/AI%20(artificial%20intelligence)/businessman%20using%20technology%20AI%20for%20working%20tools%20by%20Deemerwha%20studio%20via%20Shutterstock.jpg)

The artificial intelligence (AI) hardware race is heating up, and two contenders are emerging from different corners of the tech world. Qualcomm (QCOM), well-known for its mobile chip dominance, is expanding into AI-powered products, data centers, and edge computing. Super Micro Computer (SMCI) has established itself as a crucial supplier of AI servers and infrastructure that power today’s most advanced AI models. As both firms ride the wave of rising AI demand, let’s find out who has a better chance to emerge as the next true AI winner.

The Case for Qualcomm

Valued at $175.8 billion, Qualcomm is emerging as a serious contender in the AI revolution with strong momentum across smartphones, PCs, automobiles, internet of things (IoT), and now data centers.

QCOM stock is up 6.1% year-to-date, compared to the tech-heavy Nasdaq Composite Index’s ($NASX) gain of 17.2%.

In the third quarter of its fiscal 2025, Qualcomm posted adjusted revenue of $10.4 billion, up 10% year over year, and adjusted earnings per share of $2.77, a 19% increase from the prior year.

The company’s key segment, Qualcomm CDMA Technologies (QCT), which includes its semiconductor operations, generated $9 billion in revenue, up 11% year on year. Within QCT, Automotive increased by 21%, while IoT increased by 24%. Its Snapdragon Digital Chassis platform has been embraced by major automakers, with 12 new design wins and 50 vehicle launches in the current fiscal year. Meanwhile, Qualcomm’s licensing arm, QTL, contributed $1.3 billion to total revenue.

Qualcomm’s move into data center AI represents a strategic extension beyond mobile and edge computing. The company’s intentions to buy Alphawave IP Group will help it compete in AI infrastructure and networking technology. Management is optimistic about meeting its ambitious $22 billion revenue target for the automotive and IoT businesses by fiscal 2029. Beyond mobile and cloud AI, Qualcomm sees a massive opportunity in physical AI and robotics, which it believes could reach $1 trillion within the next decade.

Importantly, besides being a growth stock, Qualcomm is also a dividend stock. It returned $3.8 billion to shareholders in the quarter, including $2.8 billion in buybacks and over $1 billion in dividends, meeting its target of returning 100% of free cash flow to investors.

Looking ahead, Qualcomm expects 12% revenue growth and 16% EPS growth for fiscal 2025, marking its second straight year of over 15% growth in non-Apple (AAPL) QCT revenues.

