declaring that bitcoin can go as high as one million.

The Details About the Auction Aren’t Correct

“The auction Mr. Kiyosaki mentioned was held by the Treasury and not by the Fed,” Bjegovic said. It’s essential to emphasize that the Fed didn’t conduct this auction, as that’s a crucial fact stated in the announcement.

Reuters pointed out that the auction was poorly received, which led to a stock sell-off, with investors concerned about the national debt. However, the article also shared that the 20-year bonds usually see less demand than other maturities and that it wasn’t a disaster.

While the demand for the $16 billion sale of 20-year bonds was weak, it’s also unfair to say that nobody showed up to the auction on May 21. Bjegovic said it went better than feared due to the circumstances at the time (Moody’s downgrade, passage of the “Big Beautiful Bill Act” and wider fiscal deficits).

“Treasury auctions are functioning well (as evidenced by other auctions that followed, like the two-year note this week) and inflation remains relatively low. The contents of Mr. Kiyosaki’s post on X have grossly exaggerated both the current situation and what is likely to happen in the future,” Bjegovic explained.

While it’s important to be cautious about your investing approach, you also don’t want to get caught up in the fear-mongering that can be evident on social media. As always, we recommend that you speak with a qualified financial professional before making any important decisions about your funds.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- Aldi's 8 Best Products of 2025, According to 40,000 Shoppers

- Trump's $2K Dividend: What Low-Income Americans Should Expect

- 5 Clever Ways Retirees Are Earning Up to $1K Per Month From Home

- 9 Low-Effort Ways to Make Passive Income (You Can Start This Week)

This article originally appeared on GOBankingRates.com: Robert Kiyosaki’s Warning That Hyperinflation Could Devastate Millions: Fair or Foul?