Shares of Rite Aid (RAD) on Thursday have lost more than a quarter of their value after the drugstore chain reported earnings.

Of course, the broad stock market also is under significant selling pressure once again.

As for the company's report, it beat revenue expectations even as sales fell 3.4% year over year. But its loss of 63 cents a share missed estimates by 17 cents.

While management maintained its full-year revenue outlook, it lowered its net loss outlook and adjusted-Ebitda range. That’s as consumer spending remains pressured and supply-chain issues continue to hobble corporate operations.

Many investors may look to CVS Health (CVS) and Walgreens (WBA), especially as the latter pays close to a 6% dividend yield.

Still and all, let's review Rite Aid's chart.

Trading Rite Aid Stock

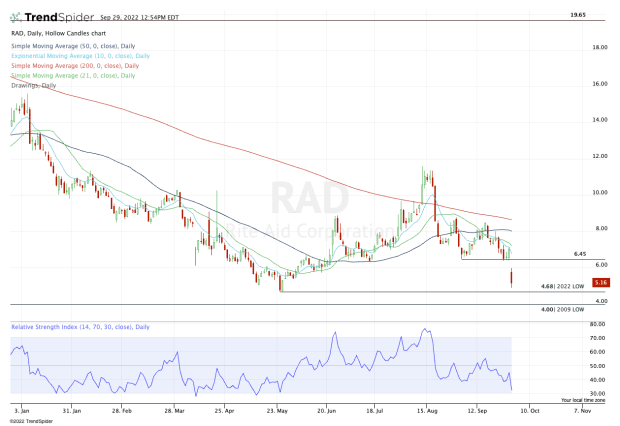

Chart courtesy of TrendSpider.com

The shares had been doing a pretty good job of holding the $6.50 level as support, which had formed a nice double bottom. A positive reaction could have put $8 or higher in play.

Instead, we have a massive gap-down in Rite Aid, with the $6.50 area acting as the gap-fill area to watch on any potential rebound of consequence. (The stock at last check was trading at $5.12.)

On the downside, the shares have -- at least so far -- avoided fresh 2022 lows on the day, which would come on a break of the $4.68 area.

Should Rite Aid close below that mark, the door opens down to the 2009 low at $4.

It’s hard to believe that the March 2009 low — the same month that the S&P 500 officially bottomed during the financial crisis — could be in play, but here we are, not that far from it.

For those looking at Rite Aid now, the shares look to be in no man’s land.

Over $6 and they could push up toward $6.50. But as they stand, sub-$5 leaves them open to a test of $4.68, then $4.