The real estate investment trust benchmark ETF closed strongly today with an advance of 1.99%, its 3rd straight day of gains:

The Real Estate Select SPDR Fund (NYSE:XLRE), as it’s known, represents a diversified group of the major REITs and trades on the New York Stock Exchange. About 7 million shares of this ETF changed hands today, a bit less than usual. The fund pays a dividend of 3.16%.

Medical Properties Trust (NYSE:MPW) is bouncing off of the lows made earlier this month and today’s gain of 2.73% is good news for their investors who’ve been reeling from a June swoon:

The Birmingham, Alabama headquartered REIT invests in healthcare facilities and pays a 7.92% dividend. 60% of its portfolio owns properties in the United States, 20% in the United Kingdom and the rest is centered in Europe and Australia.

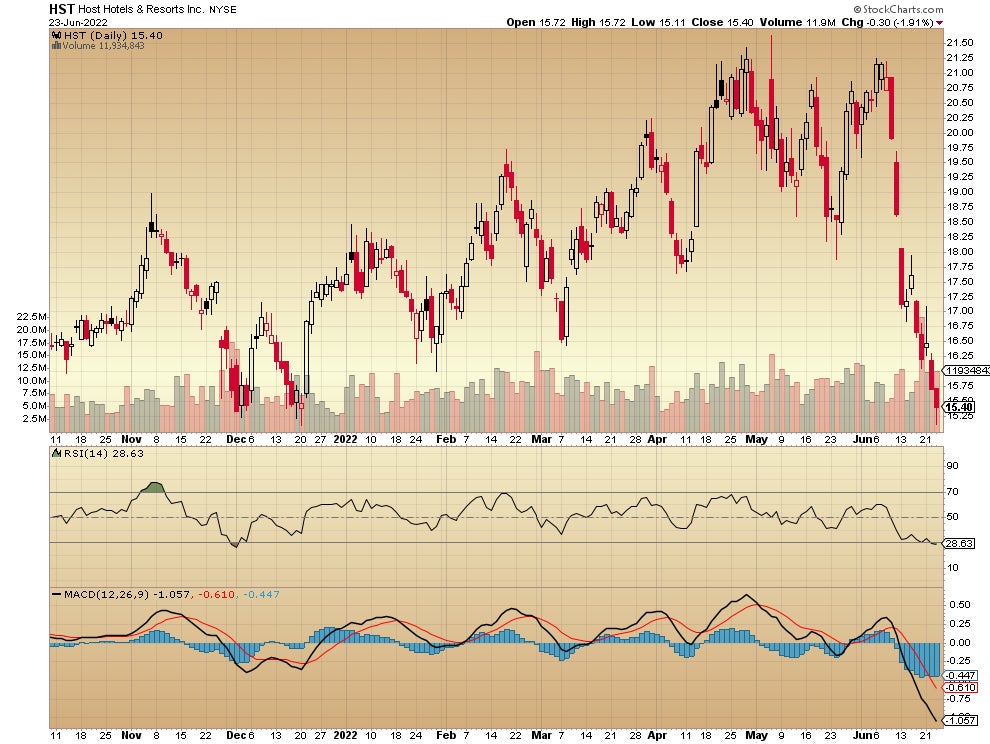

Host Hotels and Resorts (NYSE:HST)had a bad day today with its units down by 1.91% – that’s a move from $21 per share earlier this month to just above $15 per share right now:

Investing in hotels and motels, the Host Hotels pays a lower dividend – at 1.53% – than most others in the same sector. Based in Bethesda, Maryland, the company owns 78 hotels with more than 42,000 rooms, according to its website.

An Alternative Option

Publicly traded REITs aren’t the only option for adding passive real estate investments to your portfolio. A lot of investors prefer the stability of non-traded REITs, such as this one with an 8.4% dividend yield.

Other investors prefer the greater upside potential with private equity real estate through crowdfunding or syndication. You can even browse current offerings from all of the top platforms and syndicators with Benzinga’s Offering Screener.

Charts from StockCharts

Photo by kwarkot on Shutterstock

Not investment advice. For educational purposes only.