Shares of Rigetti Computing Inc (NASDAQ:RGTI) are trading higher Wednesday morning, extending a rally that began earlier this week. Here’s what investors need to know.

- RGTI is charging ahead. Get the scoop here.

What To Know: The quantum computing sector has gained momentum following reports the U.S. Commerce Department was considering taking equity stakes in key firms like Rigetti to bolster national security. This has put speculative names like Rigetti in the spotlight as they compete with established giants like IBM.

While the department later clarified it was not in active negotiations, the news sparked investor optimism about potential strategic government support for the industry. The sector is also seeing increased attention this week amid Nvidia’s ongoing GTC event in Washington D.C., which features discussions on key topics including quantum computing.

Investors are now turning their focus to Rigetti’s upcoming third-quarter earnings report, scheduled for release after the bell on Nov. 10. Wall Street analysts are forecasting a loss of 4 cents per share on revenue of $2.26 million, a slight sequential dip from the prior quarter’s revenue of $2.38 million.

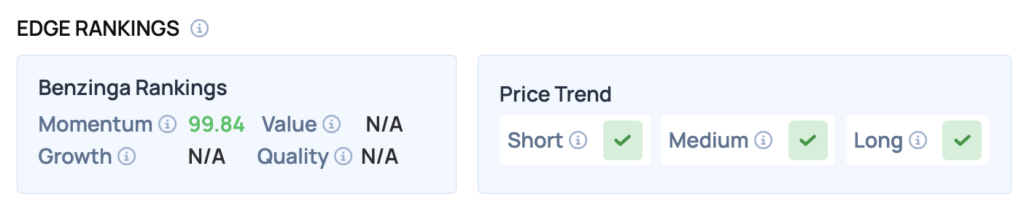

Benzinga Edge Rankings: Underscoring the stock’s recent surge, RGTI boasts an exceptional Momentum score of 99.84, according to Benzinga Edge stock rankings.

RGTI Price Action: Rigetti Computing shares were up 5.25% at $39.02 at the time of publication on Wednesday, according to Benzinga Pro data.

How To Buy RGTI Stock

By now you're likely curious about how to participate in the market for Rigetti Computing – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock