QuantumScape Corp (NYSE:QS) shares are trading higher Wednesday, adding to strong gains of more than 80% over the past month. Here’s what investors need to know.

What To Know: QuantumScape stock has been surging following last week’s announcement of a strategic agreement with manufacturing giant Corning Inc.

The two companies announced a collaboration to develop and commercialize ceramic separators, a critical component for QuantumScape’s next-generation solid-state lithium-metal batteries. The goal is to achieve high-volume production, a key step toward the industrialization of this advanced battery technology.

The partnership has ignited investor confidence, sending the stock soaring to a new 52-week high on Wednesday. The news builds on recent positive momentum for the company, including a successful battery demonstration in a Volkswagen vehicle earlier this year.

Ron Verkleeren of Corning and Siva Sivaram of QuantumScape both expressed excitement about advancing the future of battery technology. As of Wednesday morning, the stock has seen a more than 200% increase year-to-date.

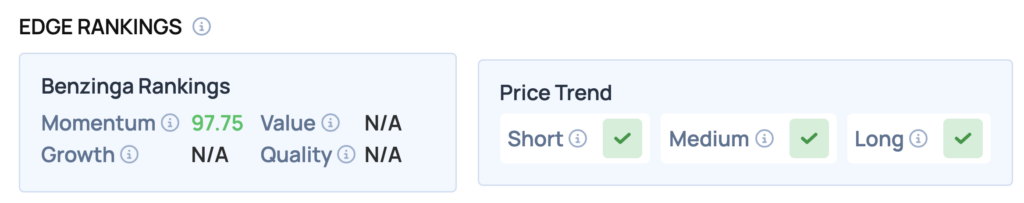

Benzinga Edge Rankings: Reflecting its strong recent performance, the stock has earned a Benzinga Edge Momentum score of 97.75.

QS Price Action: QuantumScape shares hit new 52-week highs of $17.77 on Wednesday before pulling back. The stock was up 2.32% at $15.69 at the time of publication Wednesday, according to Benzinga Pro.

QuantumScape is experiencing strong upward momentum, significantly surpassing its 50-day moving average of $10.05. The stock briefly broke through its previous resistance level near $16.68, which was the upper bound of its 52-week range, indicating potential for further gains if momentum continues.

Read Also: Meta And Apple Nearing Settlement With EU Lawmakers On Antitrust Cases: Report

How To Buy QS Stock

By now you're likely curious about how to participate in the market for QuantumScape – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock