It's relatively common to find several market-tracking ETFs in one's portfolio. The steady-ish growth, built-in diversification, and assured liquidity make them an easy choice for almost any investor.

For more growth-oriented investors, the QQQ, or the Invesco QQQ Trust, is the go-to ETF. It tracks the Nasdaq-100, which includes all of the Magnificent 7, as well as other large tech, communications, and consumer discretionary companies.

And tech has been the strongest market driver in the last decade; the QQQ is up a staggering 480%. Plus, it just reached an all-time high of $592.86 yesterday, September 16, 2025.

So, yes, QQQ has been performing well.

However, it’s not immune to the market's ups and downs, and, unfortunately, you never really know when you’ll need some of your capital. Let's say you have an emergency expense, but there's been a significant decline, such as the one we saw back in 2021-2022, when the QQQ fell from over $400 to just shy of $250. You'd have had to sell at a substantial loss.

So how do you protect yourself from these drops?

Well, there are a few option strategies that you can choose from. Today, I’ll discuss one of my favorites: a strategy that offers protection against downside risk and can be set up for free - or even better, you might get paid for it - at the cost of some upside.

Protective Collar

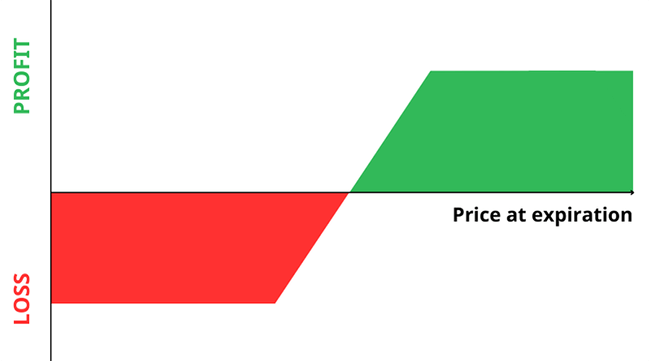

A protective collar is an options strategy that involves buying an out-of-the-money put with a strike at your preferred “stop-loss” price, while simultaneously selling an out-of-the-money call option with a higher strike price, on the same asset, with the same expiration dates. Essentially, you sell a covered call, and with the premium collected, you buy a put.

The objective of a collar is to establish downside protection for an owned asset by virtue of the long put, while offsetting or outright eliminating the cost using the short call.

Collars are one of the cheapest ways to protect your assets. However, the strategy comes with limited upside. In the event of an assignment - which will happen if the short call is in the money at expiration - you'll be obligated to sell 100 shares of the underlying asset at the strike price, effectively capping your profit. Of course, nothing will prohibit you from buying back the underlying asset.

