/Quantum%20Computing/A%20concept%20image%20of%20a%20neon%20pink%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

Quantum computing firm Rigetti Computing (RGTI) recently received a Street-high price target of $50 from analysts at Benchmark, indicating potential upside of 13% from current levels. The upgrade marks a giant leap from the earlier target of $20 per share.

Analyst David Williams believes the quantum sector is accelerating, and that Rigetti’s long-term strategy is well-supported by its execution. Moreover, the contracts that the company has managed to gain also position Rigetti for growth.

Investors welcomed this price target raise, as the stock gained 5.3% intraday on Oct. 7 following the news release. Should you consider buying RGTI stock now?

About Rigetti Computing Stock

Headquartered in Berkeley, California, Rigetti Computing specializes in developing superconducting quantum processors and quantum computers. The company designs and manufactures quantum chips, integrates them with control architectures, and provides cloud-based access through its Quantum Cloud Services platform. Rigetti focuses on delivering scalable, high-performance quantum computing solutions to address complex problems beyond the reach of traditonal computers.

With ongoing innovation and research, Rigetti Computing aims to transform industries such as healthcare, energy, and materials science by advancing quantum technology from its base in Berkeley and its fabrication facility in Fremont, California. The company has a market capitalization of $15.5 billion.

RGTI stock has been on a tear over the past year as the company has unveiled some significant developments amid the rapid growth of the quantum computing field. Over the past 52 weeks, the stock has gained a whopping 4,600%, while it is up 193% year-to-date (YTD). RGTI stock reached a fresh 52-week high of $58.15 on Oct. 14, although it is now down 23% from that high.

RGTI stock is trading at an eye-watering valuation. Its price-to-book ratio sits at 32.97 times, which is considerably higher than the industry average.

Rigetti Computing’s Operations Are Growing

On Aug. 12, Rigetti reported its second-quarter results for fiscal 2025, which showed some financial weakness. Revenues declined by almost 42% year-over-year (YOY) to $1.8 million. Total gross profit also dropped from $1.99 million in Q2 2024 to $566,000 in Q2 2025. Rigetti's net loss per share jumped from $0.07 to $0.13 over the same period.

However, the company has not shied away from growing operationally. In Q2, Rigetti Computing announced the general availability of its multi-chip quantum computer, Cepheus-1-36Q. This is also the industry’s largest multi-chip quantum computer. This model offers a “2x reduction in two-qubit gate error rate” compared to the previous Ankaa-3 system, achieving a median two-qubit gate fidelity of 99.5%.

Last Month, Rigetti was awarded a three-year $5.8 million contract from the Air Force Research Laboratory (AFRL) to advance superconducting quantum networking, in collaboration with Dutch quantum technology startup QphoX. The company also secured purchase orders worth approximately $5.7 million for two 9-qubit Novera quantum computing systems.

Rigetti Computing is also not financially strapped. In Q2, the company completed the sale of $350 million in gross proceeds of its common stock through an at-the-market equity offering program. As of the end of the quarter, Rigetti had approximately $571.6 million in cash, cash equivalents, and available-for-sale investments, with no debt. This positions the company favorably to support further scaling of its operations.

Wall Street analysts are optimistic about Rigetti’s ability to reduce its losses. They expect loss per share to narrow by 37.5% YOY to $0.05 for Q3. For the current fiscal year, loss per share is projected to decrease 36% annually to $0.23, followed by a 26% improvement to a $0.17 per-share loss in the next fiscal year.

What Do Analysts Think About Rigetti Computing Stock?

Apart from the price target upgrade from Benchmark analysts, other Wall Street analysts have a favorable view of Rigetti Computing’s prospects. Last month, B.Riley Securities analyst Craig Ellis raised the price target on RGTI from $19 to $35, while maintaining a “Buy” rating. This followed the Quantum World Congress, which showcased the robust growth of the quantum computing sector.

In August, analysts at Needham reiterated their “Buy” rating on RGTI stock while maintaining an $18 price target, citing the company’s launch of the Cepheus-1-36Q system. In July, analysts at Cantor Fitzgerald also initiated coverage of Rigetti Computing with an “Overweight” rating and $15 price target, citing the company’s prospects.

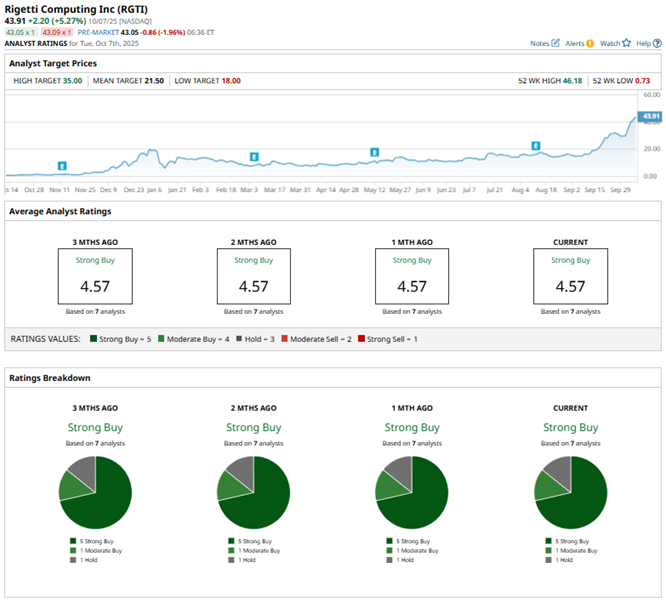

Rigetti has come under the spotlight on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the seven analysts rating the stock, a majority of five analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and one analyst provides a “Hold” rating. The consensus price target of $26.50 represents 40% potential downside from current levels.

Key Takeaways

Rigetti Computing appears well-positioned to capitalize on the industrial tailwinds currently driving the quantum computing sector. The company’s operations are expanding, and the contracts it has secured strengthen its position. Therefore, it might be wise to invest in RGTI shares now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.