/PulteGroup%20Inc%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Valued at $26.6 billion by market cap, PulteGroup, Inc. (PHM) is one of the largest U.S. homebuilders, founded in 1950. The Atlanta, Georgia-based company sells and constructs homes, and purchases, develops, and sells residential land and develops active adult communities. PHM also provides mortgage financing, title insurance, and other services to home buyers. The homebuilding powerhouse is expected to announce its fiscal second-quarter earnings for 2025 before the market opens on Tuesday, Oct. 21.

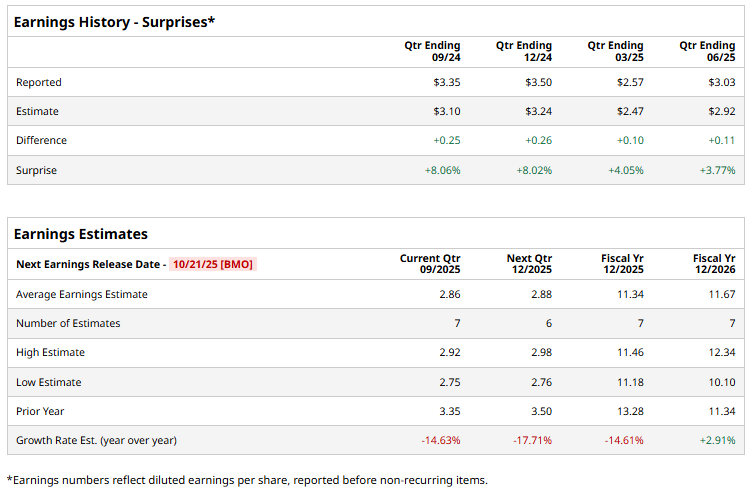

Ahead of the event, analysts expect PHM to report a profit of $2.86 per share on a diluted basis, down 14.6% from $3.35 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect PHM to report EPS of $11.34, down 14.6% from $13.28 in fiscal 2024. However, its EPS is expected to rebound 2.9% year over year to $11.67 in fiscal 2026.

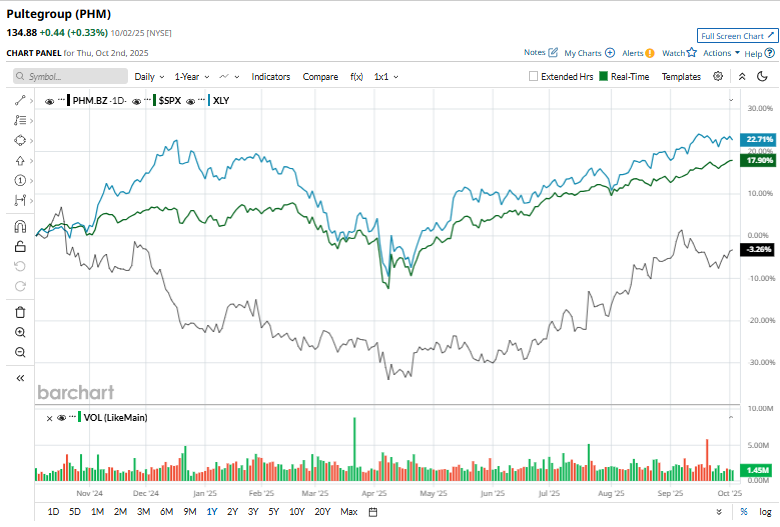

PHM stock has plunged 5.9% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 17.6% gains and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 21% gains over the same time frame.

On July 22, PulteGroup surged 11.5% following the release of its Q2 earnings report. The results were aided by a rebound in homebuyer demand, as the late-June decline in interest rates helped offset market headwinds and lifted overall performance. It posted revenue of $4.4 billion, down 4.3% year-over-year but slightly above consensus forecasts, while earnings of $3.03 per share fell 20.9% from the prior year yet comfortably exceeded the $2.92 estimate.

Analysts’ consensus opinion on PHM stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, nine advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and six give a “Hold.” PHM’s average analyst price target is $138.23, indicating a potential upside of 2.5% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.