Billionaire investor and hedge fund Bridgewater Associates founder Ray Dalio has issued a stark warning that provides a critical historical framework for the Donald Trump administration’s escalating financial wars against Russia, China, and Canada.

Dalio Warns That Trump’s Trade Tensions Weigh On US Dollar

In a recent post on the social media platform X, Dalio argued that the aggressive use of sanctions ultimately backfires, reducing global demand for the sanctioning nation’s currency and debt.

“History and logic have made clear that sanctions reduce the demand for fiat currencies and debts denominated in them and support gold,” Dalio wrote. He characterized these economic weapons as “financial and economic wars” designed to cut “opponents off from money and needed goods.”

This comes as the US Dollar Index has declined by nearly 8.75% on a year-to-date basis in 2025.

According to the latest Commitments of Traders (COT) report shows non-commercial net short positions on U.S. Dollar Index futures reached -10,334 in late September. That’s the most bearish positioning since February 2021 — a level that historically coincides with local bottoms in the greenback.

See Also: Trump Crushed The Dollar–But The Next Chapter Could Shock Markets

US Dollar Facing ‘Detrimental Effects’ Of Trade Conflicts

According to Dalio’s post, while these tactics hurt opponents, they also have the “detrimental effects of weakening the sanctioning/debtor country’s currency.”

He warned that when this strategy is employed by the “world’s leading power and its reserve currency”—the United States and the dollar—the “global monetary order is inevitably weakened.”

As other nations seek to reduce their reliance on the U.S. dollar to avoid such pressure, Dalio concluded that the “holding and price of gold rise, as it is a non-fiat currency that remains securely held and universally accepted.”

Trump Slaps Full Sanctions On Russian Oil Giants

Dalio’s analysis comes just as President Trump announced “full blocking sanctions” on Russia’s two largest oil companies, Rosneft and Lukoil, barring them from the U.S. banking system. Trump described the move as “tremendous sanctions” intended to force an end to the war in Ukraine.

This action is part of a broader, multi-front economic pressure campaign. The administration is also threatening a “100% tariff” on Chinese imports as Beijing tightens its control over rare-earth minerals.

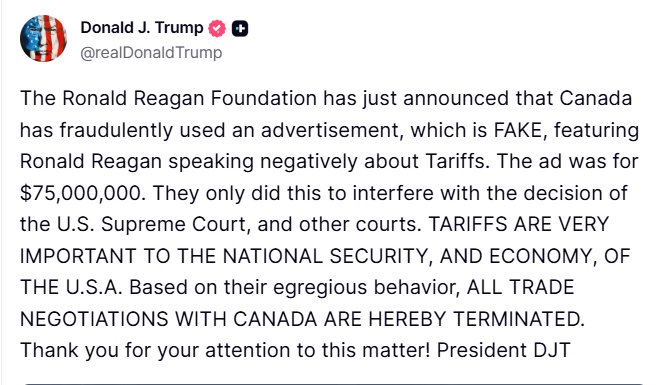

Simultaneously, trade relations with America’s closest ally have cratered, with Trump stating on social media, “ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED,” over a dispute involving an anti-tariff advertisement.

US Dollar Remains Rangebound Below 100

The US Dollar Index traded above the 100 level in May 2025. It has consistently been 9% to 10% lower on a YTD basis in the current year, while asset classes like Gold and Bitcoin (CRYPTO: BTC) have steadily hit fresh highs.

As of the publication of this article, the U.S. Dollar Index spot was 0.09% higher at the 99.0290 level.

On Friday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Meanwhile, on Thursday, the S&P 500 index ended 0.58% higher at 6,738.44, whereas the Nasdaq 100 index rose 0.88% to 25,097.42. On the other hand, Dow Jones advanced 0.31% to end at 46,734.61.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.