San Francisco, California-based Prologis, Inc. (PLD) is the world’s largest industrial real estate company, specializing in logistics and distribution properties. With a market cap of $97.2 billion, it owns, operates, and develops warehouses and fulfillment centers that support e-commerce, retail, manufacturing, and supply-chain operations for major global companies.

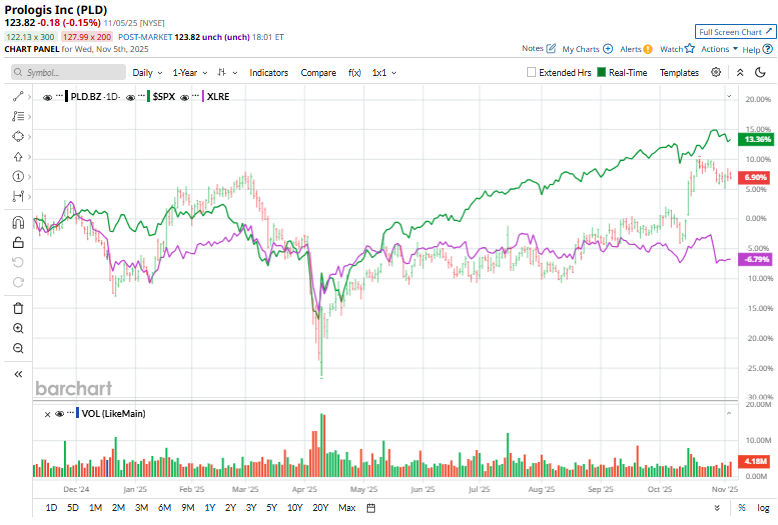

Shares of Prologis have been quietly powering higher, surging 8.2% over the past year and increasing 14.1% in 2025. However, it has lagged behind the broader S&P 500 Index ($SPX), which has gained 17.5% over the past year and 15.6% this year.

On the positive side, the sector-specific Real Estate Select Sector SPDR ETF (XLRE) has declined 6.6% over the past year and is up marginally on a YTD basis, making Prologis a clear outperformer in an otherwise sluggish real estate landscape.

On Oct. 15, Prologis reported its third-quarter earnings, and its shares popped 7.3%. It posted an EPS of $0.82 and its core FFO stood at $1.49, up 4.2% year over year. Its total revenue surged 8.7% year over year to $2.2 billion. Driven by healthy industrial real estate demand and strong leasing activity, occupancy rose to 95.3%, while same-store net operating income increased 3.9% on a net effective basis and 5.2% on a cash basis. Leasing momentum remained robust, with record signings totaling 62 million square feet, and rental growth stayed strong with net effective rent change near 49% and cash rent change around 29%.

For the current fiscal year, ending in December 2025, analysts expect Prologis to report an FFO of $5.80, representing a growth of 4.3% YoY. The company has consistently outperformed expectations, beating consensus EPS estimates in each of the past four quarters.

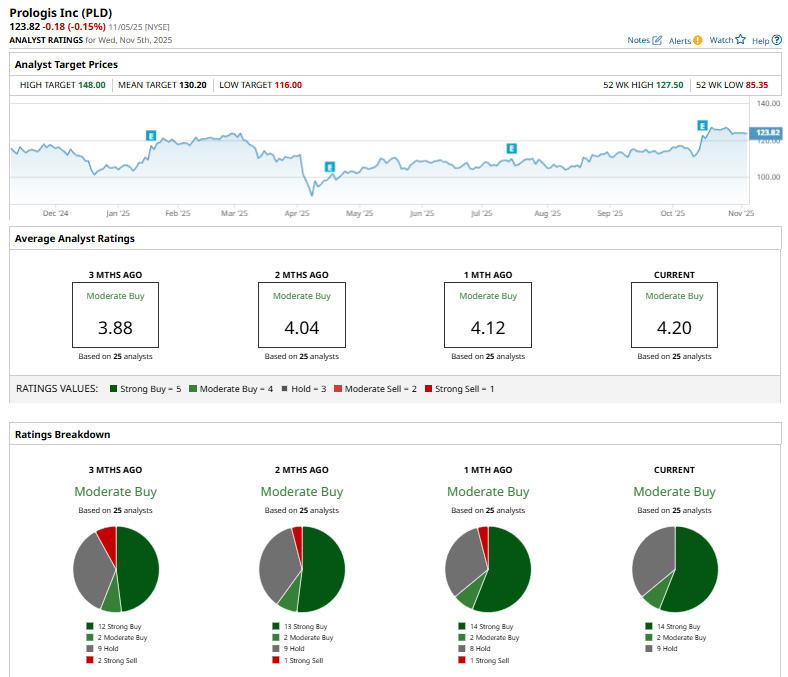

Out of the 25 analysts covering PLD stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buys,” two “Moderate Buys,” and nine “Hold” ratings.

The current configuration is more bullish than two months ago when 13 analysts had recommended a “Strong Buy” rating for the stock.

On Oct. 17, Evercore ISI analyst Steve Sakwa reiterated a “Hold” rating on Prologis and set a $116 price target.

The mean price target of $130.20 represents a premium of 5.2% to PLD’s current price, while the Street-high price target of $148 suggests an upside potential of 19.5%.