/Regeneron%20Pharmaceuticals%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Tarrytown, New York-based Regeneron Pharmaceuticals, Inc. (REGN) is a biotechnology company that invents, develops, manufactures, and commercializes medicines aimed at treating serious diseases across multiple therapeutic areas. Valued at a market cap of $59.1 billion, the company is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Oct. 28.

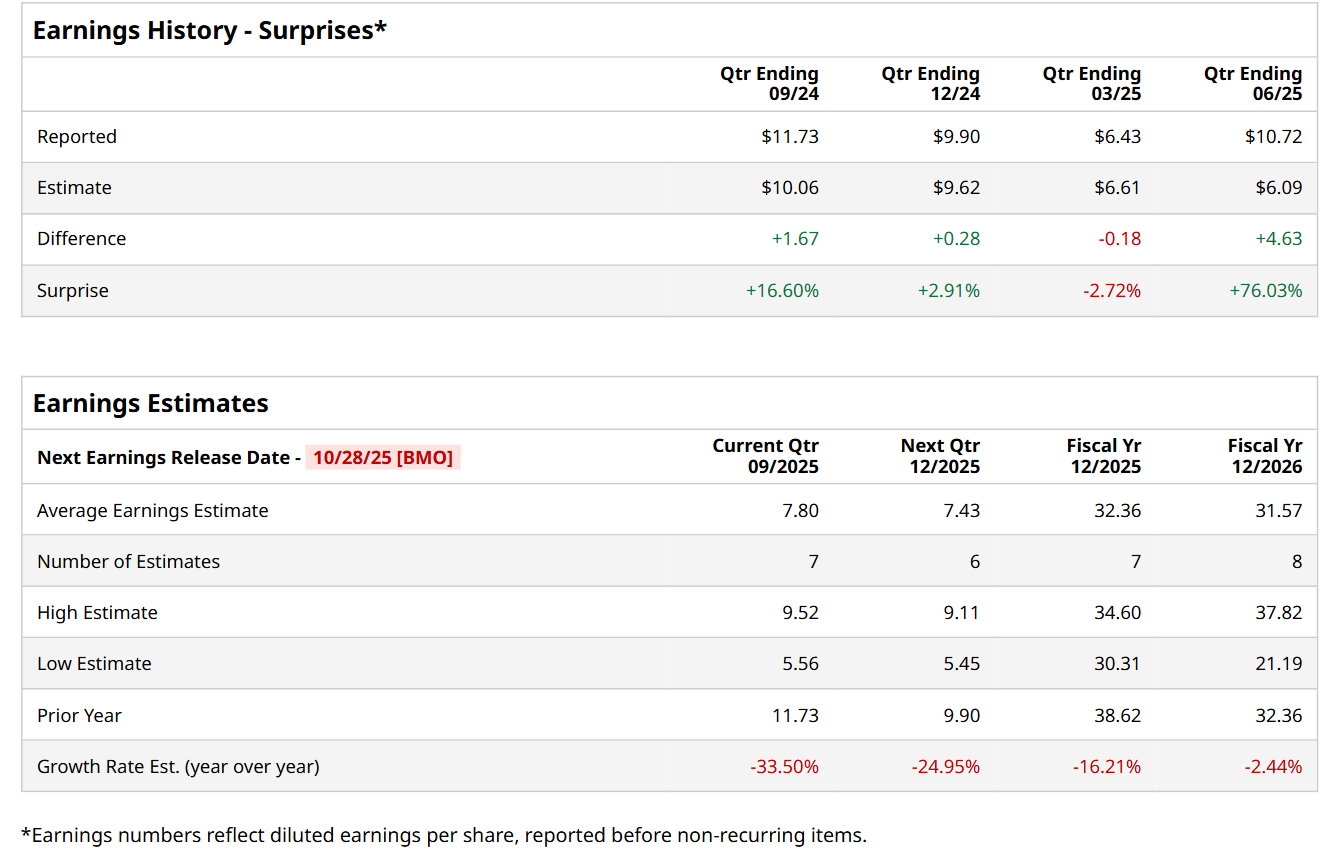

Before this event, analysts expect this healthcare company to report a profit of $7.80 per share, down 33.5% from $11.73 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $12.89 per share in the previous quarter outpaced the consensus estimates by a notable margin of 60.5%.

For fiscal 2025, analysts expect REGN to report a profit of $32.36 per share, down 16.2% from $38.62 per share in fiscal 2024. Its EPS is expected to further decline 2.4% year-over-year to $31.57 in fiscal 2026.

