The RealReal Inc (NASDAQ:REAL) stock witnessed a 21.05% surge during the after-hours on Thursday.

Check out the current price of REAL stock here.

What Happened: The stock of the San Francisco-based online marketplace soared to $6.67 in extended trading hours on Thursday. This surge came after the company announced its second-quarter results, which surpassed market estimates.

The RealReal reported a revenue of $165 million, marking a 14% year-over-year increase. The gross merchandise value and total revenue for the second quarter also saw a 14% annual rise. The company’s consignment revenue grew by 14%, and direct revenue by 23% during this period.

Rati Levesque, RealReal’s CEO, commented on the results, stating, “The second quarter was a breakout performance for The RealReal, further validating the success of our strategic roadmap as strong execution fueled top-line momentum and margin expansion.”

The RealReal saw trading volume reach 6.76 million shares today, more than twice its average of 3.22 million, with a market capitalization of $623.15 million during the day.

Why It Matters: RealReal’s second-quarter results have been received positively by the market, leading to a surge in its stock value. The company’s gross margin for the quarter was 74.3%, showing a 20 basis point improvement from the same period in 2024. The adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) margin for second quarter of 2025 was 4.1%, a 530 basis point increase from the previous year.

The company’s announcement of its third-quarter sales guidance of GMV between $495 million and $502 million and total revenue of $167 million to $170 million, which exceeded market estimates, indicates its strong financial performance and the company's resilience and growth potential in the luxury resale market.

Price Action: According to the Benzinga Pro data, RealReal closed at $5.51, down 4.17%, experiencing a decrease of $0.24 on Thursday.

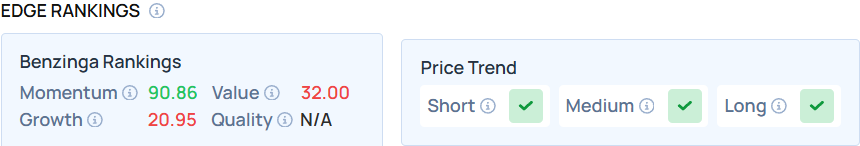

With a strong Momentum in the 90th percentile, Benzinga’s Edge Stock Rankings indicate that REAL has a positive price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Photo Courtesy: Mizkit on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.