Rio Tinto Group has dropped out of the bidding for a stake in Soc. Quimica & Minera de Chile SA, one of the world’s top lithium producers, as it pursues other ways to capitalize on the electric-car boom, people familiar with the matter said.

Rio decided not to proceed with an offer for Nutrien Ltd.’s 32 percent stake in Santiago-based SQM after studying information in a data room, according to the people. Other strategic bidders remain interested in the holding, one of the people said, asking not to be identified because the information is private. Nutrien’s interest in SQM is worth about $5 billion at current market prices.

Nutrien, the Canadian firm formed through Potash Corp. of Saskatchewan Inc.’s recent merger with Agrium Inc., is selling the holding to meet a condition imposed by Indian regulators when approving that combination. Rio last year sought advice from firms including Credit Suisse Group AG on a possible bid for the stake, people familiar with the matter said in November.

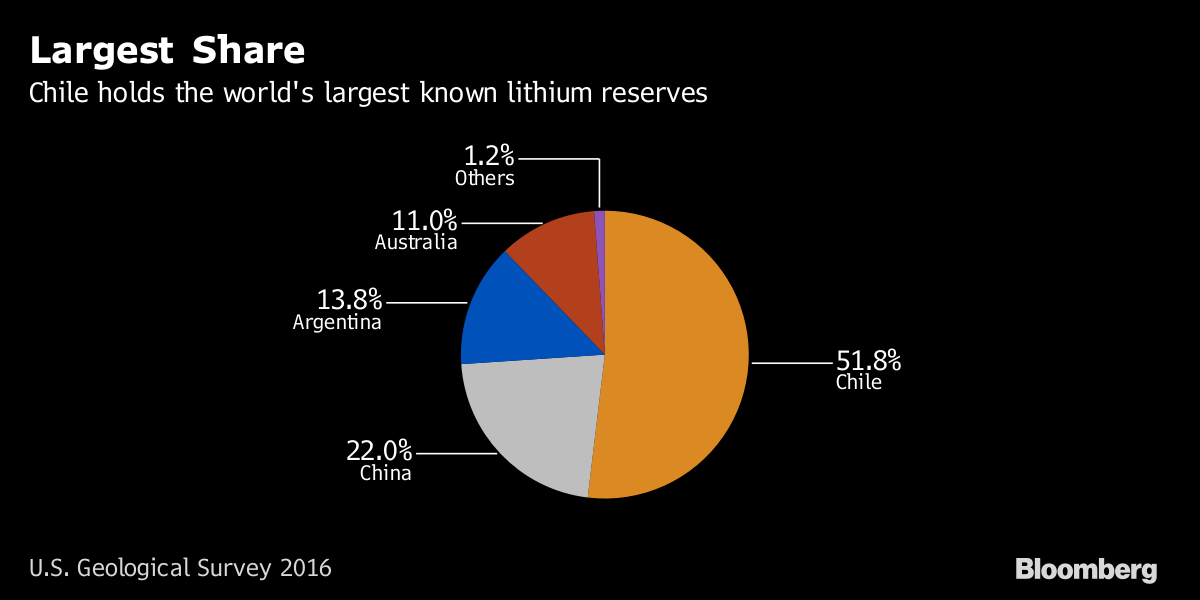

Lithium is a key element used in electric-vehicle batteries, and prices have tripled since 2015. BHP Billiton Ltd., the world’s largest mining company, in September approved a $43 million project to start producing nickel sulfate, a product needed for lithium-ion batteries. Glencore Plc plans to double its production of cobalt in the next two years, another key battery component.

Representatives for Rio Tinto, Nutrien and SQM declined to comment.

Rio rose 1.1 percent in London to 4,138 pence, the highest in more than six years. The stock earlier closed little changed at A$79.25 in Sydney trading Thursday, as rival BHP Billiton Ltd. fell along with Australia’s benchmark index. Lithium producers including Galaxy Resources Ltd. also declined.

“A good move, and one that shareholders will welcome,” said Paul Gait, an analyst at Sanford C. Bernstein Ltd. in London. “Discipline is maintained, shareholder money will not be diverted to another top of the cycle acquisition. Important line in the sand has been drawn here. Rio showing discipline and leadership. Good all round.”

London-based Rio is “well placed to benefit from the growth of EVs with our copper and aluminum offering,” though is continuing to evaluate other opportunities, Chief Executive Officer Jean-Sebastien Jacques told investors at a Sydney forum last month. The company is studying development of a Serbian lithium project, called Jadar, that could meet 10 percent of global demand and begin production as soon as 2023.

“They get to see the data room, they probably understand the lithium industry much better now as a consequence of this exercise, which will help with the development of Jadar,” said Gait.

Rio’s Ventures unit, led by former Xstrata Plc dealmaker Andrew Latham, is also reviewing investments and partnerships in commodities that are outside Rio’s core portfolio and exposed to green technology. Nutrien CEO Jochen Tilk told analysts in October that the company had seen “significant interest” for its SQM stake as investors seek exposure to lithium assets amid expectations of a boom in electric vehicles.

Mining companies need to remain wary of buying assets at over-inflated prices as they seek to tap forecast rising demand for battery raw materials, Evy Hambro, who manages BlackRock Inc.’s World Mining Fund, said in a September interview. Investors are urging the biggest miners not to repeat past mistakes on failed acquisitions, and major deals to add lithium would risk eroding trust as the commodity is likely at the top of its price cycle, Sanford C. Bernstein Ltd. wrote in a Jan. 5 report.

While Nutrien is the biggest shareholder in SQM, Chilean businessman Julio Ponce controls the company via voting shares held through a series of holding companies. Ponce, who is engaged in a bitter contractual dispute with Chilean authorities who are pushing him to relinquish control, last month agreed to certain conditions in order to restart talks on SQM’s main mining license in the Atacama salt flat.

--With assistance from Laura Millan Lombrana and Jonathan Gilbert

To contact the reporters on this story: Brett Foley in Melbourne at bfoley8@bloomberg.net, David Stringer in Melbourne at dstringer3@bloomberg.net, Dinesh Nair in London at dnair5@bloomberg.net, Thomas Biesheuvel in London at tbiesheuvel@bloomberg.net.

To contact the editors responsible for this story: Ben Scent at bscent@bloomberg.net, Jason Rogers at jrogers73@bloomberg.net, Dinesh Nair at dnair5@bloomberg.net, Lynn Thomasson at lthomasson@bloomberg.net, Keith Gosman

©2018 Bloomberg L.P.