/A%20sign%20and%20office%20building%20for%20QuantumScape%20by%20JHVEPhoto%20via%20Shutterstock.jpg)

Investors are cheering QuantumScape (QS) shares this morning after the NYSE-listed firm showcased its QSE-5 next-gen battery cells powering a Ducati motorcycle at IAA Mobility in Munich.

This marked the first real-word demonstration of an anode-free solid-state lithium-metal battery in an electric vehicle, according to the company’s press release on Monday.

QuantumScape stock has been in a sharp uptrend over the past five months. At the time of writing, the EV batteries specialist is up nearly 180% versus its year-to-date low set in early April.

Significance of Ducati Demo for QuantumScape Stock

The live demo of QSE-5 powering a Ducati motorcycle is positive for QS stock since it validates the company’s battery technology, moving it from a lab concept to a tangible, functioning product.

More broadly, the showcase suggests QuantumScape is making meaningful progress towards commercialization, which is absolutely critical for a pre-revenue company.

“Today, we have crossed the threshold from possibility to reality,” said Dr. Siva Sivaram, the firm’s chief executive officer, in a press release today.

In short, the demo offered irrefutable evidence that QuantumScape’s technology can revolutionize the EV market with improved range, safety, and charging speeds.

Why QS Shares Remain Unattractive to Own

The aforementioned demonstration confirms QuantumScape’s battery technology works in a real-world electric vehicle, but mass-market scalability, nonetheless, remains a formidable challenge.

Plus, the company could face regulatory hurdles ahead, which reinforces that it’s indeed a high-risk investment for the back half of 2025.

Given these headwinds, QuantumScape shares’ valuation looks overly stretched at writing.

Simply put, unless QS stops burning cash, begins generating revenue, and lays out a clear path to profitability, it may not be able to sustain the current hype over the long term.

The QuantumScape Share Price Has Gone a Bit Too Far

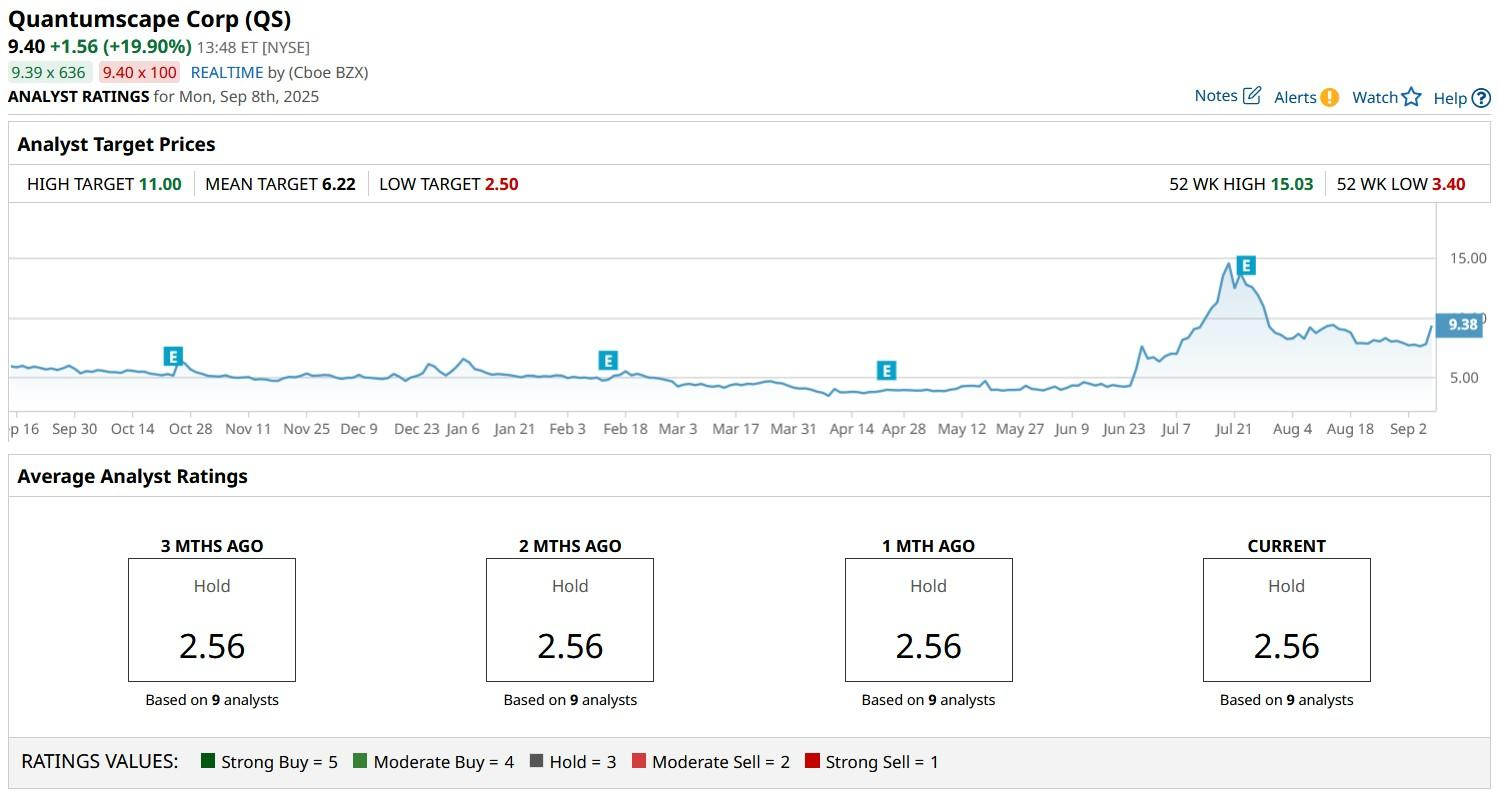

Investors should consider unloading QuantumScape stock at current levels also because it has now rallied well past Wall Street’s expectations.

According to Barchart, the consensus rating on QS shares sits at “Hold” only with the mean target of about $6.22 indicating potential downside of more than 35% from here.