Real estate investment trusts traded generally lower Wednesday with the benchmark Real Estate Select Sector SPDR Fund (NYSE:XLRE) giving back 0.63%:

That’s three red selling bars in a row for the ETF, which tracks daily activity of the major REITs. Note that the price returned to huge volume selling levels that ended the May sell-off, but without the similar kind of volume.

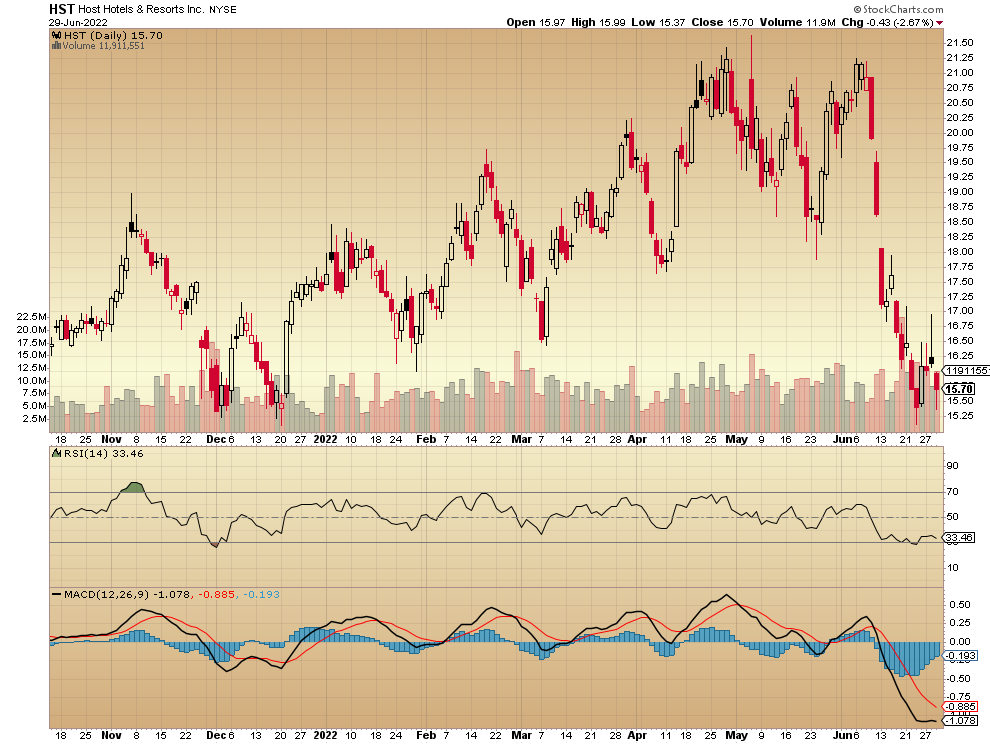

Host Hotels & Resorts Inc (NYSE:HST) had the worst day among the leaders in the sector, off by 2.67%:

After a short-term peak on Tuesday at just under $17 per share, sellers took over and sent it back down to the $15.50 area before the REIT recovered a bit and closed at $15.70. Host is basically re-testing the support level from five days ago.

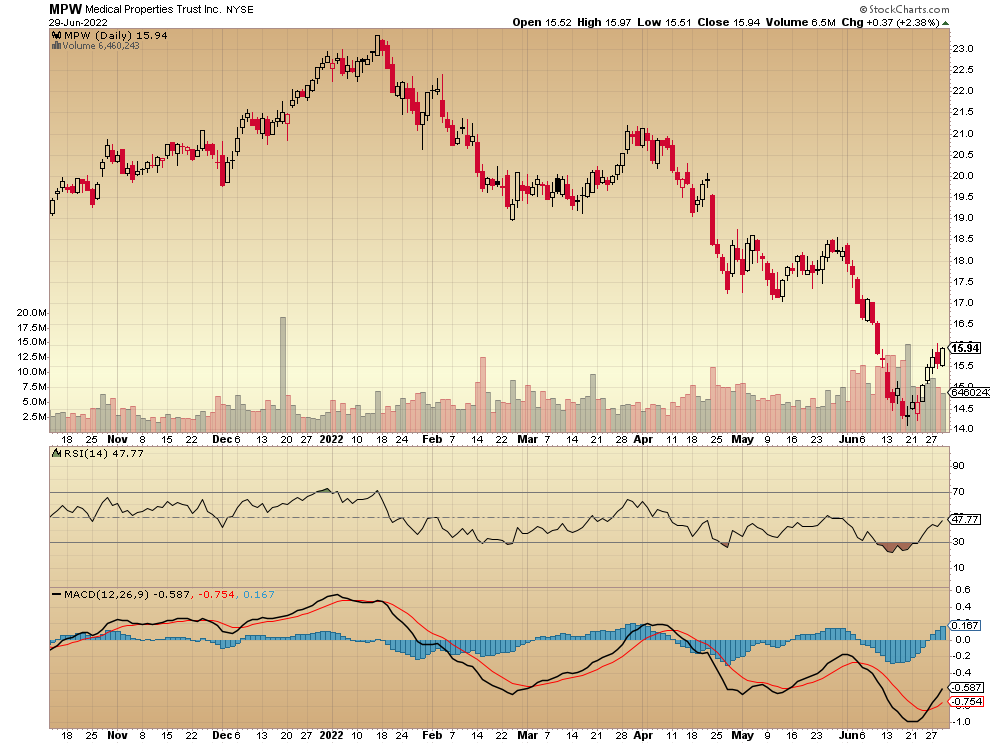

Medical Properties Trust Inc (NYSE:MPW) showed the most strength among the highest-volume REITs, up today by 2.38%:

In a different style than the benchmark ETF and Host Hotels, this one shows how much the kind of properties a REIT invests in matters. Healthcare locations are more attractive among investors today than lodging properties. The higher close for Medical Properties Trust continues a positive trend for the company as it comes off the mid-May lows.

Tomorrow is the end of the second quarter, so the large institutional investors who really move the market could be making adjustments before the close. We’ll see how much that affects REITs.

Real Estate News Bite: While stock prices have been trending lower, many retail investors have been turning to more stable assets, like shares of fractionalized rental properties. Arrived Homes, the real estate investment platform backed by billionaire Jeff Bezos, has doubled its active investors in the past two months and has funded $11 million worth of properties in the last 30 days. Single-asset real estate shares may be something to keep an eye on as the market remains in a bear market.

Not investment advice. For educational purposes only

Photo by Vintage Tone on Shutterstock