After staging their strongest two-day rally in nearly a year earlier this week, U.S. regional banks reversed course dramatically on Thursday, with the group facing its steepest sell-off since the Trump tariff shock of April 2025.

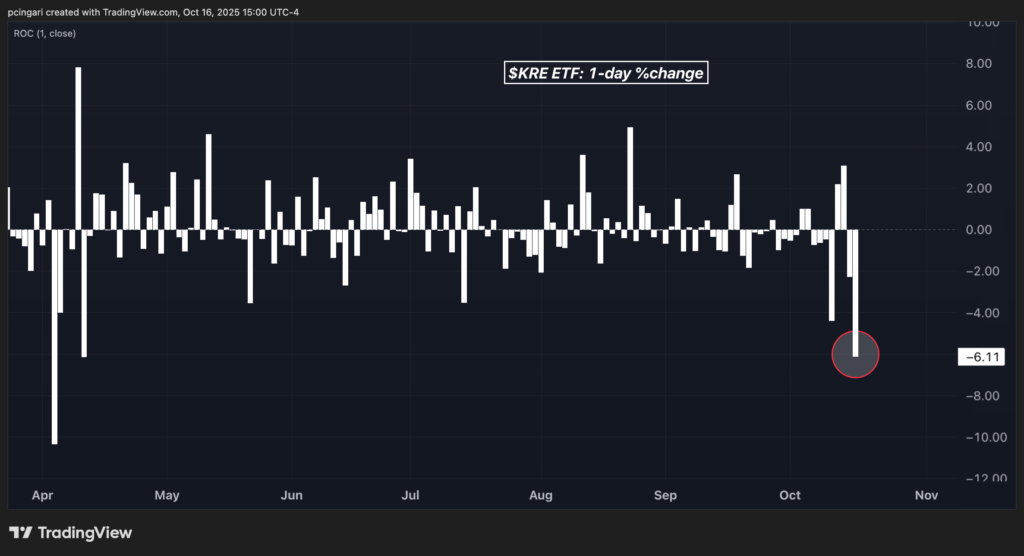

The SPDR S&P Regional Banking ETF (NYSE:KRE) plunged 6.1% in afternoon trading, logging its worst single-day performance since April 4, when Donald Trump's sweeping Liberation Day tariffs triggered a broad market sell-off.

The sharp reversal is being driven by renewed fears of credit deterioration and unexpected loan losses at some mid-sized lenders—just days after investor optimism surged on hopes of rate cuts and strong bank earnings.

While smaller and mid-sized lenders bore the brunt of the sell-off, the damage also rippled up to larger Wall Street institutions. The Financial Select Sector SPDR Fund (NYSE:XLF) slid 2.8%, making it the worst-performing S&P 500 sector and marking its steepest one-day decline since April.

Chart: Regional Banks Crash As Credit Fears Emerge, KRE ETF Drops 5.6%

What Happened?

Shares of Zions Bancorporation (NASDAQ:ZION) collapsed 12.3% after the bank disclosed late Wednesday that it would record a $50 million charge-off in the third quarter related to two troubled commercial and industrial loans held by its California Bank & Trust unit.

The bank stated that total provisions for credit losses would amount to $60 million, with the full update expected in its earnings release on October 20.

A Truist Securities analyst described the episode as a "step on a rake," highlighting that even isolated loan problems are enough to rattle a market already jittery about the broader credit cycle.

Compounding investor concerns, Jamie Dimon, CEO of JPMorgan Chase & Co. (NYSE:JPM), referenced growing risk in the credit market earlier this week, citing the recent bankruptcies of Tricolor Holdings, a subprime auto lender, and First Brands, an auto parts manufacturer.

“When you see one cockroach, there's probably more,” Dimon said, raising red flags across the sector.

Contagion Fears Spread

The fallout from Zions quickly spilled over. Western Alliance Bancorp (NYSE:WAL) dropped 10.4% after revealing it had filed a lawsuit against a borrower, alleging fraud. The Phoenix-based bank said it would provide more transparency on this credit exposure following a similar disclosure from a peer.

Other regional lenders also took heavy losses:

- Great Southern Bancorp Inc. (NASDAQ:GSBC) fell 10%

- Customers Bancorp Inc. (NYSE:CUBI) slid 9.5%

- Hingham Institution for Savings (NASDAQ:HIFS) lost 9%

The Russell 2000 Index – tracked by the iShares Russell 2000 ETF (NYSE:IWM) – where financials account for nearly 20% of the weighting, dropped 2%, snapping a three-day win streak as regional banks dragged the index sharply lower.

Read now:

Photo: Shutterstock