Trade Example With QQQ

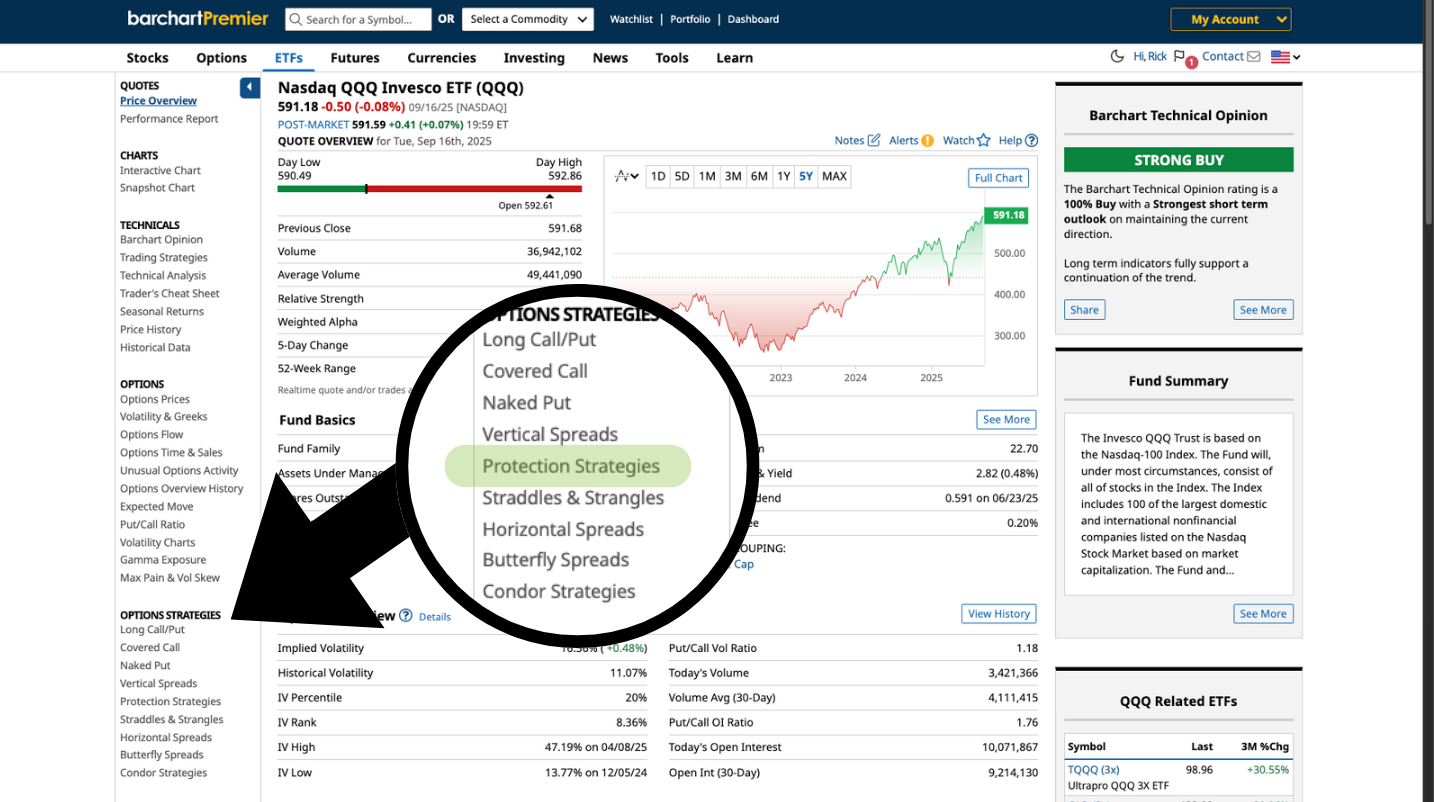

To better explain the strategy, let’s take a look at the potential collar trades on QQQ using Barchart’s Option Screener. To get there, go to QQQ’s profile page, then click on Protection Strategies on the left-hand navigation panel.

Once there, click Protective Collar, and you’ll see potential collar trades for QQQ for the nearest expiration date.

