Shares of luxury furniture retailer RH (NYSE:RH) are plummeting Monday morning following President Donald Trump’s announcement of a national security probe into furniture imports.

What To Know: The investigation, to be concluded within 50 days, is expected to result in tariffs on furniture coming into the United States, a move Trump says is aimed at bringing manufacturing jobs back to states like North Carolina and Michigan.

The news sent shockwaves through the home furnishings industry, which is heavily reliant on global supply chains. RH, in particular, has been working to reduce its dependence on Chinese manufacturing, a process that has been closely watched by investors.

The company has been diversifying its production to other countries and increasing its U.S.-based manufacturing. This move comes after the stock was previously hit hard by tariff announcements, notably during an event dubbed “Liberation Day” in early April, which saw the stock plunge 40% in a single day.

While RH has been on a recovery path since the April downturn, this new investigation introduces fresh uncertainty. The company has been making strategic moves to navigate the volatile trade landscape, including absorbing some tariff costs and working with vendors.

However, the prospect of new, and potentially broader, tariffs threatens to squeeze profit margins and disrupt its supply chain at a time when the company is also navigating a challenging high-end housing market.

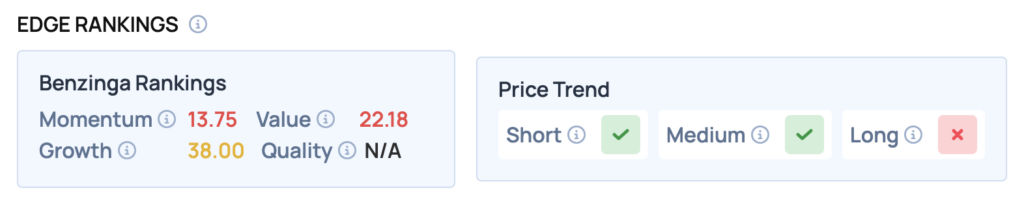

Price Action: According to data from Benzinga Pro, RH shares are trading lower by 5.44% to $230.46 Monday morning. The stock has a 52-week high of $457.26 and a 52-week low of $123.03.

Read Also: Retail Investors’ Top Stocks With Q2 Earnings This Week: NVIDIA, Webull, IREN And More

How To Buy RH Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in RH (NYSE:RH)'s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock