/Republic%20Services%2C%20Inc_%20HQ%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Phoenix-based Republic Services, Inc. (RSG) offers environmental services in the U.S. and Canada. With a market cap of $69 billion, Republic Services operates as the second largest provider of non-hazardous solid waste collection, transfer, disposal, recycling, and energy services in the U.S.

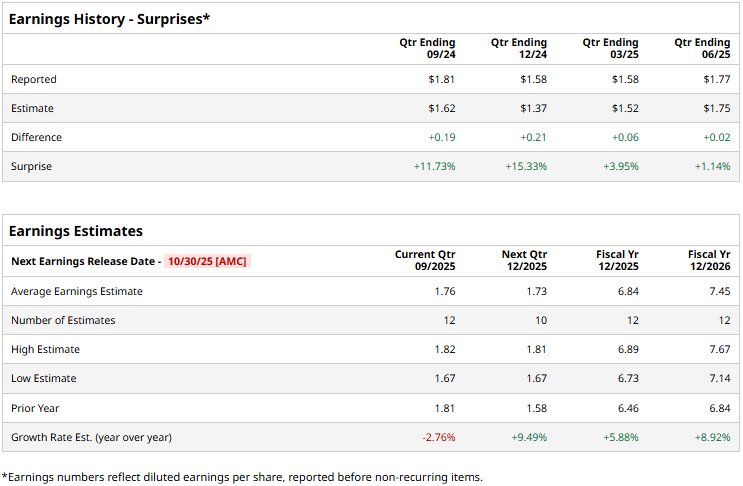

The waste management giant is set to unveil its third-quarter results after the market closes on Thursday, Oct. 30. Ahead of the event, analysts expect Republic Services to report an adjusted profit of $1.76 per share, down 2.8% from $1.81 per share reported in the year-ago quarter. On a positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect Republic Services to report an adjusted EPS of $6.84, up 5.9% from $6.46 in fiscal 2024. In fiscal 2026, its adjusted earnings are expected to grow 8.9% year-over-year to $7.45 per share.

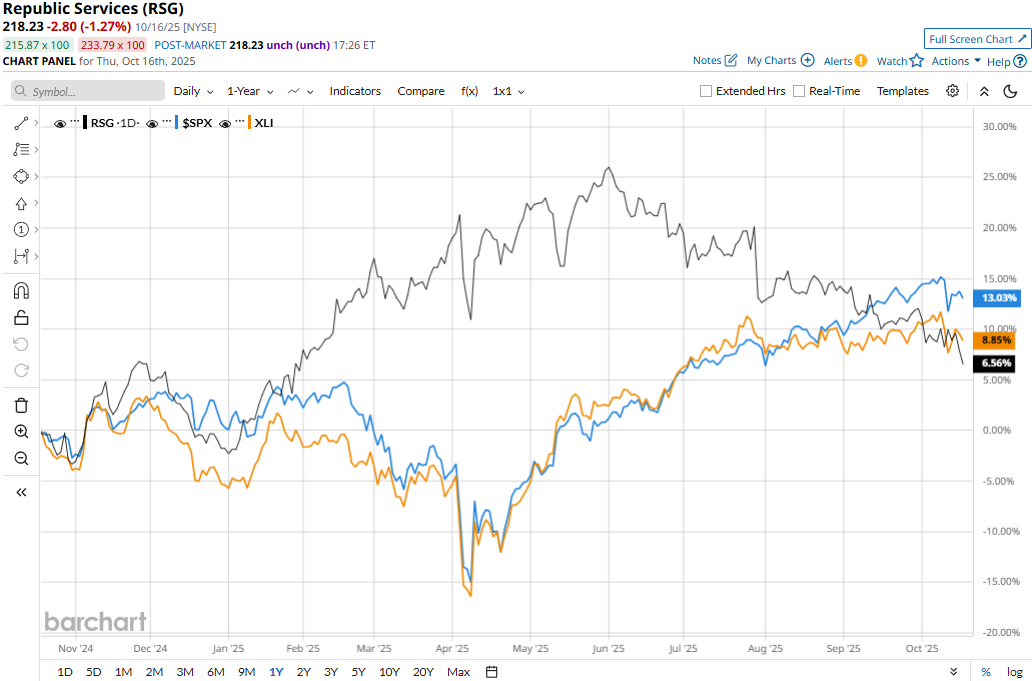

RSG stock prices have inched up 6.2% over the past 52 weeks, notably lagging behind the Industrial Select Sector SPDR Fund’s (XLI) 8.9% gains and the S&P 500 Index’s ($SPX) 13.5% returns during the same time frame.

Republic Services’ stock prices declined 5.8% in the trading session following the release of its mixed Q2 results on Jul. 29. Driven by 3.1% growth in organic revenues and 1.5% growth in acquisition-led revenues, the company’s overall topline for the quarter grew 4.6% year-over-year to $4.2 billion. However, this configuration missed the Street expectations by 75 bps. Meanwhile, its adjusted EPS for the quarter surged 9.9% year-over-year to $1.77, exceeding the consensus estimates by 1.1%. On an even more positive note, Republic Services’ operating cash flows for the quarter increased 11.7% year-over-year to $2.1 billion.

Analysts remain optimistic about the stock’s prospects. Republic Services has a consensus “Moderate Buy” rating overall. Of the 24 analysts covering the stock, opinions include 12 “Strong Buys,” two “Moderate Buys,” and 10 “Holds.” RSG’s mean price target of $262 suggests a 20.1% upside potential from current price levels.