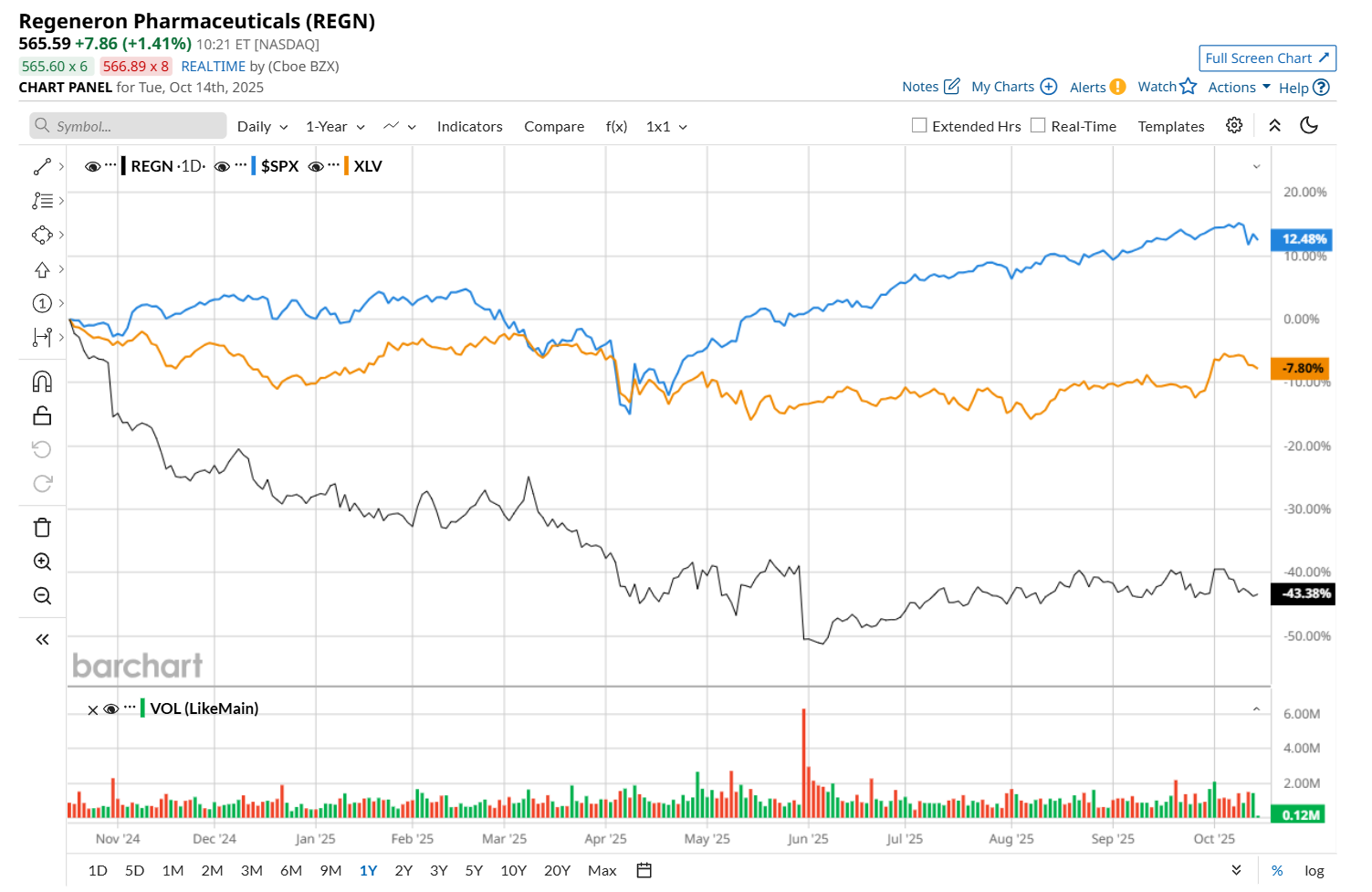

REGN has declined 44.9% over the past 52 weeks, significantly lagging behind both the S&P 500 Index's ($SPX) 12.3% return and the Health Care Select Sector SPDR Fund’s (XLV) 8.6% drop over the same time frame.

Shares of REGN surged 2.5% after its better-than-expected Q2 earnings release on Aug. 1. The company’s overall revenue improved 3.6% year-over-year to $3.7 billion, exceeding analyst expectations by 10.2%. Furthermore, its adjusted EPS came in at $12.89, up 11.5% from the year-ago quarter and a notable 60.5% ahead of consensus estimates.

Wall Street analysts are moderately optimistic about REGN’s stock, with a "Moderate Buy" rating overall. Among 27 analysts covering the stock, 18 recommend "Strong Buy," two indicate "Moderate Buy," six suggest "Hold,” and one advises a "Moderate Sell” rating. The mean price target for REGN is $729.85, implying a 29.5% potential upside from the current levels.