/Regions%20Financial%20Corp_%20logo%20on%20phone-%20by%20photo_gonzo%20via%20Shutterstock.jpg)

Regions Financial Corporation (RF) is a leading U.S. regional banking and financial services company headquartered in Birmingham, Alabama. With a market cap of $25 billion, it operates primarily through its subsidiary, Regions Bank. It provides a wide range of services, including retail and commercial banking, mortgages, credit cards, corporate lending, wealth management, and investment services to individuals, businesses, and institutions.

This regional bank has surpassed the broader market over the past 52 weeks. Shares of RF have surged 18.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. On a YTD basis, the stock is up 7.5%, lagging SPX’s 1.9% gains.

Additionally, RF has also outperformed the industry-specific iShares U.S. Regional Banks ETF’s (IAT) 11.3% rise over the past 52 weeks and 7.2% rise on a YTD basis.

On Jan. 21, shares of Regions Financial rose 3.4% in afternoon trading after the company announced a major partnership with payments technology firm Worldpay to improve how business clients accept payments and manage cash flow. The collaboration aims to streamline payment processing and make it easier for customers, ranging from small businesses to large enterprises, to receive funds efficiently, boosting investor confidence in Regions’ growth strategy.

For the current fiscal year, ending in December 2026, analysts expect RF’s EPS to grow 11.6% year over year to $2.60. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

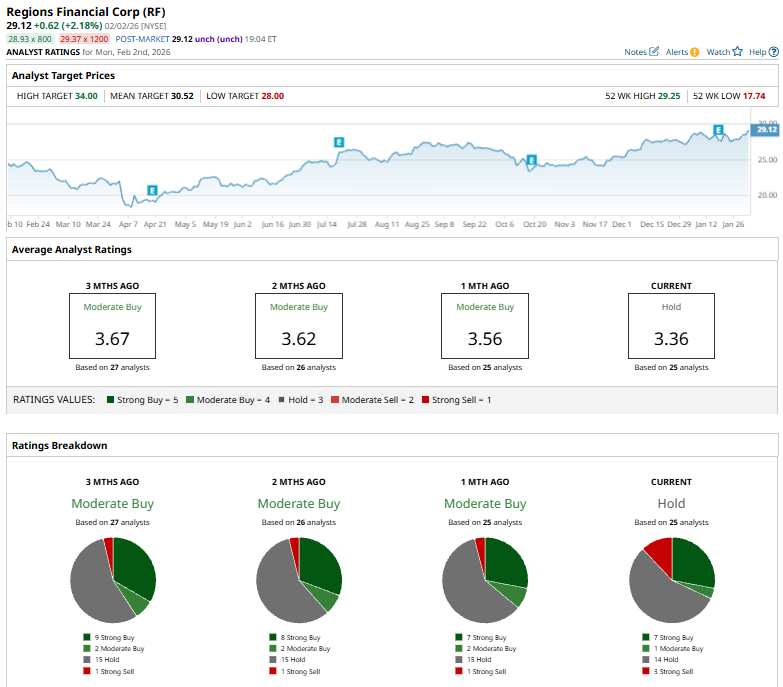

Among the 25 analysts covering the stock, the consensus rating is a "Hold,” based on seven “Strong Buy,” one "Moderate Buy,” 14 “Hold,” and three “Strong Sell” ratings.

The consensus rating is bearish than a month ago when the stock had an overall “Moderate Buy” rating.

On Jan. 21, Argus adjusted its price target on the stock to $31 from $29 and maintained its “Buy” rating. In addition, DA Davidson reiterated its “Buy” rating on the company's shares.

The mean price target of $30.52 represents a 4.8% premium from RF’s current price levels, while the Street-high price target of $34 suggests an upside potential of 16.8%.