A POWER industry expert's analysis of Australian electricity prices says gas rather than coal is the major determinant of price, and that a coal cap may well drive up prices, especially if it is set too low.

The report commissioned by the NSW Minerals Council from specialist consultants Boardroom Energy comes after the Albanese government floated the idea of a domestic coal price cap of $A125 a tonne, with the idea expected to dominate today's delayed National Cabinet meeting, called to discuss power prices.

Although the report comes from the coal industry, its lead author, Matthew Warren, is a power industry veteran whose CV includes stints as chief executive of the Australian Energy Council, the Energy Supply Association of Australia and the Clean Energy Council.

Its short-term recommendations include helping coal supplies and keeping Eraring and Liddell open while the renewables system is built.

NSW Minerals Council CEO Stephen Galilee urged those involved in the power debate to read the "informed" report.

"As an energy user, the mining sector is extremely concerned about high energy costs, and we want workable solutions to address the problem," Mr Galilee said yesterday.

"We also want a properly managed transition that delivers the reliable, affordable low emissions energy we have all been promised.

"However, a price cap on coal is a short term political fix, not the solution it is being portrayed as, and it may actually make things worse.

"Any plan that fails to address the coming electricity supply crunch is doomed to failure, and holds out false hope that energy prices will fall. It also puts public support for the energy transition itself at risk."

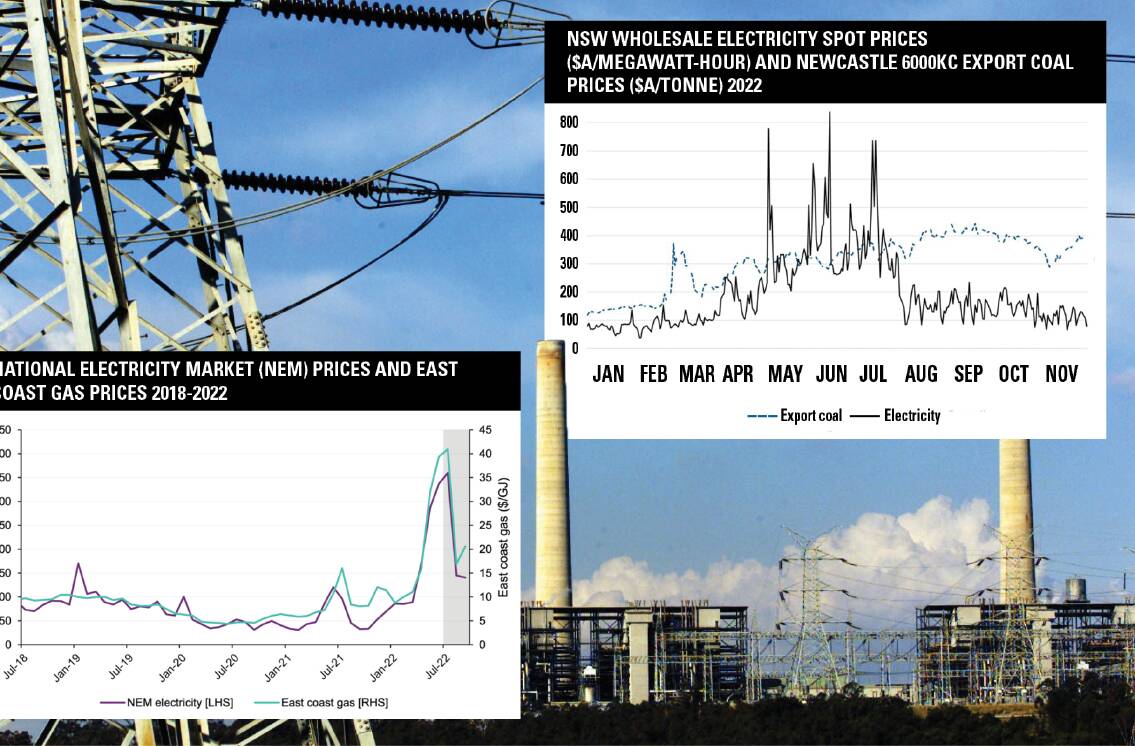

The 15-page report by Mr Warren and co-author Kieran Donoghue includes graphs of power prices set against coal and gas prices (shown above) to argue that east coast gas prices, rather than export coal prices, are a dominant factor in wholesale electricity generation costs and prices.

"At the end of 2022, wholesale electricity prices have stabilised at around $100 a megawatt-hour in NSW, marginally higher than the average price before winter," the report says.

"This is primarily because spot gas prices remain elevated, and gas prices are the main marginal price setter in the electricity market.

"Because most coal generators have purchased most of their coal on long term contracts, they are less exposed to spot prices when demand is inside predicted levels."

The report says wholesale prices may spike again next winter, and that the best way to relieve energy shortages - and so high prices - is to get more of "all energy types" into the electricity market.

It says there is a "a simple relationship" between energy abundance and scarcity, on one hand, and electricity prices on the other.

"Energy abundance eases electricity prices, energy scarcity increases them," the reports says.

"Recent high energy prices were fundamentally the result of a scarcity of supply. This was amplified because it increased generators' exposure to a global spike in fuel prices. The way to reduce electricity prices is to increase energy supplied."

As well as supporting renewables the government should "make more gas and coal capacity available and help get more coal to power stations until there is sufficient new capacity to replace them".

"Capping coal prices is impractical and risks exacerbating electricity price increases by further constraining energy supplies," the report says.

"Broad-based domestic coal caps could reduce coal supply to domestic power stations, particularly if the cap is set close to or lower than production costs."

The report says a price cap cannot "mandate the sale of coal" and that "a legitimate response from coal sellers" would be to withdraw their offers to power station buyers if the cap price did not cover their costs.

That coal could then chase higher-priced export markets, and "accordingly, the effect may be opposite from that intended".

WHAT DO YOU THINK? We've made it a whole lot easier for you to have your say. Our new comment platform requires only one log-in to access articles and to join the discussion on the Newcastle Herald website. Find out how to register so you can enjoy civil, friendly and engaging discussions. Sign up for a subscription here.