With a market cap of $12.9 billion, Regency Centers Corporation (REG) is a leading publicly traded retail REIT, recognized as a premier national owner, operator, and developer of shopping centers in affluent, high-density suburban trade areas. Its portfolio features thriving properties anchored by top-performing grocers, restaurants, service providers, and best-in-class retailers that foster strong connections with their communities.

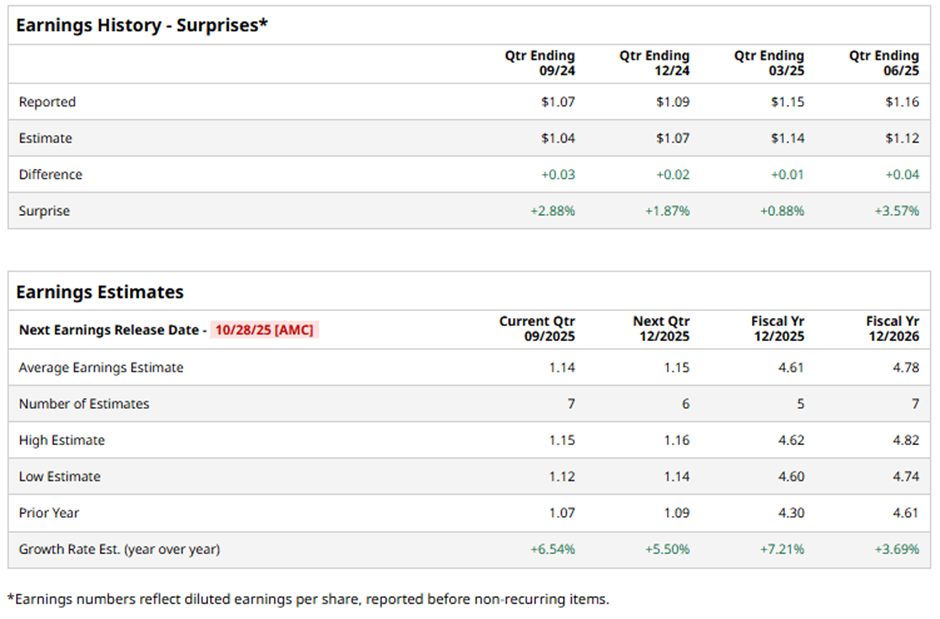

The Jacksonville, Florida-based company is set to release its fiscal Q3 2025 earnings results after the market closes on Tuesday, Oct. 28. Ahead of this event, analysts project Regency Centers to report Nareit FFO of $1.14 per share, reflecting a rise of 6.5% from $1.07 per share in the year-ago quarter. It holds a solid track record of consistently surpassing Wall Street's bottom-line estimates in the last four quarterly reports.

For fiscal 2025, analysts forecast the shopping center REIT to report Nareit FFO of $4.61 per share, up 7.2% from $4.30 per share in fiscal 2024.

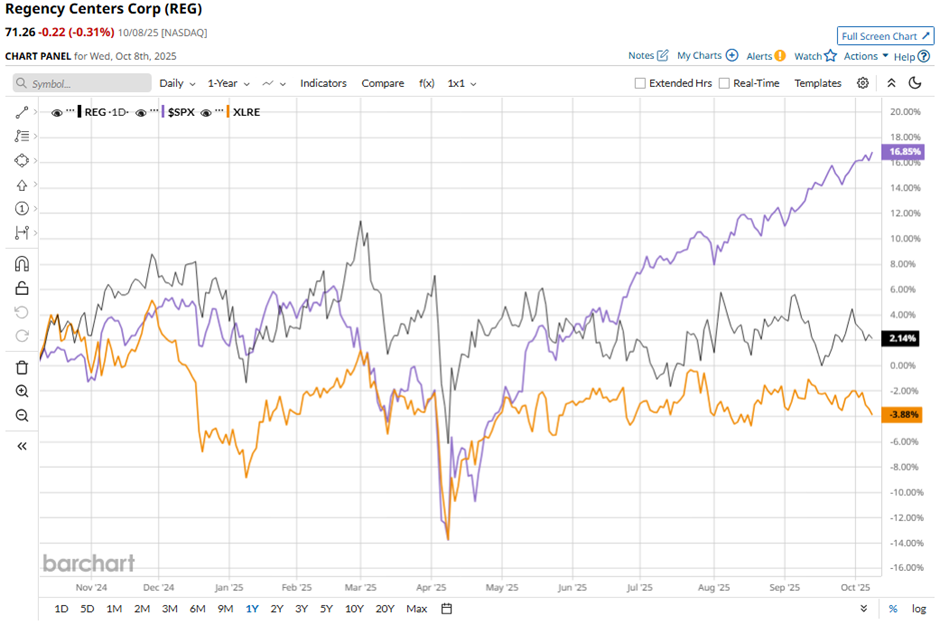

REG stock has risen 1.6% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 17.4% increase. However, the stock has outperformed the Real Estate Select Sector SPDR Fund's (XLRE) 4.8% decrease over the same time frame.

Shares of Regency Centers rose marginally following its Q2 2025 results on Jul. 29, as the company reported Nareit FFO of $1.16 per share, surpassing analysts’ expectations. The REIT also raised its full-year Nareit FFO guidance to $4.59 per share - $4.63 per share, and increased its core operating earnings outlook to $4.36 per share - $4.40 per share. Investor sentiment was further boosted by rising rental rates and resilient leasing demand across its grocery-anchored shopping centers in affluent localities.

Analysts' consensus view on REG stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, 11 suggest a "Strong Buy," two give a "Moderate Buy," and seven recommend a "Hold." The average analyst price target for Regency Centers is $79.95, indicating a potential upside of 12.2% from the current levels.