/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

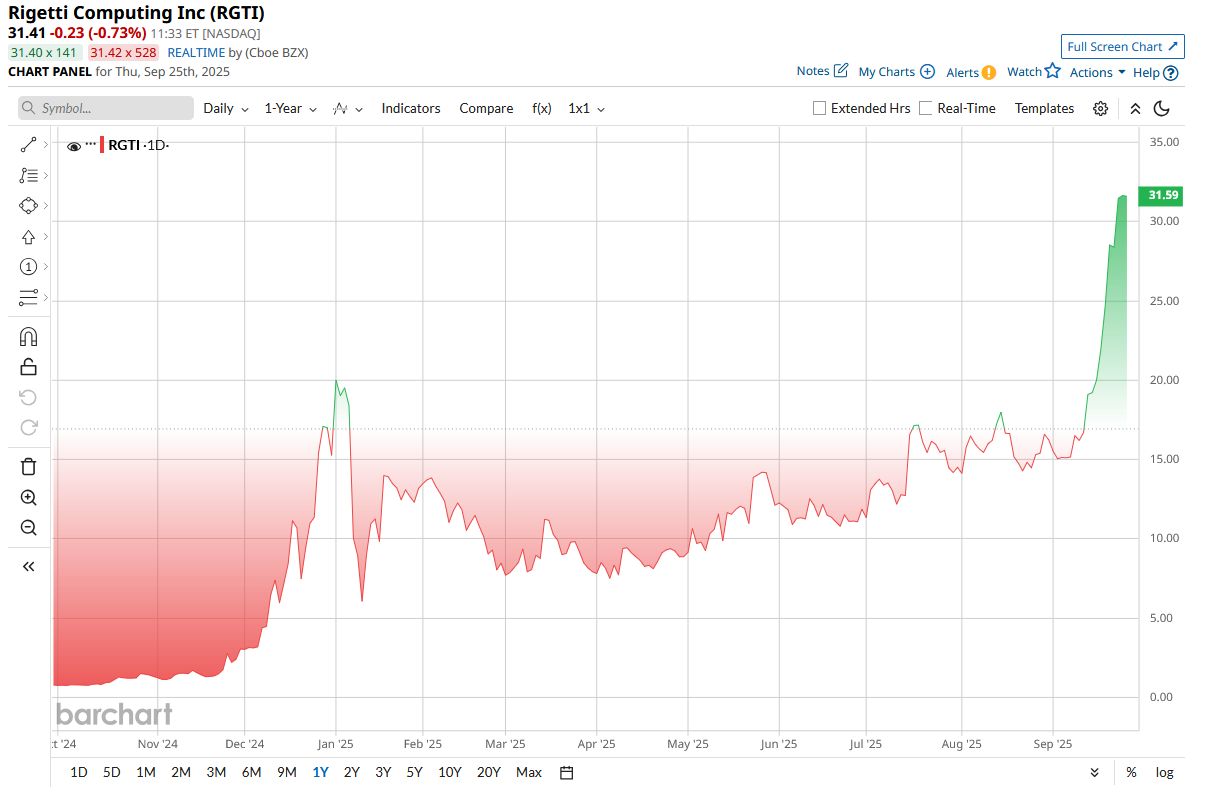

Rigetti Computing (RGTI) has been in the spotlight after B. Riley analyst Craig Ellis boosted his price target to a street-high $35 on Sept. 23. RGTI stock jumped 10% that day as a result. The firm’s bullish note pointed to accelerating progress in the quantum computing sector, including national labs shifting focus from pure research to commercialization, as justification. This new target is well above the consensus analyst forecast of around $21, reflecting confidence in Rigetti’s execution and market potential.

But should investors buy in at these levels? A look at Rigetti’s latest developments, finances, and stock history may shed light.

About RGTI Stock

Based in California, Rigetti Computing is a key player in the quantum computing industry, pushing forward as quantum computing gets closer to a major turning point. The company recently launched Cepheus-1-36Q, a 36-qubit processor made from four connected chiplets. The processor cut two-qubit gate errors in half and reached 99.5% fidelity. Rigetti says this validates its proprietary chiplet-based scaling approach and brings it closer to “quantum advantage” with larger systems. The company remains on track to deliver a 100+ qubit chiplet system by the end of 2025. This shows Rigetti can grow its systems while keeping performance strong, something many experts thought was still years away.

Valued at $10 billion by market cap, RGTI’s stock rally has been extremely strong, with a one-year price performance surging more than 4100%, significantly outperforming the sector’s 15%. However, the stock has been extremely volatile, making sharp swings over the past few months, which highlights its speculative nature and sensitivity to news flow. Much of the movement has been tied to developments around funding, partnerships, and progress on advancing its quantum computing technology.

