The release on Oct. 13 of the consumer price index report (CPI) from the U. S. Bureau of Labor Statistics is a big deal for real estate investment trusts (REITs).

That’s because of how interest-rate-sensitive most of them are. If the CPI shows greater inflation than expected, the Federal Reserve is likely to hike rates more dramatically. Real estate investment trusts suffer when that happens.

There might be a little up and down in REIT prices until Oct. 13, but they’re likely to move once the inflation reading is out. Fed officials consider it a significant economic indicator and may decide to keep hiking rates based on the results. Because REITs are so affected by interest rates, Oct. 13 is likely to see movement in price.

To state it plainly, if the number is higher than expected — more inflationary — then REITs are likely to continue to head down. If the number is lower than expected — less inflationary — buyers may show up again with bargain hunting in mind as a possible rally gets underway.

Take a look at the daily price chart for the iShares U.S. Real Estate Exchange-Traded Fund (NYSE:IYR), a benchmark for the real estate investment trust sector:

REITs as a group have been dropping steadily, with a brief rally now and then, since the April peak up near $112. In September, the price dropped below the 50-day moving average and below the mid-June lows. The CPI number will reveal whether this exchange-traded fund (ETF) has dropped enough to find support.

Here’s the weekly price chart for a wider view:

It’s troubling for investors to see that the price has fallen to below both significant weekly moving averages. An inflationary CPI reading could set the ETF on a path back toward the March 2020 support level down near $55.

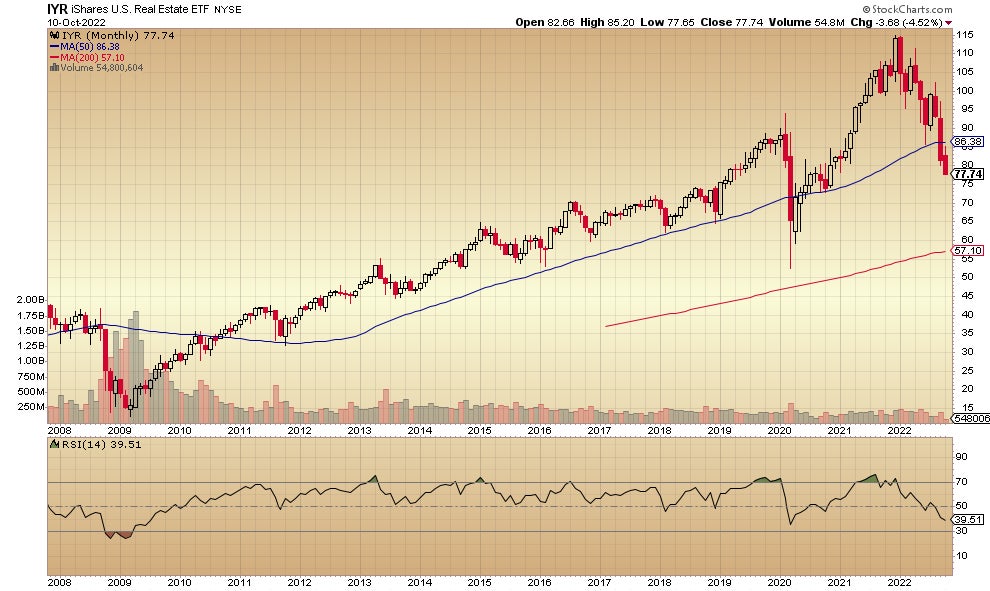

And this is the monthly chart for the long-term perspective:

Now that the price has dropped to below the 50-month moving average, will it test the lows of the March 2020 pandemic scare?

Another factor to consider: The effects of the oil production cuts announced last week by OPEC will not start showing up in CPI numbers for a few months. The expectation that the cuts will have an effect is already showing up in price action as investors have been unloading REITs almost without interruption lately. How much it costs to buy gas will definitely impact how real estate investors make decisions.

Read next: This Little-Known REIT Is Producing Double-Digit Returns In A Bear Market: How?

Not investment advice. For educational purposes only.