While the global business ecosystem has been firmly focused on artificial intelligence and other innovative solutions, key industrial commodities have also risen to the forefront. Increasingly, awareness has been building regarding the enormous scale of resources required to feed the digitalization machinery. However, production of necessary metals and minerals is difficult to come by, potentially presenting a unique opportunity for forward-thinking investors.

Fundamentally, one only needs to consider the tremendous burden that generative AI imposes on the supply chain of core resources used in the production of power. According to the International Energy Agency (IEA), a single request on the popular large-language model (LLM) ChatGPT requires ten times more electricity than a Google search.

Not only that, the average query on the platform costs approximately 36 cents. That might not sound like much until the realization hits that ChatGPT represents the fifth-most visited website in the world, just after Instagram and ahead of X (formerly Twitter).

It's not just AI that consumes vital resources. Thanks to next-generation energy solutions such as electric vehicles and solar panels, metals such as copper and silver have witnessed price acceleration. Moreover, securing a stable supply chain of rare earth elements carries significant economic and national security implications. As such, a McKinsey report notes that global demand for magnetic REEs may triple between 2022 and 2035.

Still, a production lead time bottleneck clouds the overall supply picture. Per data from S&P Global, mining projects may take from 15 years to nearly 18 years to go online. Because of this dynamic, prices of critical resources may rise to accommodate market conditions.

The Sprott ETF: While retail investors may be tempted to jump on the commodities bandwagon, a viable alternative is to consider the latest product from financial services giant Sprott Inc. (NYSE:SII). Known as the Sprott Active Metals & Miners ETF (NASDAQ:METL), this actively managed fund diversifies its holdings across a range of expertly vetted ideas. As such, market risk is spread out across a wide canvas.

What's more, the Sprott Asset Management team which oversees the METL ETF commands over four decades of specialized leadership in metals and mining investments. Senior Portfolio Manager Justin Tolman is an economic geologist, specializing in project and company evaluations. By marshaling Sprott's collective experience and insights, METL investors have greater confidence in navigating the exciting — but often volatile — resource sector.

As with any idea tied to the capital markets, prospective participants should consider the risks involved. Primarily, commodity pricing can be incredibly dynamic, likely warranting considerable patience. In addition, even the best miners face a host of challenges, including operational, environmental and geopolitical. Finally, commodity demand and corporate performance aren't always aligned.

The METL ETF: With the Sprott Active Metals & Miners ETF having just made its debut on Sep. 10, there's not much to analyze. However, the early performance may be characterized as strong. Following its first public session, METL gained 0.90%. Furthermore, during afterhours trading, the actively managed fund gained 1.24%.

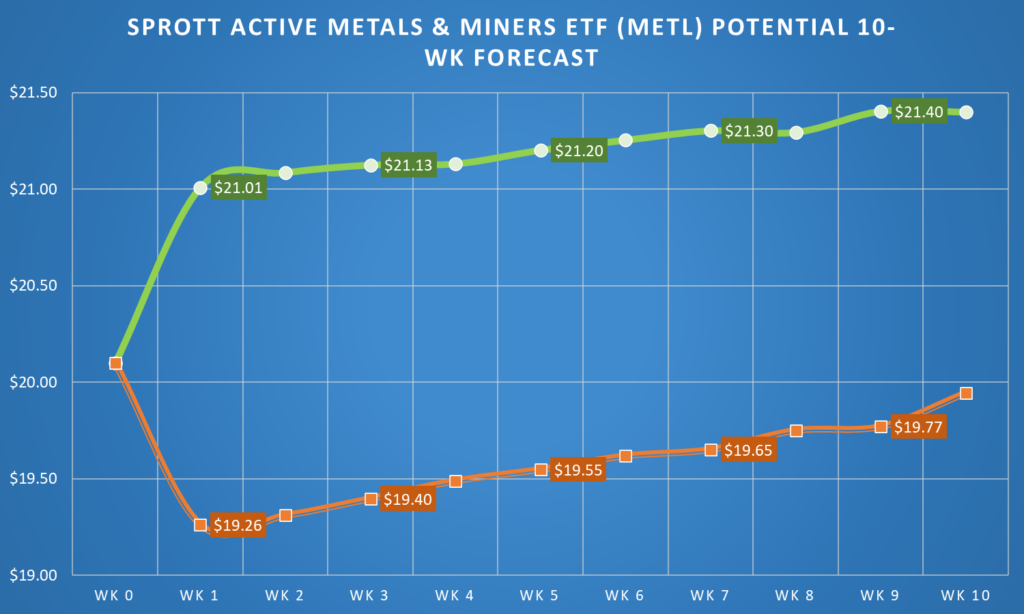

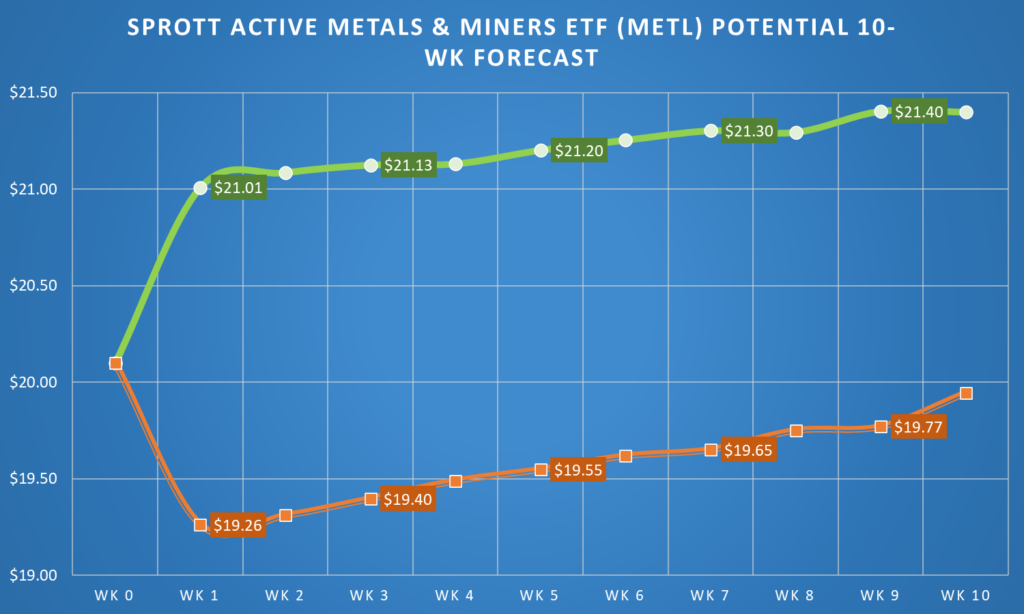

To get a better understanding of where the Sprott Active Metals & Miners fund may move over the next 10-week period, it's possible to take a composite of METL's top five individual holdings. Based on past analogs, analysts can calculate an aggregate expected drift along both a median positive and negative pathway.

Through this calculation, METL could potentially aim for a range between $19.95 and $21.40. Of course, because of the lack of trading data, these projections are highly speculative — but they could provide a rough idea of what to expect in the near term.

Featured image by Łukasz Klepaczewski on Pixabay.