Americans are clearly worried about the state of the U.S. economy – especially when it comes to their ability to pay their household bills every month.

Approximately 52% of U.S. adults say the U.S. is “too expensive to live in” these days, according to a USA Today/Suffolk survey. Additionally, about 70% say high inflation and a struggling economy are the biggest issues the country faces right now in a recent Pew Center survey.

DON’T MISS: Feds minutes show inflation risk is still too high

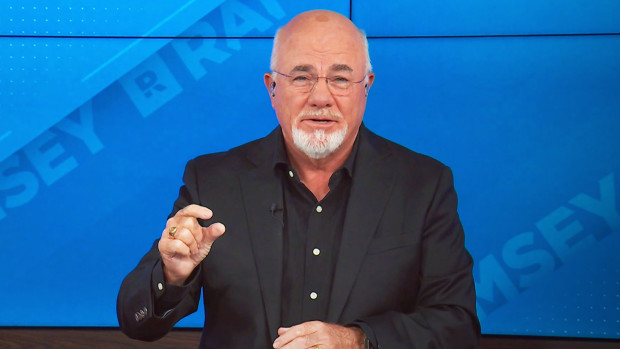

Consumer financial advocate Dave Ramsey recognizes Americans are anxious over their finances and has some advice on how to tough things out and keep that household budget stable and secure – but it may take some sacrifices.

“If you can’t pay all of your bills and are having a hard time making ends meet, these “Four Walls” should be what you spend your money on first (and in this order),” Ramsey said in an August 19 X post.

More Dave Ramsey:

- Dave Ramsey has a blunt warning on a key homeowner mistake

- Dave Ramsey has an outspoken view on the ‘lie’ about college

- This couple’s million-dollar confession actually floored Dave Ramsey

Here’s how Ramsey rates the “must pay” monthly bills.

1. Food

2. Utilities

3. Shelter

4. Transportation

Making sure you avoid overspending on “luxuries” is the best way to address those four keystone financial priorities, Ramsey said on his Aug. 19 “The Ramsey Show.”

“If you’re behind on your payments you have to prioritize your dollars,” he noted. “There’s a big difference between necessities and luxuries and that must be addressed. Food is not a luxury and eating out is not a necessity. Some of you people out there - all you know how to do is make (dinner) reservations. You need to work on that.”

Next, pay for your lights and water so you have heat and keep moving down the checklist.

“Once your bellies are full and you’re warm make sure to take care of shelter - you pay your rent,” he added. “If you stay calm, cool, and collected and say, ‘We’re going to eat before we do anything, we’re going to pay utilities before we do anything, and we're going to pay our rent.”

“Until you clear food, utilities, housing, and transportation and get them current you don’t spend anything else on anyone or anything,” Ramsey said.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.