Prologis, Inc. (PLD) is a leading real estate investment trust (REIT) headquartered in San Francisco, California, specializing in industrial and logistics real estate. Its market cap hovers around $98.6 billion, reflecting its status as one of the largest industrial REITs globally.

Founded in 1983 and later formed through a landmark merger between AMB Property Corporation and ProLogis in 2011, the company owns and operates more than 1.3 billion square feet of logistics facilities across 20 countries, serving major tenants in the business‑to‑business and retail/online fulfillment sectors.

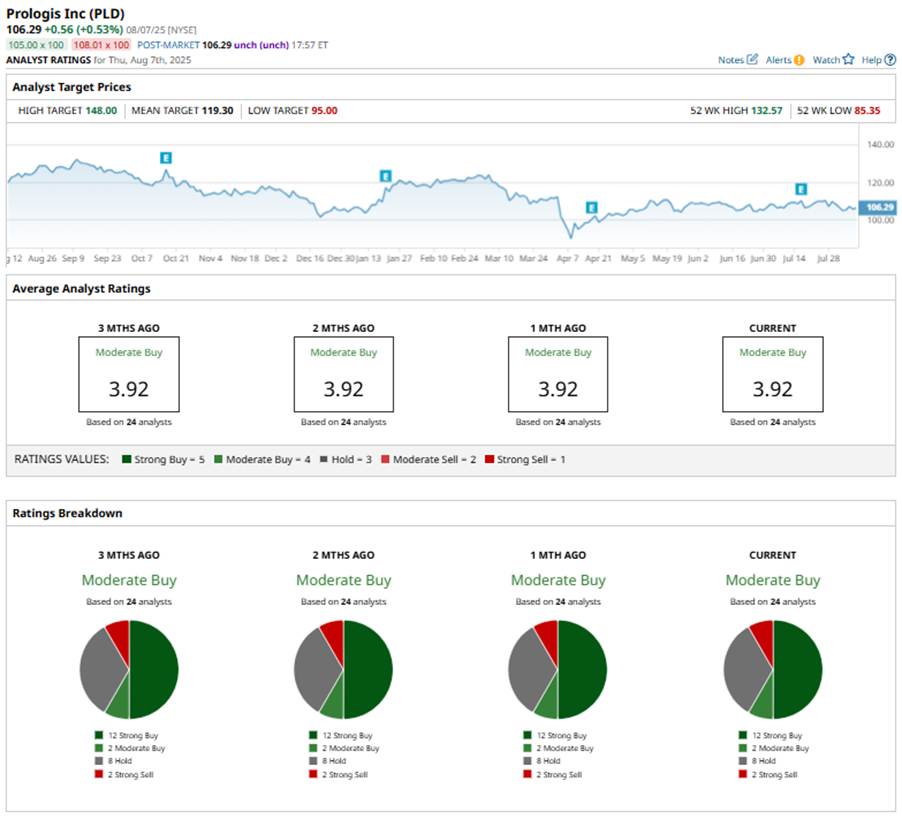

Shares of Prologis have returned just 0.6% on a year‑to‑date (YTD) basis, while remaining significantly below its 52‑week high of $132.57. Over the past 52 weeks, the stock declined 11.5%.

In contrast, the broader S&P 500 Index ($SPX) has gained 7.8% YTD, while the past year returns stand at 21.9%. Narrowing the focus, the Real Estate Select Sector SPDR ETF (XLRE) rallied by 2.3% YTD and rose marginally over the past 52 weeks, also outpacing PLD stock.

Several factors have shaped Prologis’ performance. On the positive side, the company continues to benefit from strong leasing demand in infill logistics markets. Moreover, trade‑policy shifts, especially expectations of a U.S.-China trade war, are spurring onshoring and warehousing demand.

However, heightened U.S. warehouse vacancy and rate‑sensitive sector pressures, including rising interest expenses, have weighed on sentiment.

For the current fiscal year, ending in December 2025, analysts expect Prologis to report EPS growth of 3.8% YoY to $5.77, on a diluted basis. The company has a stellar history of surpassing consensus EPS estimates. It topped consensus estimates in each of the last four quarters.

Out of the 24 analysts covering PLD stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buys,” two “Moderate Buys,” eight “Hold” ratings, and two “Strong Sells.”

The current configuration has remained consistent over the past few months.

Citi has maintained its “Buy” rating on PLD, but trimmed the price target from $150 to $140, reflecting heightened caution amid unresolved trade‑policy risks.

The mean price target of $119.30 represents a premium of 12.2% to PLD’s current price, while the Street-high price target of $148 suggests an upside potential of 39.2%.