Recap: Global shares stalled as investors assessed corporate earnings reports and awaited the latest US jobs report for clues on the next policy decisions from the Federal Reserve. Most emerging market shares fell on Friday as Chinese material and technology stocks retreated.

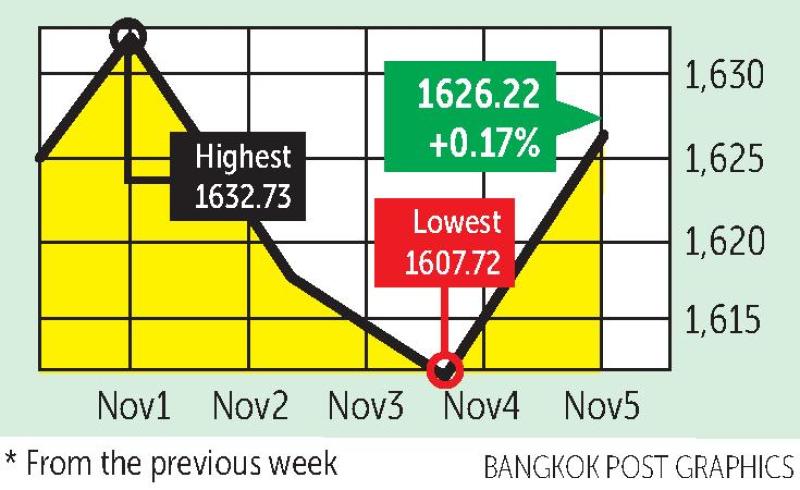

The SET index moved in a narrow range of 1,607.72 and 1,632.73 points this week before closing yesterday at 1,626.22, up 0.17% from the previous week, in daily turnover averaging 76.91 billion baht.

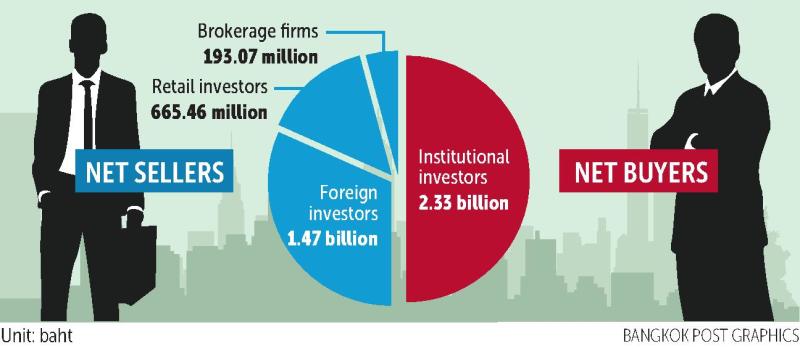

Institutional investors were net buyers of 2.33 billion baht. Foreign investors were net sellers of 1.47 billion baht, retail investors sold 665.46 million and brokerage firms offloaded 193.07 million baht worth of shares.

Newsmakers: The US Federal Reserve is starting to remove a major plank of the stimulus policies it rolled out last year as the pandemic began, a sign of the progress the US economy has made. The Fed said asset purchases would be cut by $15 billion a month from the current $120 billion.

- The Biden administration on Monday took the first significant step to impose bank-like oversight on the cryptocurrency companies involved in issuing of stablecoins, a process that could shape the future of digital money.

- The Bank of England on Thursday defied market expectations by keeping interest rates on hold, prioritising immediate concerns over slowing growth more than the prospects of an inflation spike.

- The United States and the EU agreed to the lifting of punitive tariffs on imported European steel and aluminium, ending a dispute that strained their trade ties since then-president Donald Trump imposed the levies three years ago.

- China said it has increased daily coal production by over one million tonnes, easing its energy shortage, even as world leaders gathered in Scotland for climate talks billed as one of the last chances to avert catastrophic global warming.

- Microsoft is once again the most valuable company in the US, with a market capitalisation hitting $2.49 trillion and surpassing Apple for the first time in more than a year. Apple shares have sunk amid concerns that supply-chain problems could hammer holiday season product shipments.

- Yahoo said it was pulling out of China, citing an increasingly challenging business and legal environment, the latest foreign company to be caught up in Beijing's toughening rules for businesses.

- Australia and New Zealand have ratified the world's biggest free trade deal that links the 10 Asean nations and five major trading partners. The Regional Comprehensive Economic Partnership will formally take effect on Jan 1, as a sufficient number of countries have now ratified it.

- Ether, the world's second-largest cryptocurrency, hit an all-time high above $4,600 on Wednesday, catching up with bitcoin's rally amid news of wider blockchain adoption. Bitcoin is trading above $63,000 and is up 117% this year, while ether is up six-fold.

