As one of the premier aerospace and defense contractors, Lockheed Martin Corp (NYSE:LMT) represents somewhat of an oddity in the equities arena. Typically, geopolitical tensions aren't conducive to capital growth. For one thing, investors tend to demand higher risk premiums (relative to so-called risk-free assets like U.S. Treasuries), thereby leading to contracting multiples. Just as importantly, a flight to safety occurs, which sees commodities like gold rise.

Of course, there are important nuances to the broader capital flight narrative — one that tends to benefit defense contractors like Lockheed Martin. Geopolitical tensions boost demand for weapons, missiles and various support systems, thereby outweighing market-wide drag in many cases. For example, when Israel began launching airstrikes against Iran in June, LMT stock conspicuously shot higher.

At the same time, Lockheed Martin isn't immune to everyday investor pressures. For its second-quarter earnings disclosure — released on July 22 — Lockheed posted earnings per share of $7.29, beating Wall Street analysts' consensus estimate of $6.63. This figure was also an improvement against the year-ago quarter's print of $7.11. However, revenue of $18.16 billion missed the consensus view of $18.63 billion. This tally was only a slight improvement over last year's print of $18.12 billion.

Subsequently, LMT stock stumbled following the publication of its quarterly results. What's worse, the red ink has contributed to LMT losing more than 8% since the start of the year. For context, the benchmark S&P 500 index has gained just under 10% during the same frame.

Still, the bulls aren't deterred because geopolitical tensions and flashpoints continue to escalate around the world. Perhaps most notably, the conflict in Ukraine does not appear to be any closer to a resolution, despite significant efforts by President Donald Trump to help secure a peace agreement. Because of the uncertainty that the war poses, European allies are likely to bolster their spending — which in theory should lift LMT stock.

On the other hand, investors will be all too aware of the last earnings report. At the time, the painful realization was that narratives alone aren't always enough to invigorate investor sentiment. Lockheed Martin still has to run a viable business — and that can be tricky when most of the revenue is tied to defense or defense-adjacent endeavors.

The Direxion ETFs: Given the many angles that can be explored for Lockheed Martin, speculators on both sides of the sentiment spectrum have justification for their beliefs. To that end, financial services provider Direxion offers two new products.

For the optimists, the Direxion Daily LMT Bull 2X ETF (NASDAQ:LMTL) seeks 200% of the performance of LMT stock. On the other hand, pessimists may consider the Direxion Daily LMT Bear 1X ETF (NASDAQ:LMTS), which seeks 100% of the inverse performance of the namesake security.

Over the years, Direxion ETFs have gained popularity with retail investors, with a key reason being flexibility. Usually, traders interested in more exotic strategies such as leveraged or short positions must engage the options market. However, financial derivatives carry complexities that may not be suitable for everyone. In contrast, Direxion ETFs can be bought and sold much like any other publicly traded security, thus mitigating the learning curve.

Nevertheless, traders interested in these funds must recognize their unique risks. First, leveraged and inverse ETFs typically incur greater volatility than funds tracking benchmark indices, such as the S&P 500. Second, Direxion ETFs are designed for exposure lasting no longer than one day. Holding these funds longer than recommended may expose traders to value decay due to the daily compounding effect.

The LMTL ETF: Having just launched earlier this month, there's not much that can be inferred from the LMTL ETF directly.

- That said, technical analysts can attempt to infer demand for LMTL by focusing on the ebb and flow of LMT stock.

- The biggest bullish takeaway at the moment is that the ongoing Ukraine war and its implications may have contributed to LMT's August rally.

