Valued at roughly $105.1 billion by market capitalization, Prologis, Inc. (PLD) is the global leader in logistics real estate, specializing in the ownership, development, and operation of industrial properties. The California-based company has been at the forefront of the logistics real estate sector for over 40 years. The company's portfolio comprises over 5,800 buildings located in high-barrier, high-growth markets, which facilitates efficient supply chains worldwide. The company is all set to report its fiscal 2025 third-quarter earnings before the market opens on Wednesday, October 15.

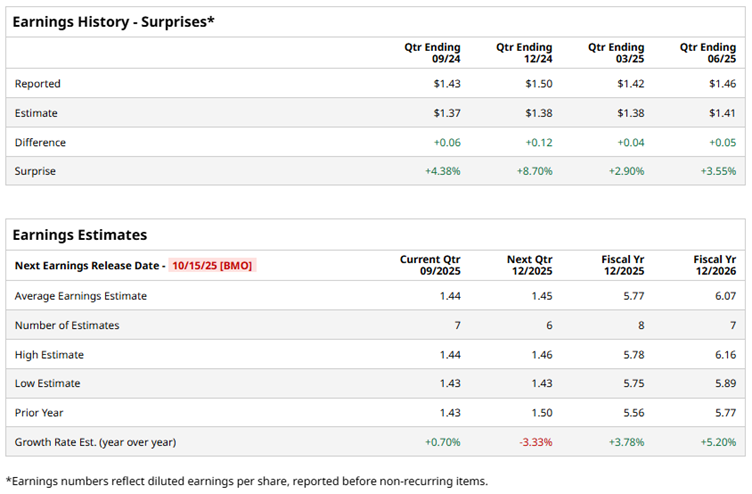

As Prologis gears up for its upcoming earnings release, analysts are projecting a slight uptick in core funds from operations (FFO), with estimates at $1.44 per share, just above last year’s $1.43 per share. PLD has outpaced Wall Street’s FFO estimates for four consecutive quarters. In the most recent quarter, it delivered $1.46 per share, topping expectations by 3.6%, highlighting its consistent ability to deliver strong and reliable performance.

Looking ahead, analysts anticipate Prologis will post a core FFO per share of $5.77 for fiscal 2025, marking a 3.8% rise from $5.56 in fiscal 2024. Furthermore, Prologis’ core FFO is projected to climb another 5.2% year-over-year (YOY) to $6.07 per share in fiscal 2026.

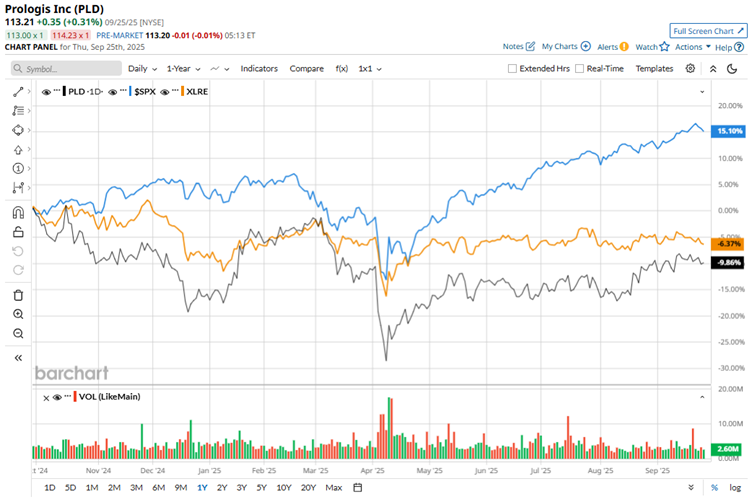

Over the past year, Prologis has seen its stock dip 9.7%, underperforming the broader S&P 500 Index ($SPX), which surged 15.4% over the same period. Even compared with its real estate peers, PLD underperformed, as the Real Estate Select Sector SPDR Fund (XLRE) dipped a more modest 7.2%, underscoring the stock’s relative weakness in a mixed market environment.

On the brighter side, Prologis stock closed up about 1.4% following its strong Q2 earnings report on July 16. The quarter showcased impressive occupancy and retention rates, alongside a healthy 4.9% growth in cash same-store NOI. In the second quarter, Prologis’ total revenue jumped 8.8% YOY to $2.2 billion, comfortably beating Wall Street expectations. In addition, Core FFO per share climbed nearly 9% YOY to $1.46, topping consensus estimates of $1.41, highlighting the company’s continued operational strength and consistent outperformance.

Even with Prologis showing lackluster price performance over the past year, Wall Street remains cautiously bullish on the stock, with an overall “Moderate Buy” rating. Among 25 analysts covering the stock, 14 recommend a "Strong Buy," two indicate a "Moderate Buy," eight advise a “Hold,” and the remaining one has issued a “Strong Sell.”

In fact, the sentiment has shifted slightly more bullish over the past two months, with “Strong Buy” recommendations rising from 12 to 14. Plus, analysts have set a mean price target of $121.45, implying roughly 7.3% upside potential from the current market price.

.png?w=600)