/A%20sign%20and%20office%20building%20for%20QuantumScape%20by%20JHVEPhoto%20via%20Shutterstock.jpg)

QuantumScape (QS) shares are pushing higher on Wednesday after the company said it has teamed up with Corning (GLW) to co-develop ceramic separator manufacturing for its solid-state batteries.

Dr. Siva Sivaram, the chief executive of QuantumScape, dubbed Corning “an ideal addition to the firm’s technology ecosystem,”but refrained from disclosing the financial terms of the agreement in the press release.

Including today’s surge, QuantumScape stock is up over 300% versus its year-to-date low in April.

Significance of Corning Deal for QuantumScape Stock

Partnering with Corning is a strategic victory for QS stock, as it accelerates the company’s path to commercializing its solid-state battery technology.

Corning’s deep expertise in ceramics and high-volume manufacturing helps de-risk one of the most complex components – ceramics separators – while allowing QuantumScape to maintain a capital-light model.

The announced collaboration strengthens QuantumScape’s supply chain, boosts its credibility with investors, and signals industrial readiness.

More importantly, it aligns with rising demand for EV battery innovation, making QuantumScape shares especially attractive to long-term investors.

Should Valuation Deter Investors From QS Shares?

While QuantumScape stock is far from inexpensive to own at current levels, there still are ample reasons to stick with it for the longer term.

For example, the company has cash runway extending well into 2028, thanks to its licensing deal with Volkswagen (VWAGY). Moreover, the NYSE-listed firm has a capital-light business, which minimizes manufacturing risks and reduces costs.

QuantumScape’s total addressable market (TAM) is growing fast as well as its solid-state lithium metal batteries’ use cases continue to expand beyond electric vehicles.

Capital discipline and the management’s history of consistent execution further indicate QS shares’ potential to prove a lucrative investment, especially as the company continues to hit operational and strategic milestones.

Wall Street Sees Massive Downside in QuantumScape

Despite the aforementioned positives, Wall Street is fixated on QS stock’s stretched valuation for now.

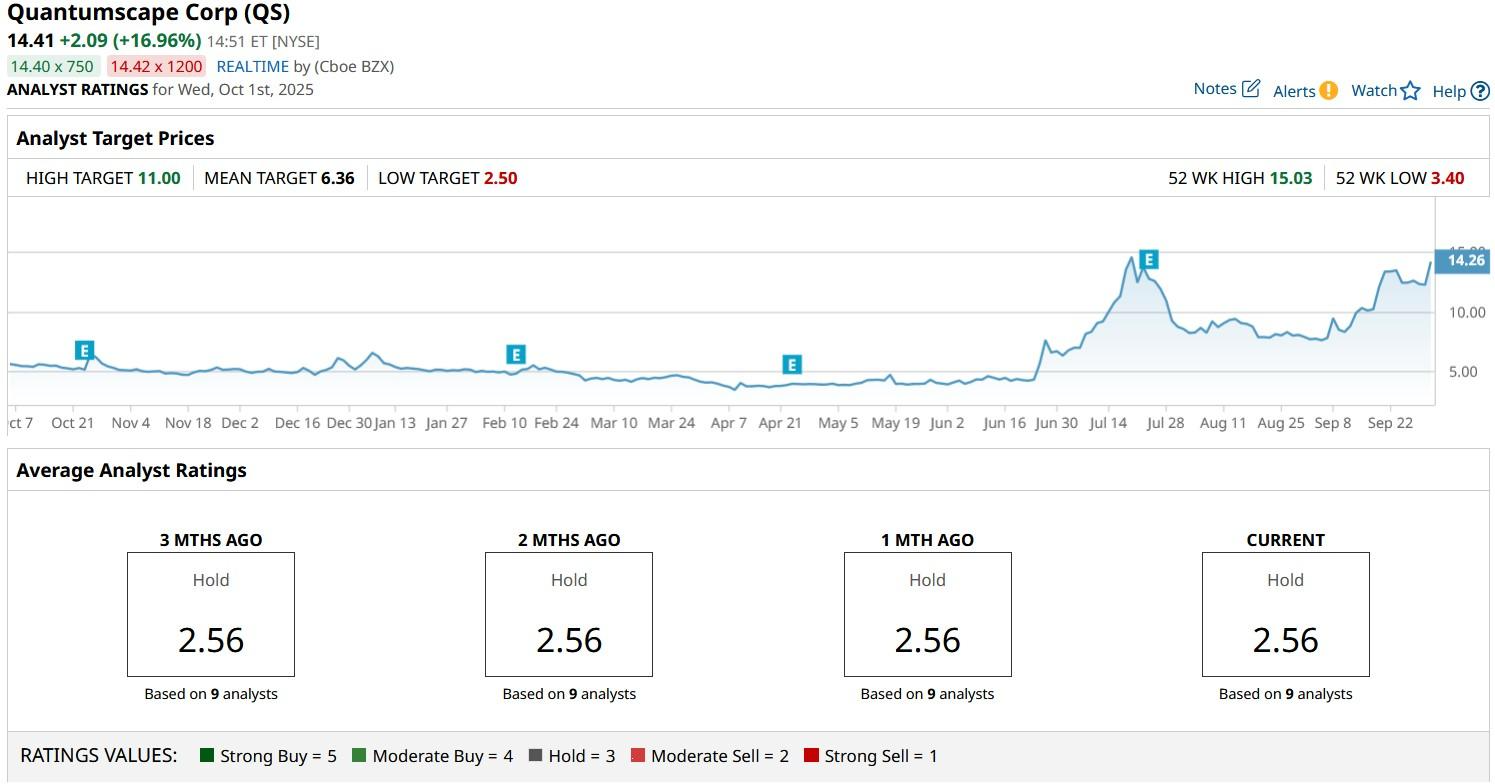

According to Barchart, the consensus rating on QuantumScape shares currently sits at “Hold” only with the mean target of $6.36 indicating potential downside of more than 50% from here.