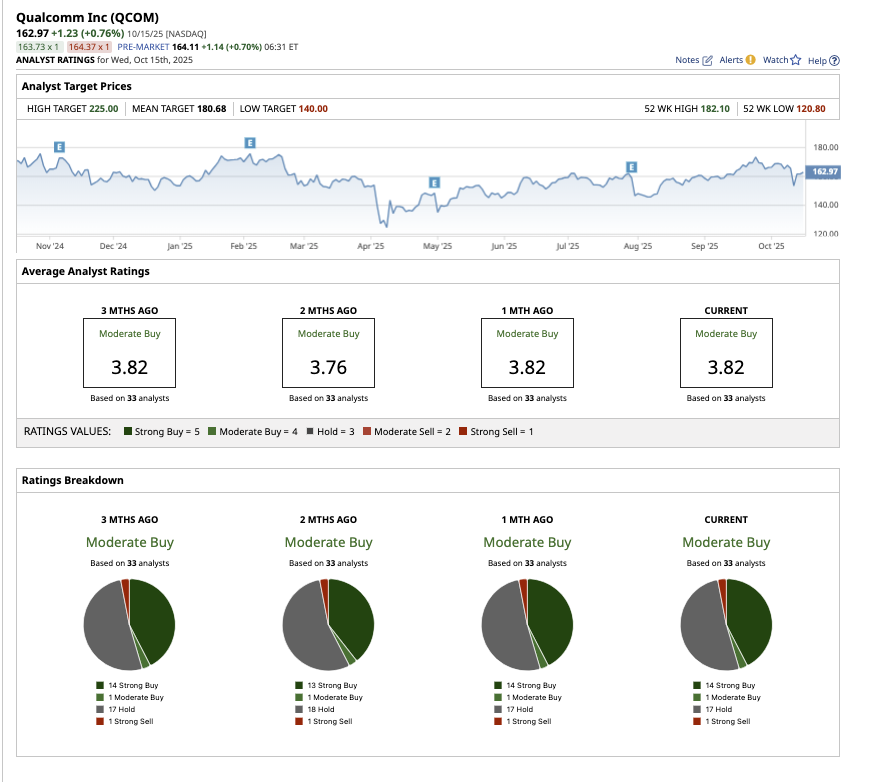

Overall, Wall Street rates QCOM stock a “Moderate Buy.” Out of the 33 analysts that cover the stock, 14 rate it a “Strong Buy,” one suggests a “Moderate Buy,” 17 rate it a “Hold,” and one says it is a “Strong Sell.” Its average target price of $180.68 suggests upside potential of 10.8% from current levels. Its high target price of $225 implies potential upside of 38% in the next 12 months.

The Case for Super Micro Computer

Valued at $32.1 billion, Super Micro Computer, better known as Supermicro, is now a critical supplier of AI-optimized data center systems, collaborating closely with semiconductor giants like Nvidia (NVDA) and Advanced Micro Devices (AMD) to build the backbone of modern AI infrastructure. Despite controversies and operational hurdles in 2024, Supermicro’s latest quarter highlighted the company regaining its footing and accelerating toward leadership in the high-performance computing era.