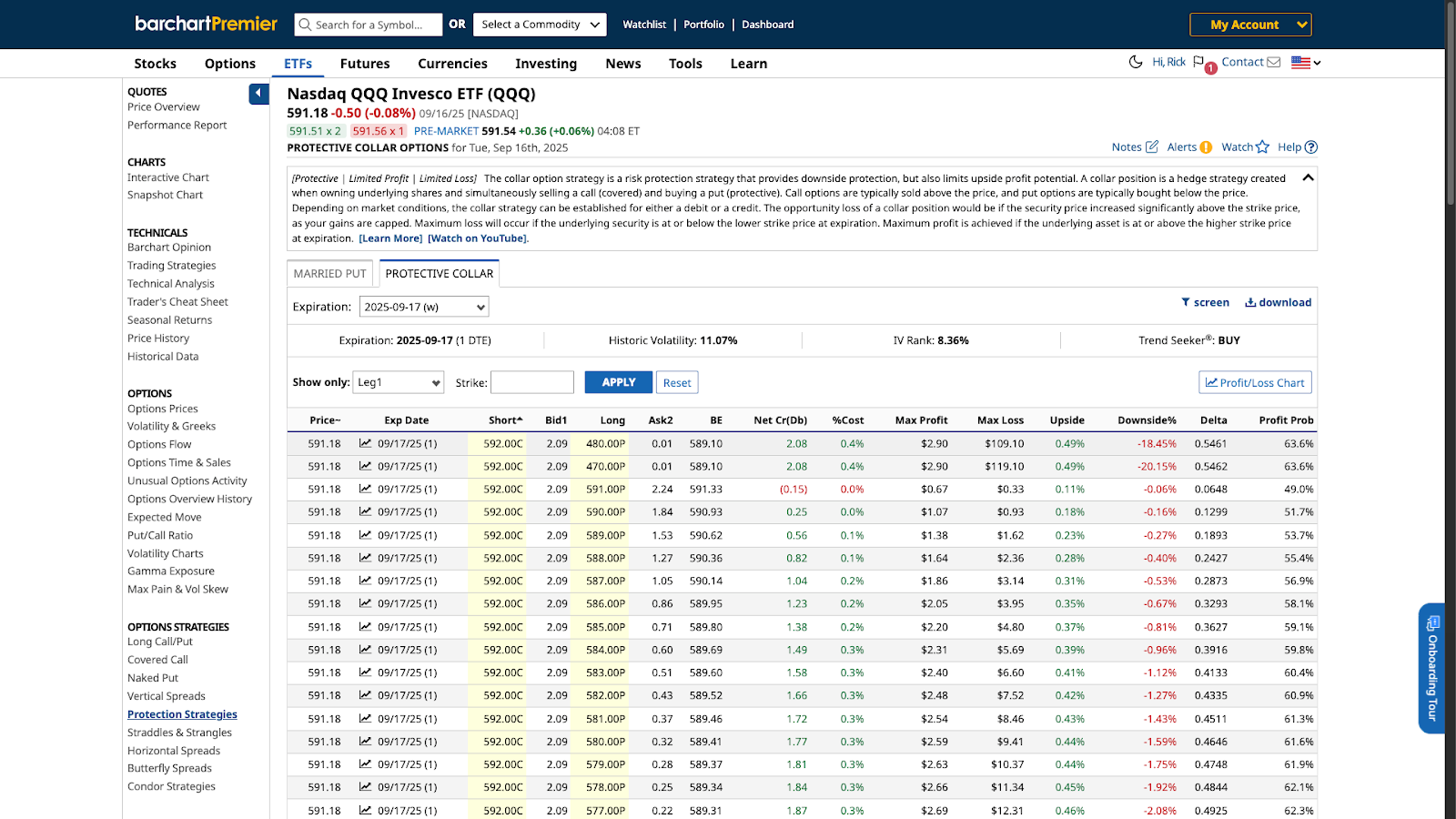

At this point, you need to decide on two things: the expiration date and the strike price.

Collars often have longer expiration dates because investors want longer protection for their assets. However, it is possible to buy short-term protection, especially if you just want to ride out short-term volatility.

