NEW DELHI: India’s economic leaders are undertaking a coordinated attack on inflation, with fiscal and monetary authorities seeking to slow price increases and blunt the impact of higher costs on consumers.

The joint moves come as inflation in Asia’s third-largest economy tracks at an eight-year high, breaching the central bank’s target for the past four months, and as markets test the ability of policy makers to smooth currency moves and keep borrowing costs in check.

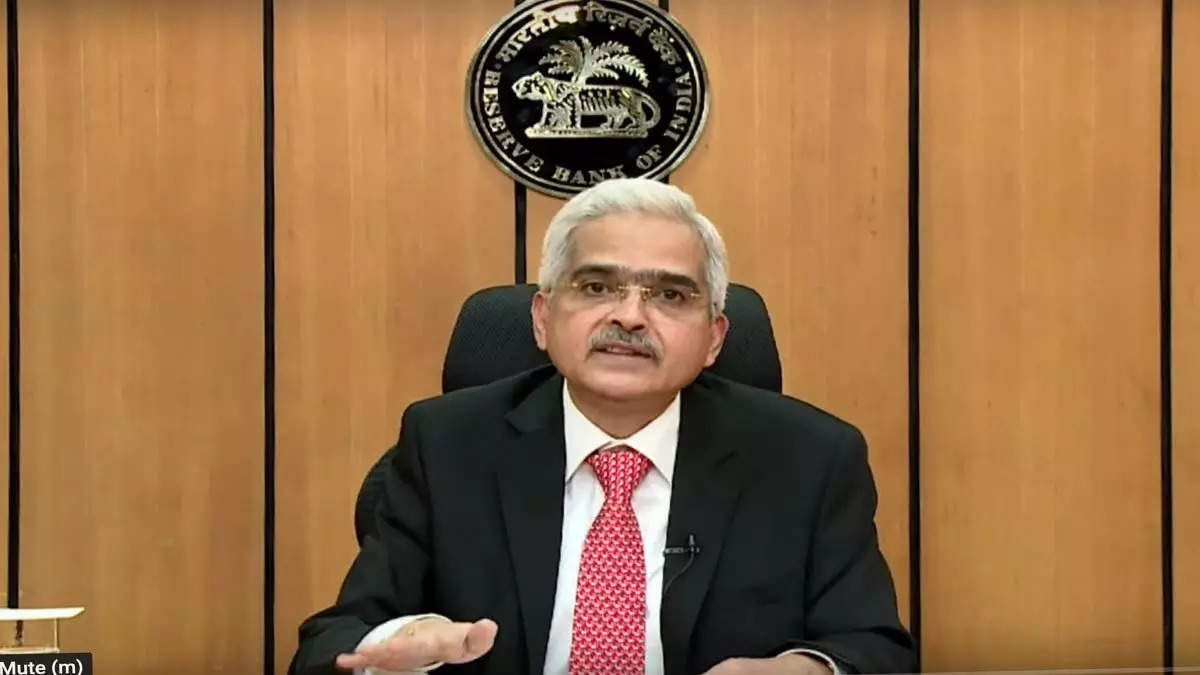

“We have entered another phase of coordinated action between fiscal and monetary authorities to check inflation,” Reserve Bank of India Governor Shaktikanta Das said in an interview on Monday, adding that the measures would have a “sobering impact” on consumer prices.

India joins policy makers globally struggling to slow a surge in consumer prices that threatens their recoveries from the pandemic and risks tipping economies back into recession.

Das said the central bank will raise interest rates at its “next few” meetings, following on a surprise hike earlier this month that ended two years of pro-growth cheap credit support to weather the pandemic.

His comments come days after the government of Prime Minister Narendra Modi announced fiscal measures, including tax and fuel price cuts, that are estimated to cost $26 billion and drive government borrowing higher.

Expectations for higher rates are “a no brainer,” Das said in the interview Monday, adding that policy makers are aiming to remove a liquidity “overhang.” He also said that the RBI won’t allow a “runaway” depreciation of the rupee.

The currency has seen a series of record lows in recent weeks amid investment outflows of more than $20 billion this year. After Das spoke, the rupee recouped earlier losses to trade down 0.1% to 77.595 to the dollar.

Borrowing costs have pushed higher as inflation takes off

While economists see the new fiscal plan widening the deficit -- Barclays Plc predicts it will hit 6.9% of gross domestic product -- Das said he expects the government to stick with its 6.4% goal. Bond yields briefly fell after his comments.

“My sense is that the government remains committed to maintaining the fiscal deficit target given in the budget,” Das said. “I cannot speak on behalf of the government, but having worked in the finance ministry, there is no one-to-one correlation” between spending and borrowing needs, he said.

While the cuts and subsidies could soften headline inflation and ease pressure on the central bank, they may not be enough to divert the RBI from its monetary tightening path, economists wrote in reports Sunday and Monday.

Other points Das made in the interview include:

*The central bank will, at its next meeting in June, revise its 5.7% inflation forecast for the current fiscal year to March

*The RBI remains committed to ensuring a non-disruptive government borrowing. “We will use various policy instruments”

*“We will move toward positive real interest rates,” without proving a timeline. External member of the rate setting panel Ashima Goyal last week pitched for frontloading hikes to prevent real rates from becoming too negative

*Cryptocurrencies will “seriously” undermine monetary and fiscal stability