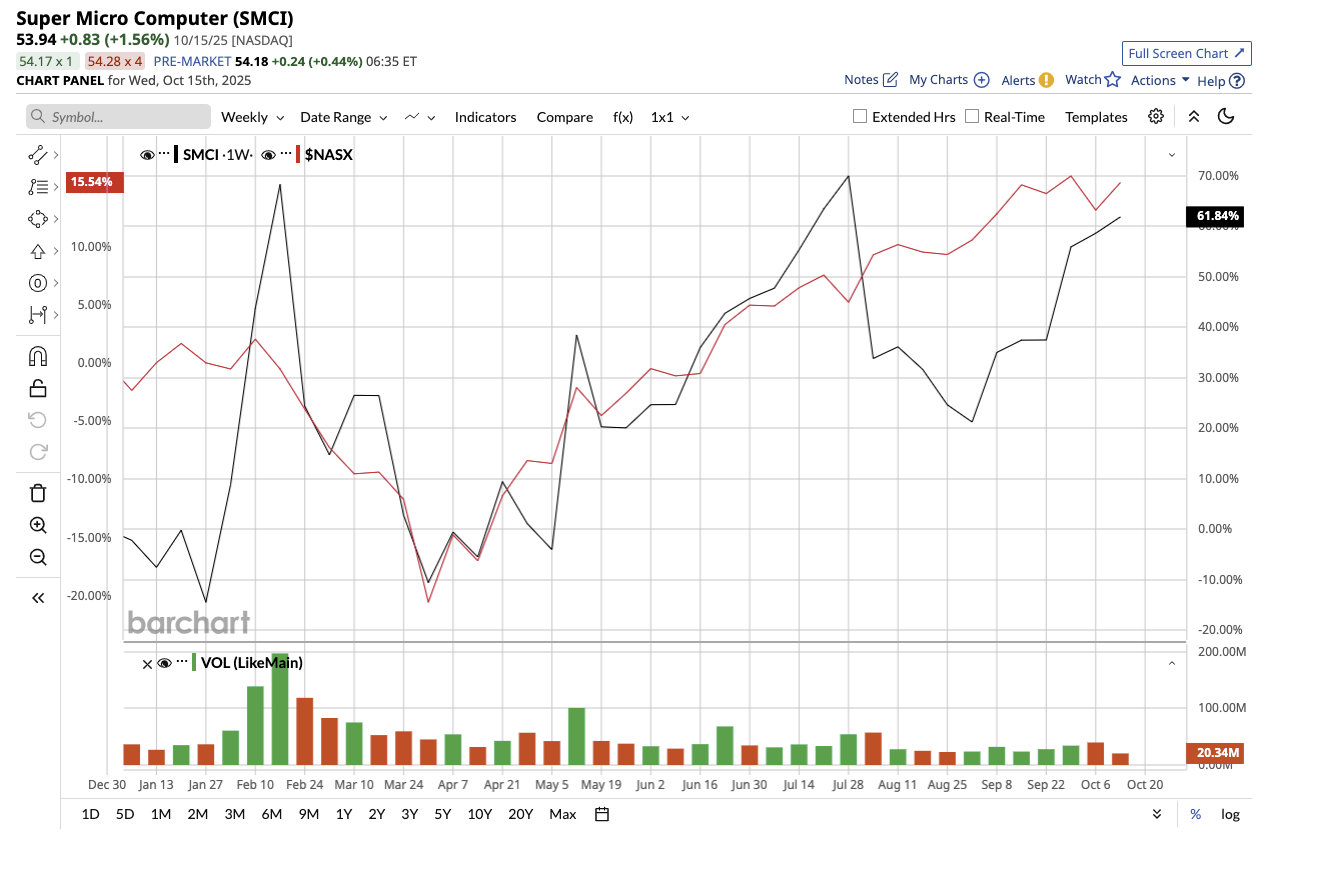

SMCI stock has climbed 81.5% YTD, outperforming the overall market and the tech-led Nasdaq Composite Index. This performance reflects renewed investor confidence following a challenging period.

In fiscal 2025, total revenue soared 47% year over year to $22 billion, reflecting strong global demand for AI data center systems. The number of large-scale direct customers has increased from two in fiscal 2024 to four this fiscal year, and management expects even more by next year. However, adjusted earnings per share dipped slightly from $2.12 to $2.06, primarily owing to tariff pressures.

While AI remains its biggest growth driver, Supermicro is rapidly diversifying its portfolio. The company is growing into enterprise IT, the Internet of Things (IoT), and telecommunications to apply its server expertise to adjacent high-growth sectors. However, management’s forecasts have been more modest. Earlier in 2025, Supermicro established an aggressive $40 billion revenue target for fiscal 2026. It has recently lowered its forecast to a still-ambitious $33 billion, or a 50% increase over fiscal 2025 levels.

Analysts mostly agree with management’s conservative outlook, anticipating revenue of around $31.8 billion in fiscal 2026 and an additional 24.7% growth to $39.7 billion in fiscal 2027. Earnings are predicted to rise 25.2% in fiscal 2026 and 33.6% in fiscal 2027, totaling $3.45 per share.

