A third of small UK businesses fear losing up to £20,000 this year amid the uncertainty caused by Donald Trump’s new trade tariffs, a new report shows.

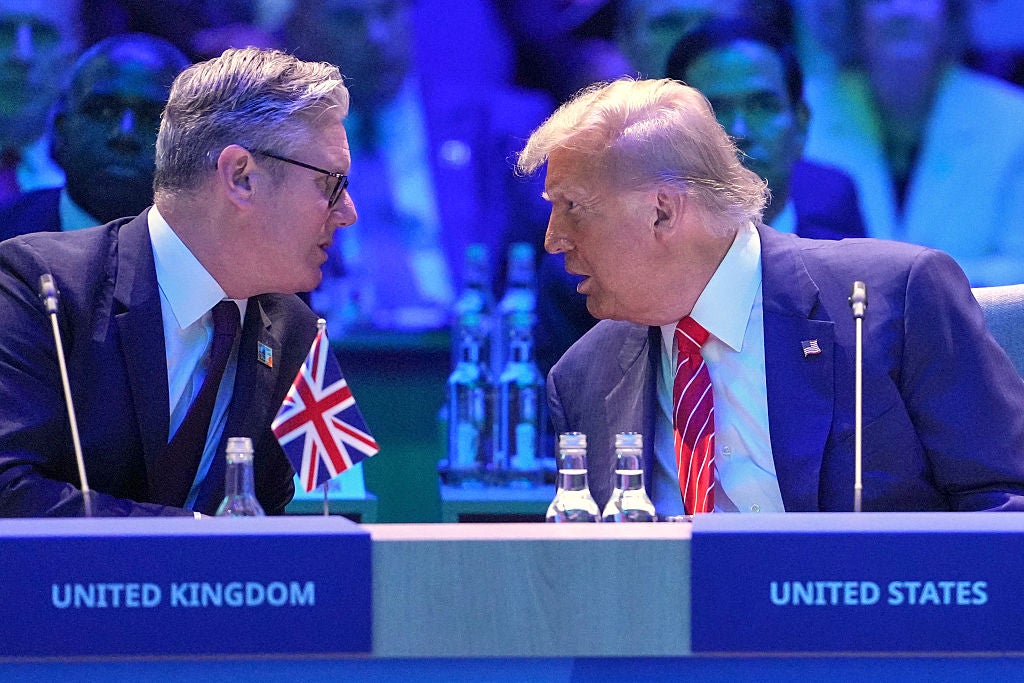

Across April and May, the US President announced - and then called a pause for - levies being placed on all goods imported to the US from other nations, as part of a plan to readdress trade balances. While the UK has since arranged a trade deal with the nation, many other countries or blocs have not done so and there remains uncertainty within some industries.

A new report looking at more than 500 small and medium enterprises (SMEs) across the UK has now revealed three in ten (30 per cent) estimate the cost of tariff knock-on effects to be between £10,000 and £20,000 this year, while two per cent believe it will cost them over £1m.

Firms in the services sector are hardest hit, but across all sectors the average amount lost to tariff “turbulence” is anticipated at £17,000 per business.

One critical factor affecting those who import and export has been this year’s volatile exchange rates, with £1 now equal to $1.358 - more than eight per cent higher than it was at the start of this year.

Tariff business impact

When the US President announced his tariffs, a stock market sell-off ensued - but it wasn’t until bonds also sold off, sending yields (and therefore borrowing costs) higher, that he relented to a point.

While those high-profile numbers were of course important, another key fluctuation came in the weakening of the dollar, which has lost ground all year.

The US Dollar index measures the value of the currency against a mix of other global currencies, showcasing its faltering power in 2025. At the start of the year it stood at 108.49 on this index; it now stands at barely above 97, a deterioration of more than 10 per cent.

If you are importing from the States, that is a positive - your pound buys more of US-based local goods, at least until sellers put prices up to account for the drop. For exporters, however, that is a big problem as it squeezes profit margins.

A critical issue, particularly for smaller businesses, has been the rate of change and the lack of certainty about what is next.

Responding to the survey undertaken by Critical Research, more than half (51 per cent) of businesses who export to the US said they expected a net decrease in volumes in future. Perhaps pointing to other geopolitical matters escalating, 47 per cent of all exporters - to the US or otherwise - said the same.

New challenges

Across all sectors, around 30 per cent of small and medium UK businesses export to the US. That figure is notably higher in retail and wholesale industries.

They point to tariffs and customs regulations as the biggest issues facing them - as do importers, notably - ahead of such factors as inflation, global conflicts, costs of trading overseas and the impact of Brexit on their businesses.

“There’s a lot of hidden activity - SME businesses are constantly dealing with change,” Jonathan Andrew, chief executive at Bibby Financial Services, told The Independent. “Firms are making constant operational changes and even small businesses are having to assess how things impact on your own business.

“Doing nothing isn’t an option - that’s the reality of tariffs which is dawning now.”

Many firms are opting to find new trade partners, the survey revealed, but they are now looking beyond the US in many cases - China was instead the most popular choice for both importers and exporters.

Future

As well as location, such global uncertainty means currency management is set to become a bigger factor for businesses too.

“SMEs are starting to pay more attention to foreign exchange. People have to think about revenue streams and where their income is from in currency terms, especially medium sized businesses,” Mr Andrew added.

The UK’s newly released industrial strategy said it is targeting “long term stability” for businesses as a core focus.

That will mean it will need to try and shield businesses working within those key industries from wider uncertainty, with recent trade deals - signed with the likes of India as well as the US - being one approach which can smooth the path for importers and exporters.

But The Independent understands there are businesses now within the EU considering opening plants in the UK, as a potential easier route to exporting to the US.

While that could yield an overall boost to potential economic growth, it could also heighten competition for those smaller domestic businesses already grappling with ever-changing conditions they are not always equipped to deal with.

Trump said he told New York Times about Musk’s alleged drug use, biographer claims

Trump live: Breakthrough for ‘Big, Beautiful Bill’ after ‘MAGA is not happy’ rant

Archaeologists perplexed to find ‘very large’ Roman leather shoes at ancient fort

Amnesty International says Israel and aid system use starvation to commit Gaza genocide

Business news live: Bonds latest after Reeves backed and Microsoft cut 4% of jobs