Due to its unprecedented rally, RGTI’s valuation has climbed to very high levels. Its price-to-sales (P/S) ratio now stands at 893, far above the sector median of 4. This makes the stock look expensive compared to its peers and suggests it may be overpriced in the current market.

Partnerships and Government Contracts

Rigetti has recently expanded through new partnerships and government contracts. In September 2025, it signed a memorandum with India’s C-DAC to co-develop hybrid quantum-classical systems, combining C-DAC’s supercomputing strengths with Rigetti’s quantum processors and opening doors to Asian markets. That same month, Rigetti and partner QphoX won a $5.8 million, three-year U.S. Air Force contract to advance quantum networking, often called the “quantum internet.”

Earlier in April 2025, Quanta Computer invested $35 million as part of a $200 million partnership, bringing both cash and manufacturing support. These deals show major institutions see promise in Rigetti’s technology.

Strong Cash Position But Modest Revenue

Rigetti’s financials remain those of a high-growth R&D enterprise. In Q2 2025, the company reported $1.8 million in revenue and an operating loss of $19.9 million. Net loss was $39.6 million, including a one-time non-cash write-down.

Notably, Rigetti has been raising capital to fund its development: the company completed a $350 million at-the-market equity offering in Q2. After that raise, cash, cash equivalents, and investments stood at $571.6 million.

With no debt on the balance sheet, Rigetti’s runway is healthy by startup standards. In practice this means the company can continue investing heavily in R&D, hardware fabrication (at its in-house Fab-1 foundry), and partnerships. However, while cash reserves are high, current revenue is still minimal. Most sales so far have been government R&D contracts or small cloud-service deals.

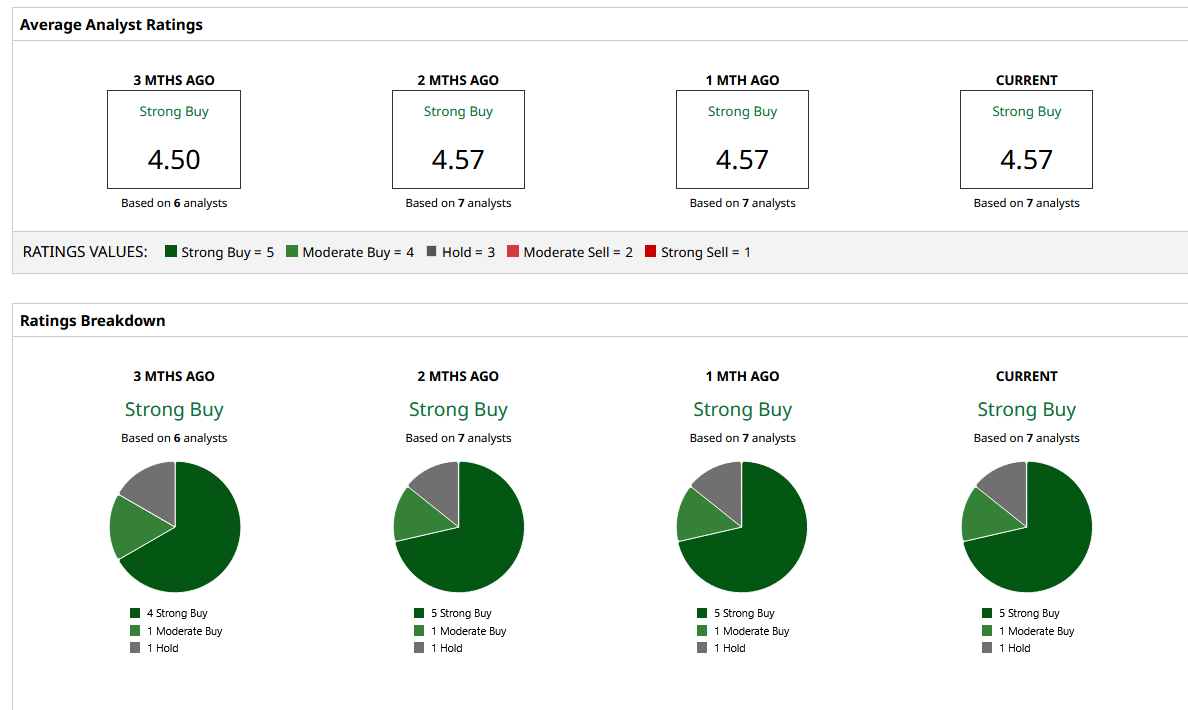

What Do Analysts Think About RGTI Stock?

Backing B. Riley’s rating, other Wall Street analysts also appear highly bullish on RGTI’s growth prospects. The group of seven analysts tracked by Barchart has given the stock a consensus “Strong Buy” rating, with a split of five “Strong Buy,” one “Moderate Buy,” and one “Hold.” Notably, the stock has no sell ratings.

Despite this optimism, RGTI is already trading above its average target price of $21.50 and is moving toward its Street-high target of $35, which is about 13% above the current price.