- The Chinese developer Kaisa Group halted trading of its shares in Hong Kong on Friday, on the back of deepening concerns over the company's cash flow and the health of the property sector.

- Oil price volatility is likely to rise after Opec and its allies shunned a US request for more crude, says Goldman Sachs, adding that the market remains undersupplied. UBS forecasts the global benchmark Brent will reach $90 a barrel over the coming months.

- The Joint Standing Committee on Commerce, Industry and Banking (JSCCIB) has revised up its GDP growth forecast to a range of 0.5% to 1.5% this year, up from 0-1% earlier, as it expects better business prospects stemming from the reopening of the country and stimulus measures.

- Economic growth will be subdued this year due to the impacts of the pandemic, but could reach 5-6% in 2022 if there are no fresh outbreaks, Deputy Prime Minister Supattanapong Punmeechaow said on Wednesday.

- The cabinet approved a budget of 3.62 billion baht proposed by the National Economic and Social Development Council on Thursday to finance research and development for two Covid-19 vaccine projects.

- Thailand's exports are expected to rise at a slower pace of 5% next year as global demand and inventories will normalise, the National Shippers' Council said on Tuesday.

- Government revenue collections for the fiscal year ended Sept 30 were 2.36 trillion baht, 11.5% short of the target, reflecting the impact of the prolonged Covid pandemic, the Fiscal Policy Office said.

- The Finance Ministry will sell to the public 80 billion baht worth of savings bonds from Nov 15 to help finance a budget deficit.

- An estimated 726,000 air passengers are expected to travel on domestic and international flights in the country this month, or about 24,200 per day, following the reopening of many parts of the country to international travellers.

- Consumer confidence rose for a second straight month in October, hitting a five-month high, thanks to an easing of coronavirus curbs and a larger reopening of the tourism sector, a survey showed on Thursday.

- The Commerce Ministry is keeping a close eye on rising prices of vegetables and other consumer products, the costs of which have been driven up by floods and higher oil and raw material prices.

- Thailand's media spending is expected to register double-digit growth next year, from a low base this year, supported by economic reopening and state stimulus, according to Media Intelligence Group.

- The board of the Oil Fuel Fund Office has approved a plan to borrow 30 billion baht to support the government's move to cap the diesel pump price at 30 baht per litre.

- Thailand has set a target of having 15 million electric vehicles (EVs) on the roads by 2035 as a part of a strategy to lower greenhouse gas emissions, according to government spokesman Thanakorn Wangboonkongchana.

- The conglomerate Charoen Pokphand Group (CP) is expanding its reach into preventive healthcare as well as the blockchain and cryptocurrency frontiers as part of its new drive for growth.

- Siam Commercial Bank has acquired a 51% stake in the local digital asset exchange Bitkub for 17.85 billion baht, making Bitkub the country's latest unicorn, with a valuation exceeding US$1 billion. Bitkub's coin tripled in value after the deal was announced.

- Airbnb says it has seen a surge in searches for stays in Thailand in recent weeks by international travellers attracted by the reopening to quarantine-free travel for fully vaccinated visitors from 63 countries.

- Thai Airways International will sell 42 planes and cut nearly a third of its workforce of 21,300 by the end of next year as part of a plan to slim down and cut costs, says Piyasvasti Amranand, head of the restructuring committee.

Coming up: National Australia Bank will release October business confidence on Tuesday. Germany will release September trade figures and the November economic sentiment outlook. The US will release October producer prices.

- The US will release weekly crude oil stock data on Wednesday. Australia will release November consumer sentiment and China will release October consumer and producer prices. The US will also release October consumer prices and initial jobless claims.

- The US will release October federal budget updates and Opec will release its monthly oil market report on Thursday. On the same day, Australia will release October employment, Britain will release third-quarter GDP and the European Central Bank will release an updated macroeconomic forecast. The US will release September job openings on Friday.

Stocks to watch: SCB Securities recommends defensive stocks with prices that are lagging, including ADVANC, BEM, BGRIM and GPSC. Firms expected to report good Q3 performance are BDMS and RJH.

- DBS Vickers Securities recommends stocks of companies that will benefit from further economic reopening. Top picks are ERW, BJC, CPN, WHA, MAJOR and M. Interesting stocks for the fourth quarter are ADVANC, TRUE, BEM, KCE, BDMS, CPALL, GPSC, GULF, TIDLOR, MAJOR and JMT.

Technical view: Capital Nomura Securities sees support at 1,603 points and resistance at 1,641. Maybank Kim Eng Securities sees support at 1,600 and resistance at 1,645.