Quantum computing company Rigetti Computing Inc. (NASDAQ:RGTI) is eyeing a significant share of both the U.S. and international government quantum computing budgets, even as a major federal funding bill remains in limbo.

RGTI shares are sliding on disappointing news. View the charts here.

Funding At Home And Abroad

During the company’s second-quarter earnings call on Tuesday, Rigetti’s CEO, Subodh Kulkarni, pointed to the scale of the opportunity tied to the pending National Quantum Initiative reauthorization, which he says would allocate “$2.5 billion over five years,” or roughly “$500 million a year.”

See Also: IonQ’s Big Growth And Big Loss Test Quantum ETF Resilience

Kulkarni notes that government funding for quantum projects isn’t limited to the U.S., with “many other countries in the western world” and certain “friendlier countries in Asia” planning to spend “hundreds of millions of dollars a year” on on-premises quantum systems.

Legislation With Bipartisan Support

Referring to the National Quantum Initiative Reauthorization Bill, Kulkarni says that the legislation has bipartisan support, but notes that there are several versions of the bill, at different committees, with a lot of hearings over the past couple of months.

He says that he hopes it becomes the NQRE Authorization Act over the next few weeks or months, while adding that “it’s just a question of when, not if.”

According to Kulkarni, such government programs will play a key role in bridging the revenue gap until the industry matures. “We will continue to participate with DOE, DoD, UK government and other governments as appropriate,” he says, while adding that he is confident of getting such opportunities.

1,700% Rally Faces Earnings Test

Shares of Rigetti Computing have witnessed a staggering 1,700% rally over the past year, and it released its second-quarter results after markets closed on Tuesday.

The company reported $1.8 million in revenue, falling short of consensus estimates at $1.88 million, while posting a loss of $0.13 per share, while analysts expected a loss of $0.06 per share.

The stock was up 1.38% on Tuesday, closing at $16.20, before dropping 3.40% after hours, following its second-quarter results, which fell short of estimates.

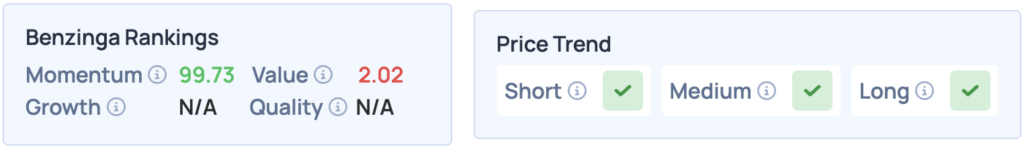

According to Benzinga’s Edge Stock Rankings, Rigetti scores high on Momentum, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock