In the latest Market on Close livestream, Senior Market Strategist John Rowland gave traders a heads-up to keep an eye on one of the market’s most watched technical lines — the 50-day moving average.

The S&P 500 Index ($SPX) and SPDR S&P 500 ETF (SPY) have both rallied sharply over recent months, but that momentum may be about to face its biggest test yet.

“We’ve had a lot of new length purchased in a very short period,” John said. “The 50-day moving average is acting as support — and that’s good — but it’s also a point of risk.”

The 50-Day Moving Average: Support or Trap?

According to John, when a large number of traders have the same stop level — in this case, just below the 50-day MA — it can create what’s known as a liquidity trap. That’s when algorithms deliberately push prices below key levels to trigger stop losses, shake out weak hands, and then reverse higher.

“Who hasn’t had that happen?” John joked. “It reverses very quickly — which could be what happened [last Friday].”

But there’s a deeper question, he says: how much of this “new length” is leveraged or on margin, and how strong is the conviction among “buy-the-dip” traders?

If that support fails, the market could shift from a bullish rhythm of higher highs and higher lows to one defined by lower highs and lower lows — a potential change in trend character.

John’s Downside Price Targets

If SPY or SPX break decisively below the 50-day line, here’s where John is watching next:

- SPY 100-Day Moving Average: around $635

- SPY 200-Day Moving Average: around $605

- S&P 500 Index Equivalent: around 6,552–6,475

“A weekly close below the 50-day,” John notes, “would be a signal that the market’s behavior is changing — and that could bring in a liquidity sweep to the downside.”

What Traders Should Watch

- Trend Confirmation: A clean close below the 50-day could mark a shift from bullish to neutral or bearish momentum.

- Volume & Leverage: Elevated margin levels increase the risk of forced selling during sharp pullbacks.

- Market Psychology: A break could flush out weak longs before a broader recovery — creating a classic “buy the fear” setup if it stabilizes near the 200-day.

How to Track These Levels

Monitor the S&P 500 and SPY using Barchart’s tools:

You can also overlay multiple MAs — 50, 100, and 200-day — on Barchart Interactive Charts with our pre-built chart templates to visualize where support may appear next.

John's S&P Blueprint

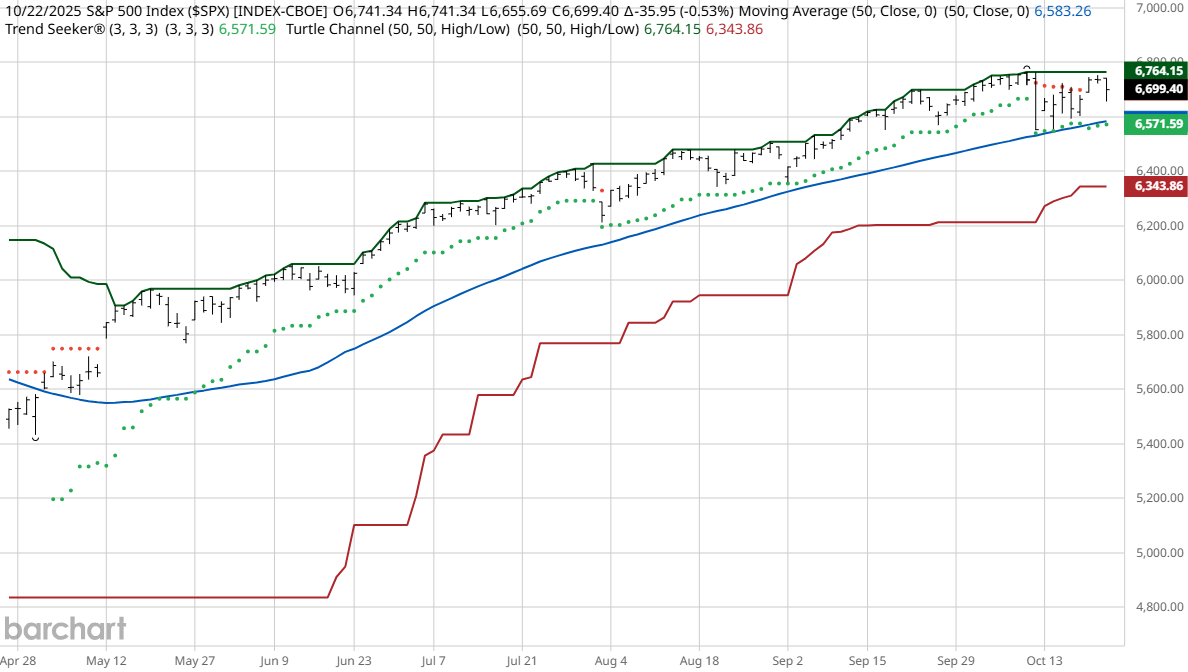

For even more precision, John says the Long Term Stop template is an “excellent tool for this occasion,” as it includes the 50-day MA along with Barchart's Trend Seeker (TS) and turtle channels (TC) overlaid:

“Notice how the Trend Seeker and the 50-day have moved from parallel to on top of each other (point of risk), after the TS went to hold (both dots above and below) after the Friday sell-off and holding the 50-day MA before signaling a new uptrend on Monday. However, at the same time, the turtle channel - with the lower TC now just above the 100-day moving average - has remained flat on the top side, a clear sign of momentum fatigue. This template captures the waning momentum, cluster of evidence (point of risk), new length, and the need for risk management.”

The Takeaway

Markets rarely fall in a straight line. But when sentiment and leverage both run hot, even small cracks can trigger sharp corrections.

“I’m not calling for a crash,” John said. “I’m calling for good risk management.”

If the 50-day line holds, it could invite another round of buying. But if it doesn’t, expect volatility — and keep your stop levels tight.

Watch the Clip: SPY 50-Day & Your Trading Blueprint →

- Stream the Full Episode of Market on Close →

- Track SPY Trade Alerts on Barchart →