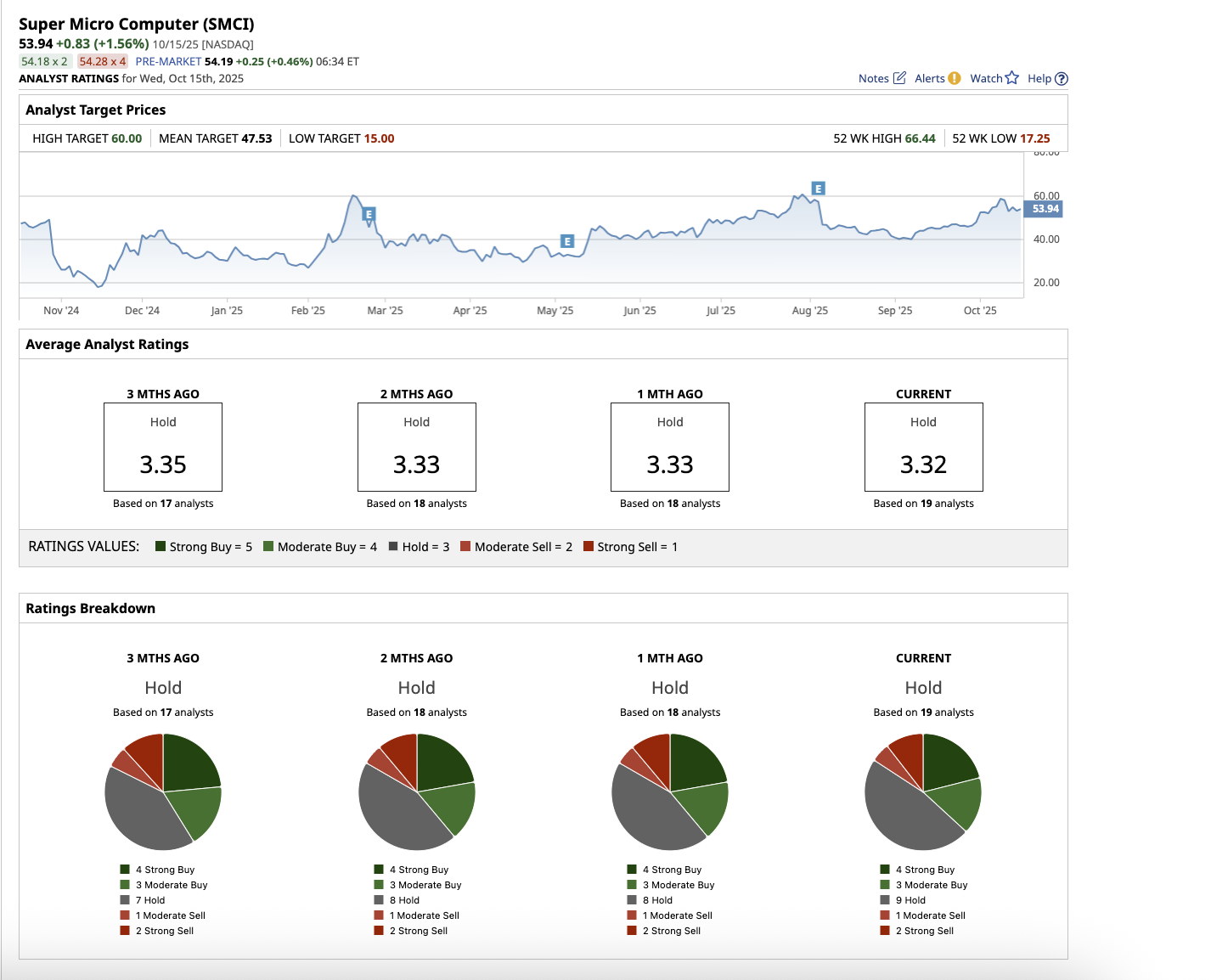

On Wall Street, overall, SMCI stock holds a consensus rating of “Hold.” Among the 19 analysts covering the stock, four rate it as a “Strong Buy,” three as a “Moderate Buy,” nine rate it a “Hold,” one says it is a “Moderate Sell,” and two rate it a “Strong Sell.” The stock has surpassed its average price target of $47.53. Meanwhile, the highest price estimate of $60 suggests the possibility of an 11.2% surge over the next 12 months.

Which Is the Better Stock to Buy for the Long Haul?

Both Qualcomm and Supermicro stand to benefit from the AI revolution in different ways. While I believe Supermicro’s near-term growth will outperform Qualcomm’s due to increasing AI server demand, Qualcomm’s broad portfolio, strong moat, and edge-AI roadmap make it the more reliable long-term option.