SoundHound (SOUN) stock got a significant lift from its second-quarter financials. The company reported its Q2 results on Aug. 7, delivering strong growth that highlighted the growing demand for its voice artificial intelligence (AI) technology. That upbeat report sent shares sharply higher, with SOUN stock climbing more than 45% since the announcement.

The company reported $42.7 million in Q2 revenue, representing a 217% increase from the same period last year. Much of that momentum came from its enterprise AI division, with both the automotive sector and restaurant partnerships adding meaningful gains. The rollout of its new agentic AI during the quarter also proved to be a growth catalyst, strengthening existing partnerships and expanding its footprint across enterprise channels.

With demand for AI-powered voice-enabled solutions continuing to surge across industries and SoundHound demonstrating its ability to capture that demand, the upward momentum can carry SoundHound stock to new heights.

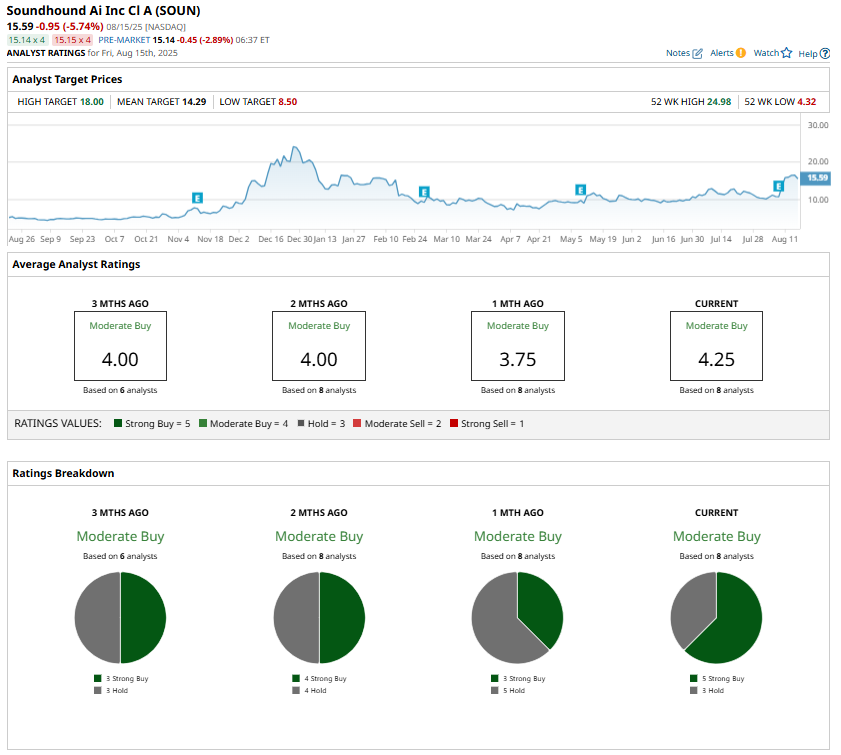

Notably, SoundHound stock hit an all-time high of $24.98 on Dec. 12, 2024. A break above that resistance could mark an important technical milestone, boosting market sentiment and driving the stock higher.

SoundHound Poised for Strong Growth in 2025 and Beyond

SoundHound entered the back half of 2025 with strong momentum across its business. Despite a challenging macroeconomic backdrop, this voice AI technology provider is benefiting from surging demand for its generative and agentic AI solutions, which are driving broader adoption across multiple industries.

The company’s subscriptions and booking backlog continue to expand quarter after quarter, pointing to a healthy pipeline of recurring revenue and signaling that demand remains strong. Cloud adoption has also been solid, with active users climbing more than 50% over the past year. This reflects SoundHound’s ability to acquire and retain customers in a competitive market.

The restaurant industry has been a key growth catalyst for the company. In Q2, growth was driven by a combination of fresh customer wins, steady new activations, and deeper integration with existing brands. By the end of the second quarter, SoundHound’s AI-powered voice solutions were deployed across more than 14,000 restaurant locations, making this vertical a significant contributor to growth. SoundHound’s business is scaling in this sector, with the company adding new restaurant partners each quarter and increasing activations at a faster clip than the quarter before.

Meanwhile, SoundHound has been cementing its position within the automotive sector, a key growth market for voice-enabled AI. The company is expanding existing relationships with major automakers and onboarding new global brands. Its generative AI offerings are gaining traction in North America, while a recent large deal in China points to its growing international footprint. Although the auto industry faces ongoing macroeconomic challenges, SoundHound’s foothold with top manufacturers provides a stable runway for long-term growth.

One of the more encouraging signs for investors is the diversification of revenue. No single customer accounted for more than 10% of SOUN’s sales in Q2, a sharp contrast from earlier years when revenue concentration was a risk factor. This broader base highlights the scalability of its platform and its growing relevance across different sectors.

Beyond organic growth, SoundHound has also been active in pursuing strategic acquisitions. Its recent deals for SYNQ3, Amelia, and Allset enhance its technological capabilities while creating opportunities for cross-selling and operational efficiencies. These deals will likely accelerate its growth while consolidating complementary technologies within its AI ecosystem.

Further, SoundHound continues to focus on cost optimization to achieve adjusted EBITDA profitability by the end of 2025. It is also evaluating low-margin contracts as they come up for renewal and identifying other areas to improve efficiency.

What’s Next for SoundHound Stock?

While not all analysts endorse SoundHound stock, its second-quarter performance reflects the company’s accelerating growth trajectory and expanding leadership in the voice AI space. With triple-digit revenue growth, an expanding customer base, and accelerating adoption across restaurants, automotive, and enterprise channels, the company is well-positioned to deliver solid growth. Strategic acquisitions are strengthening its platform, while a growing backlog and recurring revenue pipeline add visibility to future growth. As SoundHound pushes toward profitability and continues scaling its generative and agentic AI solutions, the momentum behind SOUN stock could sustain, pushing it above its previous all-time high.