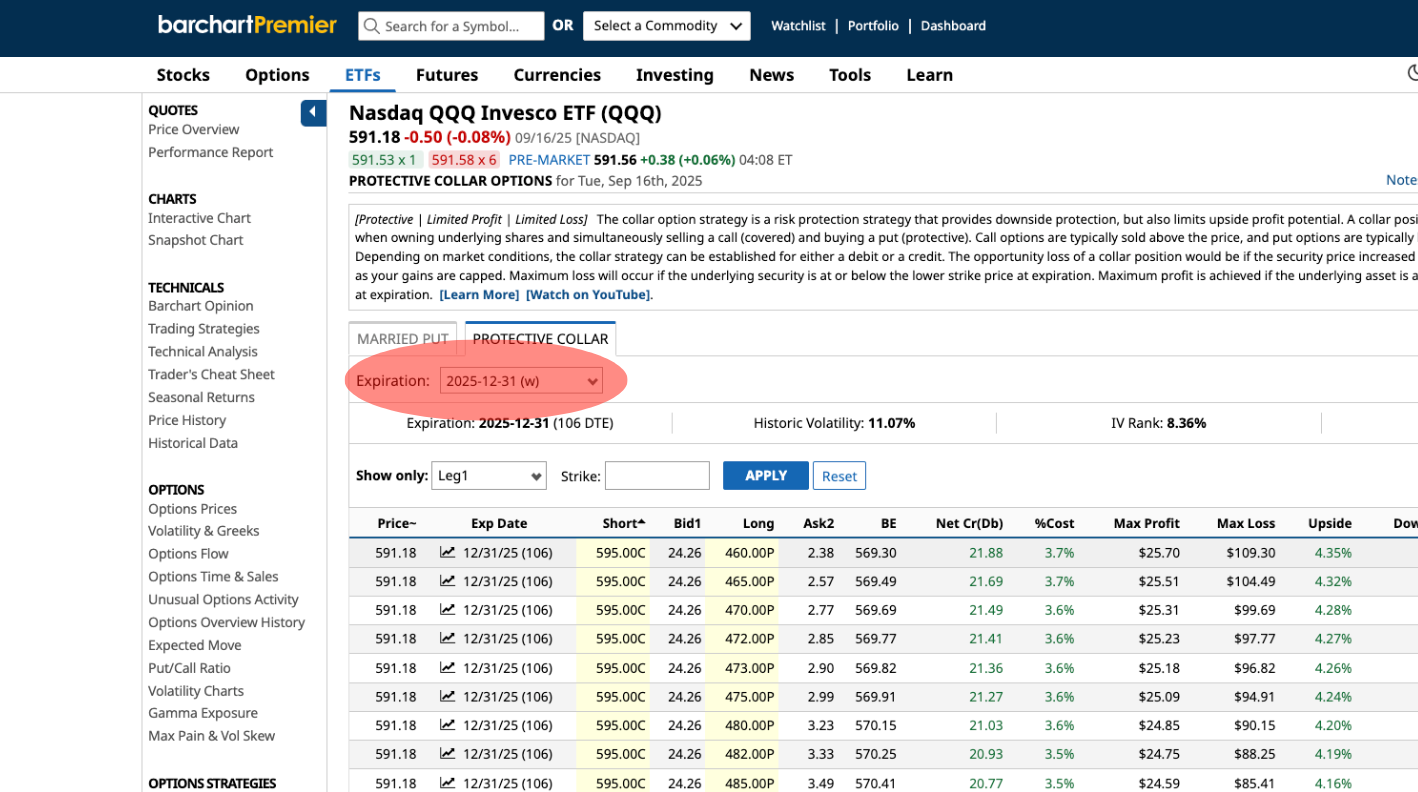

So, in this scenario, let’s say you’re just now buying QQQ for $591.18 per share, and you want to set up a collar trade to protect your shares through the end of the year.

In this case, you can change the expiration date on the dropdown here to December 31, 2025.

Now, as far as strike prices are concerned, the long put strike serves as a sort of stop-loss. The strike distances from the current trading price determine whether the trade will end at a credit or a debit. Usually, the farther out the strike prices are, the more likely the trade will end in a debit.

For this example, let’s consider two sets of strike prices: one that results in a credit and one that results in a debit.