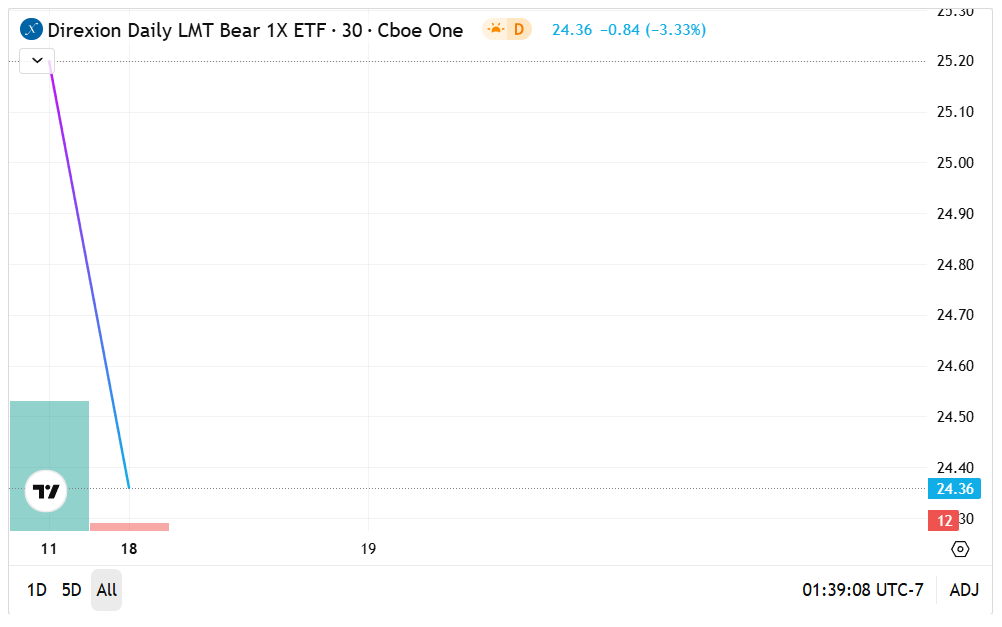

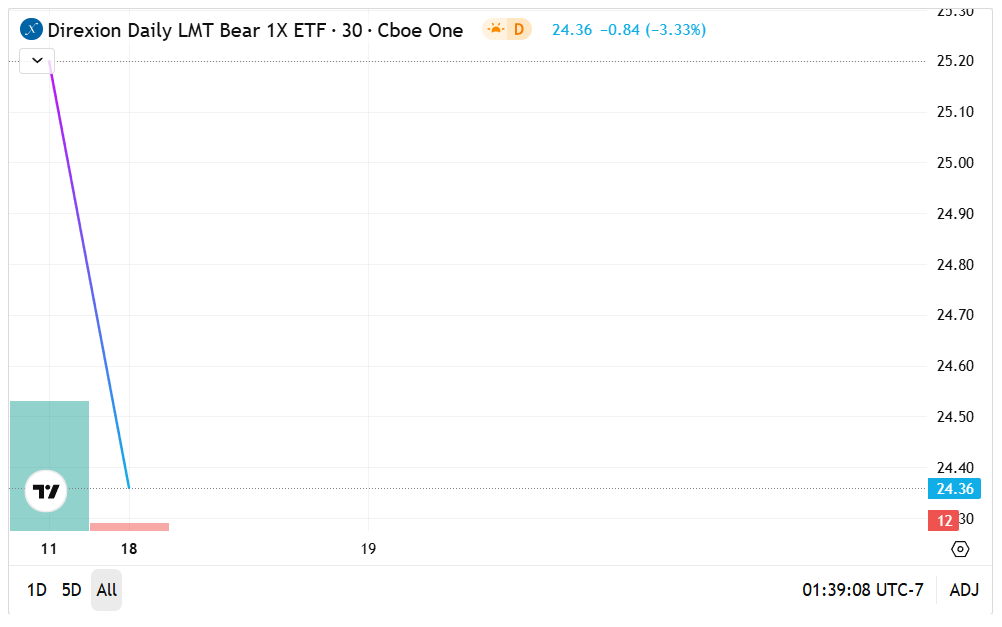

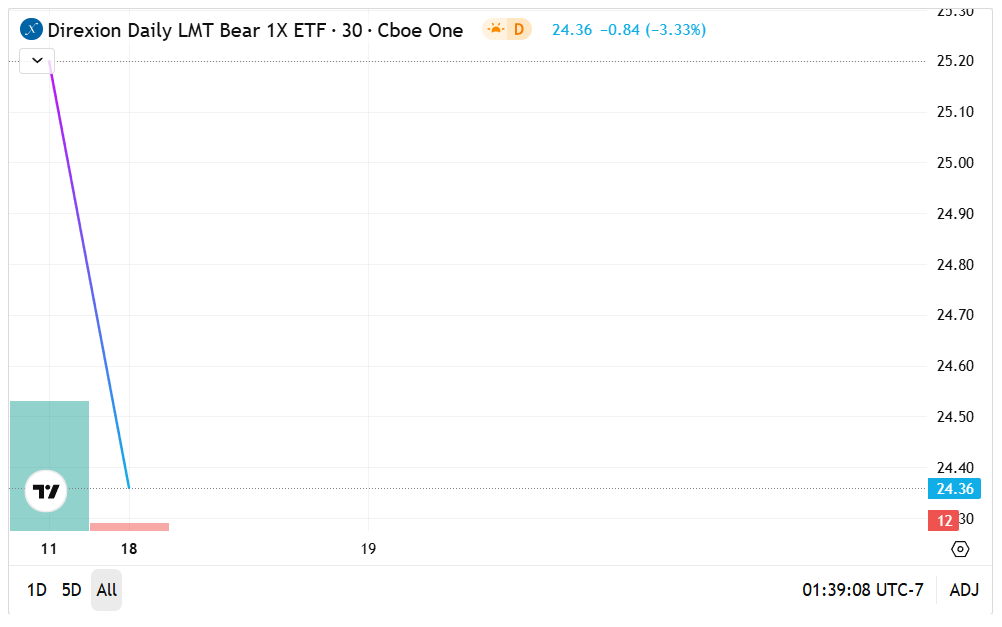

The LMTS ETF: As with its bullish counterpart, the inverse LMTS ETF has very limited history from which to make rational inferences.

- While LMT stock has been moving higher recently, the security remains well below its 2024 record high.

- One technical factor to watch is whether LMT can break above the resistance imposed by the 50-day moving average. If not, the LMTS ETF could be an interesting asset to consider.

Featured image by Military_Material from Pixabay.