Reddit Inc (NYSE:RDDT) shares are trading lower Wednesday morning. The stock is under pressure amid social media chatter ChatGPT owner OpenAI is reportedly looking to reduce Reddit citations. Here’s what investors need to know.

What To Know: This development could slash user traffic directed to Reddit and devalue its data licensing deals, which are crucial for training AI models and represent a significant growth area.

Adding to the downturn, Elon Musk revealed his AI company, xAI, is developing a platform to compete with information hubs like Wikipedia, a move that could also rival Reddit. The prospect of a well-funded, high-profile competitor is stoking fears of increased competition for users and advertising revenue.

These combined threats to Reddit's traffic and data monetization model are likely fueling the stock’s downward trajectory Wednesday as investors reassess the company's long-term outlook.

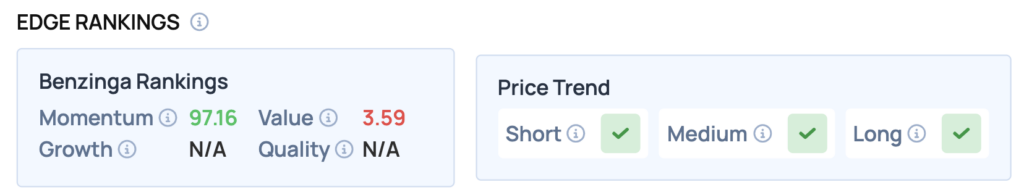

Benzinga Edge Rankings: Despite Wednesday’s pressure, Benzinga Edge rankings show the stock has a very strong Momentum score of 97.16.

RDDT Price Action: Reddit shares were down 6.54% at $214.94 at the time of publication Wednesday, according to Benzinga Pro. The stock is trading within its 52-week range of $64.51 to $282.95.

The stock is below its 50-day moving average of $219.74, indicating a bearish trend in the short term. Key support levels may be found near the 100-day moving average at $173.47, while resistance is likely at the 50-day moving average.

Read Also: Jobs Shock: Biggest Loss In Over 2 Years And Fed May Cut Again

How To Buy RDDT Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Reddit’s case, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock