/Quantum%20Computing/A%20concept%20image%20of%20a%20neon%20pink%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

Quantum computing company Rigetti Computing (RGTI) recently signed a Memorandum of Understanding (MOU) with an Indian research and development organization, the Centre for Development of Advanced Computing (C-DAC). The MOU is aimed at exploring the “co-development of hybrid quantum computing systems,” supporting functions like those in government labs as well as academia.

Rigetti’s quantum computing processors are considered ideal for hybrid systems due to the efficiency of superconducting qubits, which are over 1,000 times faster than other qubit modalities. With the MOU news in mind, should investors consider buying RGTI stock here?

About Rigetti Computing Stock

Based in Berkeley, California, Rigetti Computing engineers and operates advanced quantum computers using superconducting circuits. Started in 2013, the firm specializes in producing quantum processing units (QPUs) and delivering cloud-based quantum access for commercial, scientific, and governmental clients.

Rigetti drives its innovation through full-stack integration, offering both the hardware and software needed to build, test, and run quantum algorithms via its quantum cloud platform. Its efforts fuel research, real-world applications, and software compatibility, thereby extending the reach of quantum across fields such as artificial intelligence (AI). The company has a market capitalization of $4.87 billion currently.

Over the past 52 weeks, RGTI stock has experienced astronomical growth, surging by 1,700% primarily due to breakthrough achievements in quantum technology, strategic government contracts, and increasing investor enthusiasm for the commercial potential of quantum computing. Over the past six months, shares have increased by 92%. RGTI stock reached a 52-week high of $21.42 in January, but it is down 29% from that high.

Rigetti Computing is trading at an eye-watering valuation after RGTI stock skyrocketed. Its price-to-sales ratio sits at 466 times, which is considerably stretched compared to the industry average.

Rigetti Computing Is Taking Operational Strides

While broad commercial integration is still in the plans, the company’s operations and capabilities seem to be expanding. In its second-quarter report, Rigetti Computing announced the general availability of Cepheus-1-36Q, the company’s multi-chip quantum computer.

This is set to be the industry’s largest multi-chip quantum computer. Cepheus-1-36Q has achieved a 2x reduction in two-qubit gate error rate compared to the Ankaa-3 system, and has attained a median two-qubit gate fidelity of 99.5%.

This quantum computer features the highest number of chiplets and boasts four chips. Transitioning from a monolithic chip to chiplets implies “greater control over chip uniformity,” which, in turn, should lead to better efficiency and performance. What's more, Rigetti expects to release a 100+ qubit chiplet-based system before the end of this year.

However, Rigetti is not yet a growth giant. In the second quarter, revenue dropped 42% year-over-year (YOY) to $1.80 million. Reductions in revenue from collaborative research and professional services contracts primarily drove the decline.

Revenue trajectory was also affected by the expiration of the National Quantum Initiative Act, which is pending reauthorization. The company has significant losses on its income statement, with its loss per share climbing from $0.07 to $0.13 in Q2 2025.

Still, Rigetti Computing is not lacking cash. During the period, Rigetti completed a $350 million gross proceeds sale through an at-the-market (ATM) equity offering program. Now, the firm has approximately $571.6 million in cash, cash equivalents, and available-for-sale investments. More importantly, this cash is available with no debt, which makes the company primed for expansion.

Wall Street analysts are optimistic about Rigetti’s ability to reduce its losses. They expect the company’s loss per share to narrow 37.5% YOY to $0.05 in Q3. For the current fiscal year, loss per share is projected to decrease 22% annually to $0.28, followed by a 32% improvement to a $0.19 loss per share in the next fiscal year.

What Do Analysts Think About Rigetti Computing Stock?

Wall Street analysts are exceptionally bullish about this quantum computing company’s prospects. In August, analysts at Benchmark raised the price target on the stock from $14 to $20 while maintaining a “Buy” rating, citing continued progress on its chiplet-based scaling strategy. Analysts at Needham reiterated their “Buy” rating on Rigetti Computing with an $18 price target.

Earlier this year, Cantor Fitzgerald initiated coverage on Rigetti with an “Overweight” rating and $15 price target. While Cantor Fitzgerald analysts acknowledged that the company is in its early stages, they also stated that the company represents “highly coveted technical milestones with enormous economical implications.”

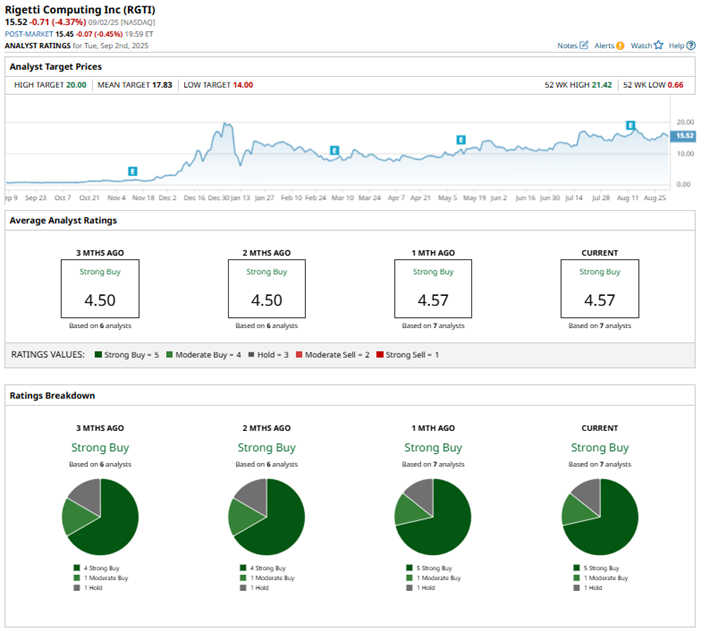

Rigetti Computing stock has come under the spotlight on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the seven analysts rating RGTI stock, a majority of five rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and one analyst provides a “Hold” rating.

The consensus price target of $17.83 represents 18% potential upside from current levels. The Street-high price target of $20 represents 32% potential upside currently.

Key Takeaways

Quantum computing is a fast-growing field, and investor interest in the sector is propelling RGTI stock. Rigetti Computing’s upcoming multi-chip quantum computer also shows extensive prospects, while the recent MOU demonstrates operating prowess in developing practical hybrid computing systems. Given such steps and market momentum, Rigetti Computing stock might be a solid bet right now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.