/Progressive%20Corp_%20HQ%20sign-%20by%20Kristi%20Blokhin%20via%20Shutterstock.jpg)

The Progressive Corporation (PGR), headquartered in Mayfield Village, Ohio, operates as an insurance holding company. Valued at $144.5 billion by market cap, provides personal and commercial auto, personal residential and commercial property, business-related general liability, and other specialty property-casualty insurance products and related services. The leading property & casualty insurance company is expected to announce its fiscal third-quarter earnings for 2025 on Tuesday, Oct. 21.

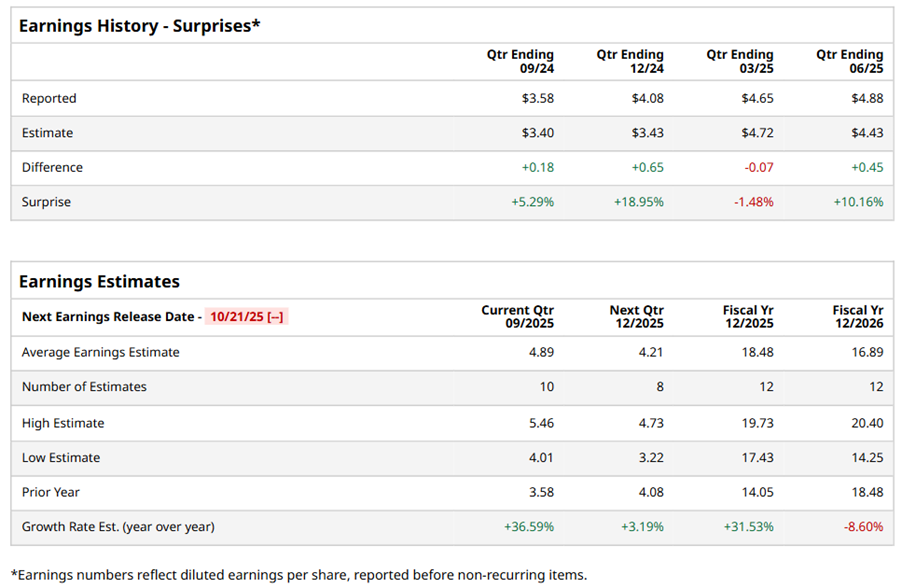

Ahead of the event, analysts expect PGR to report a profit of $4.89 per share on a diluted basis, up 36.6% from $3.58 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect PGR to report EPS of $18.48, up 31.5% from $14.05 in fiscal 2024. However, its EPS is expected to decline 8.6% year over year to $16.89 in fiscal 2026.

PGR stock has underperformed the S&P 500 Index’s ($SPX) 17.6% gains over the past 52 weeks, with shares down 4.3% during this period. Similarly, it underperformed the Financial Select Sector SPDR Fund’s (XLF) 18.2% gains over the same time frame.

Following its Q2 earnings release on Aug. 4, Progressive Corporation's shares closed slightly higher. The company achieved $22 billion in total revenue, representing a 21.3% year-over-year increase, driven by 18% growth in net premiums earned and 27.2% growth in investment income, which ultimately yielded a 117.7% rise in net income to $5.40 per share.

Analysts’ consensus opinion on PGR stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 25 analysts covering the stock, 10 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and 13 give a “Hold.” PGR’s average analyst price target is $286.05, indicating a potential upside of 17.5% from the current levels.