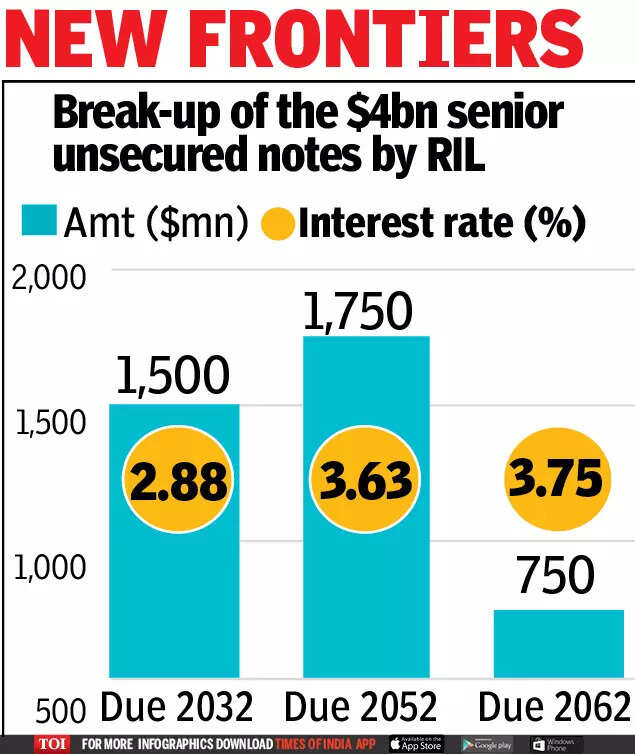

MUMBAI: Reliance Industries (RIL) has raised $4 billion in the biggest foreign currency bond sale by an Indian corporate. It raised $1.5 billion in a 10-year tranche, $1.75 billion in a 30-year and $750 million in a 40-year deal. It had recently received board approval to raise up to $5 billion in foreign bonds to take advantage of the low interest rate environment and to refinance existing borrowings. The bond issue was subscribed nearly three times with peak order book aggregating $11.5 billion. The bonds were bought by investors from Asia (53%), America (33%) and Europe (14%).

It was the largest foreign currency bond issuance from India, RIL claimed, dwarfing the earlier record set by energy major ONGC Videsh when it raised $2.2 billion in dollars notes in 2014. Bharti Airtel had raised $1.25 billion in 2021, which was the biggest debt issue last year.

The jumbo foreign currency bond issue was the largest debt capital market transaction at $4 billion and the “tightest credit spreads across each of the long-dated tenors for any corporate in India”, said RIL joint chief financial officer Srikanth Venkatachari. “The support received from the marquee international capital market investors is reflective of the strength of our underlying businesses with established growth platforms across energy, consumer and technology as well as robustness of our balance sheet.”

RIL did not divulge the name of the subscribers of the bonds. But, industry sources said the subscribers included Fidelity, Pacific Investment Management Co (Pimco), Goldman Sachs Asset Management (GSAM), Metlife, Eastspring, NeubergerBerman, Blackrock and Lombard Odier. The bonds will be listed on the Singapore Stock Exchange. Industry observers said RIL achieved a low interest rate as investors are betting on the India growth story, among other factors. “Despite heavy competing calendar at the beginning of the year, RIL printed the lowest ever 30-year coupon and the lowest ever reoffer spread on a 10-year bond from an Indian issuer,” said Bank of America India head Kaku Nakhate.

Agreeing with Nakhate was Citi India CEO Ashu Khullar. “RIL achieved lowest coupon for benchmark 30- and 40-year issuances by any private sector corporate in BBB space from Asia, ex-Japan. This is also the first ever 40-year issuance from India taking advantage of current low-rate environment to elongate debt maturity,” said Khullar.