Credit Collar Spread

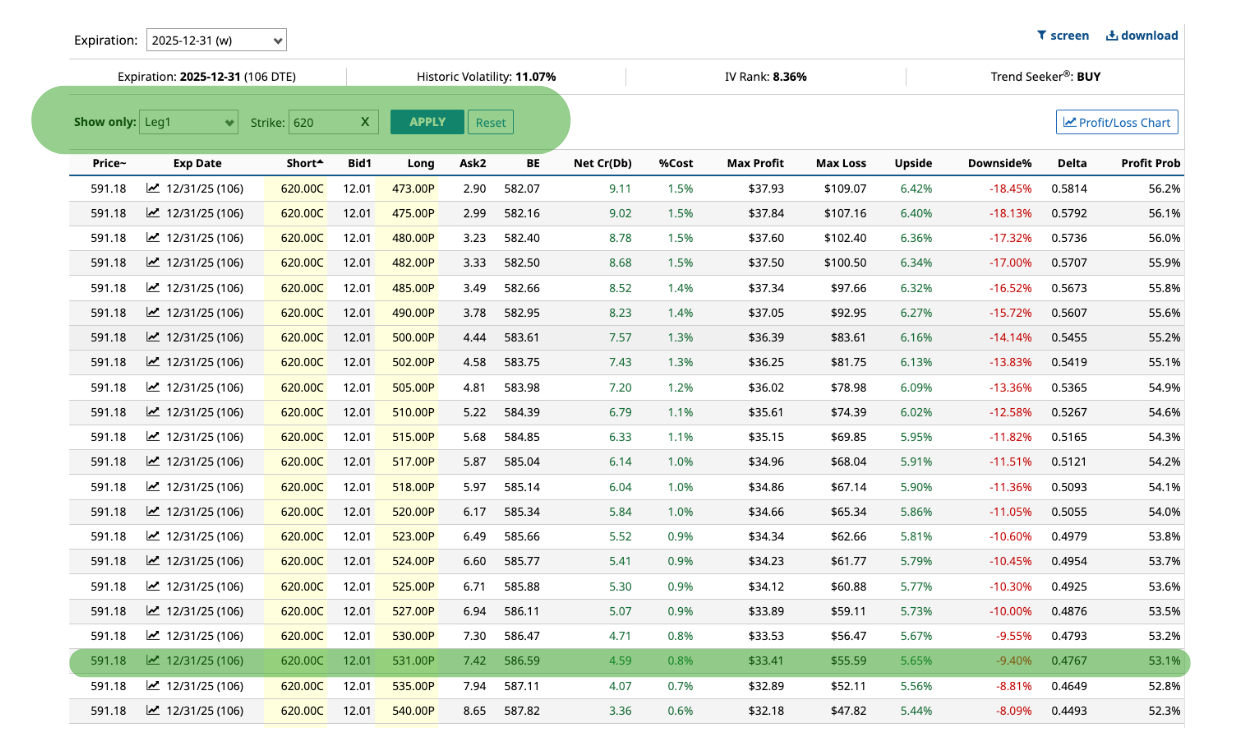

Let’s say you’re happy to limit your profit to roughly 5% above today's prices, or around $620. You can search for 620-strike short calls by typing the number in the Show Only field, then clicking Apply. All trades with 620-strike short calls will be shown.

Then, let’s say you’re willing to risk QQQ going down 10%, or to $531. All you have to do is scroll down until you see your preferred long put strike, just like this:

With this chosen trade, you can buy a 531-strike put on QQQ for $7.42, then sell a 620-strike call for $12.01, resulting in a $4.59 per share net credit. All option contracts represent 100 shares, so just multiply the per-share values by 100 to get the total.

Your maximum loss for the trade, which is calculated by taking the difference between the stock purchase price and the long put strike price, less the net credit ($591.18 - $531 = $60.18 - $4.59 = $55.59 per share). The trade will end in a loss if QQQ trades below $531 at expiration.

The maximum profit for the trade is calculated by subtracting the short call strike and the stock purchase price, then adding the net credit. In this case, it’s $620 - $591.18 = $28.82 + $4.59 = $33.41. This profit will be realized if QQQ trades above $620 at expiration. On that note, the maximum profit here is set in stone, even if QQQ shoots up to $700 before December 31.

Now, if QQQ stays between $620 and $531 until December 31, both options expire worthless, and pocket the original $4.59 credit per share ($459/contract).

