Rachel Reeves’ decision to extend the freeze on tax thresholds will hit lower earners, a leading think tank has warned.

The Resolution Foundation’s analysis of Wednesday’s Budget says that by 2030-31 people earning less than £35,000 a year will pay more than if the chancellor had raised the basic rate by 1p.

Millions more people will be dragged into paying higher income tax after Ms Reeves bet her political future on a £26bn tax raid on the middle classes in her make-or-break second Budget, after weaker economic forecasts left holes in her previous spending plans.

The tax hikes are also needed to pay for increased welfare spending, with Ms Reeves announcing the abolition of the two-child benefit cap, which is expected to lift 450,000 children out of poverty.

Having abandoned plans for a manifesto-busting income tax rise, the chancellor opted for a range of smaller tax increases to pay for government spending and build a larger buffer against her borrowing rules.

These include a new pay-per-mile tax for electric vehicles, increased taxes on online betting and a so-called “mansion tax” on homes worth more than £2m.

But she continued to face accusations of breaching Labour’s election promise not to raise taxes on working people after deciding to keep tax thresholds frozen until 2030/31 and levying national insurance on some pension contributions - a move the Resolution Foundation says is “undoubtedly a measure that asks working people to pay more”.

The decision to freeze tax thresholds to help fill a £20bn black hole in public finances will raise £8bn in 2029-30 and drag one in four workers into the highest tax band. A further 780,000 people will pay tax for the first time.

“A typical employee will face a £220 higher tax bill in 2030-31 as a result of the freeze extension”, the think tank said.

“It is a somewhat less progressive way to raise personal taxes than a manifesto-breaking rise in Income Tax rates, which would have cost less for anyone earnings under £35,000 a year."

The Resolution Foundation argued that Ms Reeves’s decision to stick to her “manifesto tax pledge has cost millions of low-to-middle earners, who would have been better off with their tax rates rising than their thresholds being frozen”.

“Indeed, all but the top 10 per cent of the income distribution are worse off because of opting for threshold freezes over rate rises (which raise similar amounts of revenue),” it said.

It comes despite the chancellor’s insistence that taxes have been kept at “an absolute minimum on ordinary working people”.

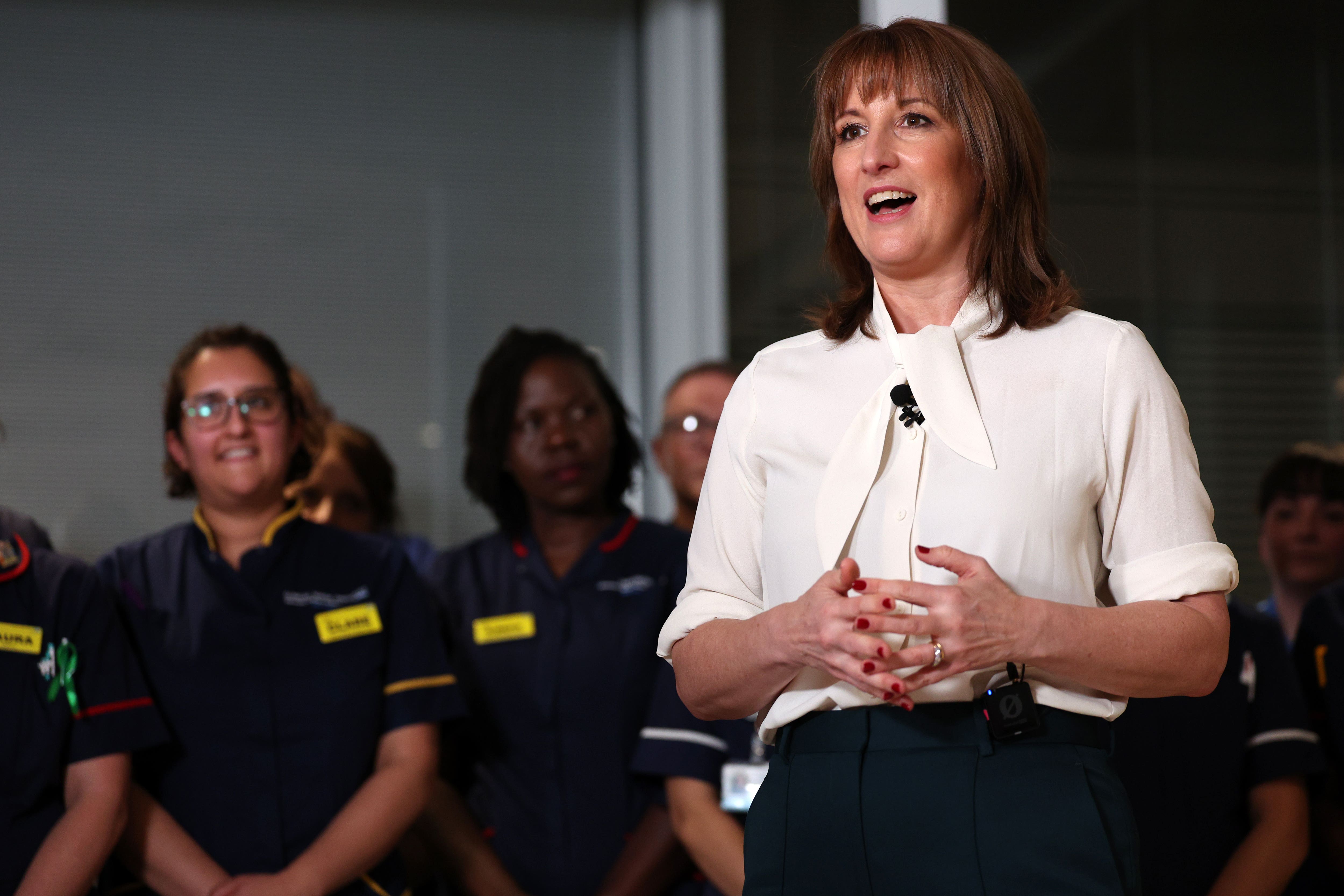

The defiant-sounding chancellor also defended her position, saying: “You’re not going to write my obituary today,” after delivering a Budget she was “incredibly proud” of.

She told Sky News: “I do recognise that that will mean that working people pay a bit more. But I’ve kept that contribution to an absolute minimum by closing … a number of tax loopholes and also bearing down on government spending, on waste and inefficiency.”

Resolution Foundation chief executive Ruth Curtice warned that most of the Budget’s impact would be felt in three years.

“Those threshold freezes kick in in 2028. Some of the other measures also not coming in – for example the mansion tax and the salary sacrifice – until 2028, so that’s when most of the pain from this Budget will be felt,” she told BBC Radio 4’s Today programme.

“This Parliament is set to be second only to the last parliament for (living) standards… This decade continues to look really, really tough.”

In what she branded a “Labour values” Budget, the chancellor moved to appease the left in her party with a package of measures that included 43 separate tax rises – according to shadow chancellor Sir Mel Stride – taking the tax burden in the UK to its highest level in history.

But she finally brought an end to the much-criticised two-child benefit cap, which campaigners say will help lift thousands of children out of poverty, and announced a £73bn splurge in welfare spending.

But the plans were not enough to generate the economic boost the chancellor had hoped for, with the Office for Budget Responsibility (OBR) watchdog downgrading her economic growth projections by 0.3 per cent and saying none of her measures helped improve the figure.