Debit Collar Spread

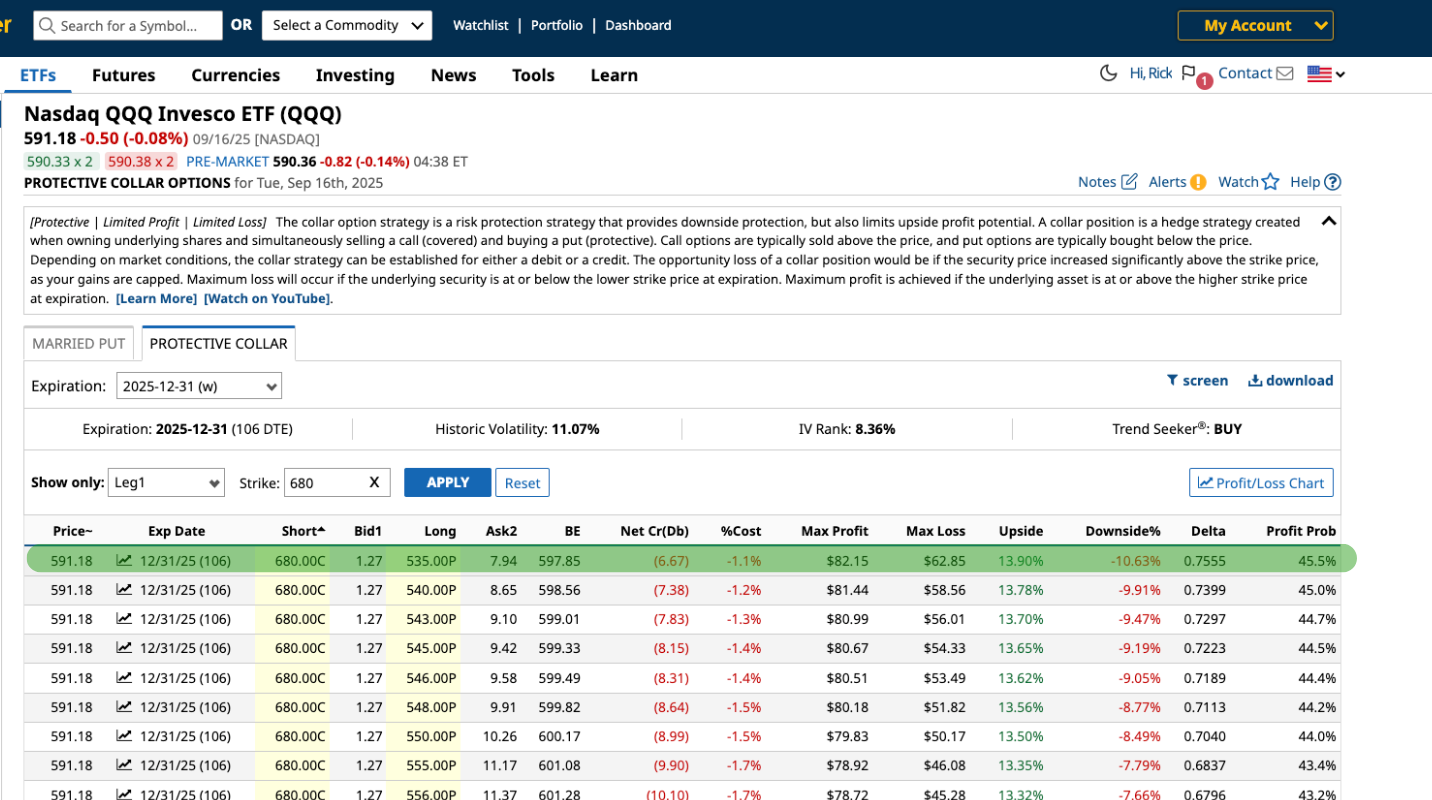

On the other hand, let’s say you want to set your take-profit price at $680, but you still want to protect yourself from QQQ going down over 10%. In this case, let’s look at 680-strike short calls with around 530- to 535-strike long puts.

According to the screener, you can write a 680-strike call and get $1.27 per share for it, while buying a 535-strike put for $7.94. This results in a $6.67 net debit.

Your maximum loss for the trade, which is calculated by taking the difference between the stock purchase price and the long put strike price, plus the net debit ($591.18 - $535 = $56.18 + $6.67 = $62.85 per share).

The maximum profit for the trade is calculated by subtracting the short call strike and the stock purchase price, then subtracting the net debit ($680 - $591.18 = $88.82 - $6.67 = $82.15).

If both options expire worthless, you lose $6.67 per share. That’s the cost of protection.

The Theta Effect

As options premiums have extrinsic value baked in, the amount of time remaining to expiration will also factor into the premium - this is called theta decay. In either case, should the QQQ trade below the long put strike, with a week or more to expiration, there will likely be extrinsic value baked into the premium at that time. Suppose, for example, the QQQ trades at $500 on October 15, your $535 long put will now be in-the-money by $35. However, there'll also be extrinsic value baked into the premium with ~10 weeks remaining on the contract. While the exact amount of the option at that time is hard to calculate, given metrics that will change, that $535 strike might now be worth $50-$60/share. Closing out the trade at that time could end up protecting you from even further losses.

Final Thoughts

The protective collar is a flexible options strategy that you can use to hedge against downside protection at a discount.

You can set your strike prices - essentially, your protection and take-profit levels - according to your preference, potentially making it a cheaper alternative to protective puts. However, just remember that there is always a trade-off for protection. For collars, your upside will be limited to the short call strike.

So, only use the strategy when preserving capital is a priority and you're willing to trade some potential gains for reduced risk at little or no cost.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.